Question: Help me please now now QUESTION 2 (20 marks) Property (Pty) Limited had the following three properties (the value of the land is considered to

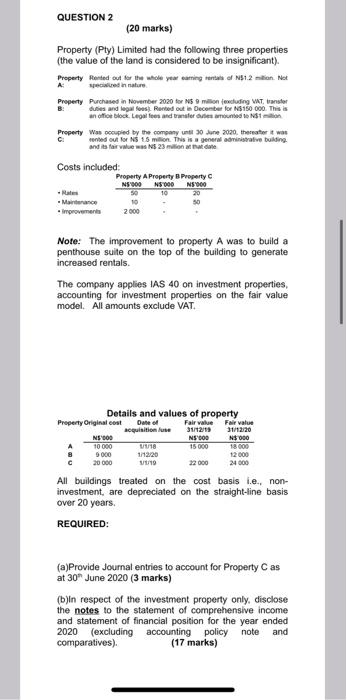

Help me please now now QUESTION 2 (20 marks) Property (Pty) Limited had the following three properties (the value of the land is considered to be insignificant). Property Rented out for the whole year earning of N$1.2 milion. Net pered in nature Property Purchased in November 2020 for NS 9 milion euring WAT, transfer duties and legal fos Ruted out in December for N6150 000. This is an office block. Legal foes and transferred to to NS1 Property Was socupied by the company und 30 June 2020. thereafter it was sented out for NS 15 milion. This is a general administrative building and its far value was NS 23 milioni Costs included: Property Property Property NS000 NS000 NS000 50 10 - Marence 10 2000 Note: The improvement to property A was to build a penthouse suite on the top of the building to generate increased rentals The company applies IAS 40 on investment properties, accounting for investment properties on the fair value model. All amounts exclude VAT. Details and values of property Property Original con Date of Fair value Fair value acquisition 31/12/15 31/12/20 NS 800 NS000 NS000 A 10 000 118 15 000 18 600 8 9000 1/12/20 12000 20 000 22 000 24000 All buildings treated on the cost basis i.e., non- investment, are depreciated on the straight-line basis over 20 years. REQUIRED: (a)Provide Journal entries to account for Property Cas at 30 June 2020 (3 marks) (b)in respect of the investment property only, disclose the notes to the statement of comprehensive income and statement of financial position for the year ended 2020 (excluding accounting policy note and comparatives) (17 marks) Help me please now now QUESTION 2 (20 marks) Property (Pty) Limited had the following three properties (the value of the land is considered to be insignificant). Property Rented out for the whole year earning of N$1.2 milion. Net pered in nature Property Purchased in November 2020 for NS 9 milion euring WAT, transfer duties and legal fos Ruted out in December for N6150 000. This is an office block. Legal foes and transferred to to NS1 Property Was socupied by the company und 30 June 2020. thereafter it was sented out for NS 15 milion. This is a general administrative building and its far value was NS 23 milioni Costs included: Property Property Property NS000 NS000 NS000 50 10 - Marence 10 2000 Note: The improvement to property A was to build a penthouse suite on the top of the building to generate increased rentals The company applies IAS 40 on investment properties, accounting for investment properties on the fair value model. All amounts exclude VAT. Details and values of property Property Original con Date of Fair value Fair value acquisition 31/12/15 31/12/20 NS 800 NS000 NS000 A 10 000 118 15 000 18 600 8 9000 1/12/20 12000 20 000 22 000 24000 All buildings treated on the cost basis i.e., non- investment, are depreciated on the straight-line basis over 20 years. REQUIRED: (a)Provide Journal entries to account for Property Cas at 30 June 2020 (3 marks) (b)in respect of the investment property only, disclose the notes to the statement of comprehensive income and statement of financial position for the year ended 2020 (excluding accounting policy note and comparatives) (17 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts