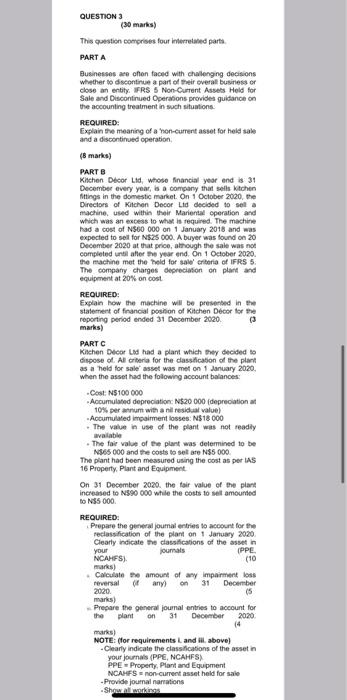

Question: Help me please now now QUESTION 3 (30 marks) This question comprises four interrelated parti PARTA Businesses are often faced with challenging decisions whether to

Help me please now now QUESTION 3 (30 marks) This question comprises four interrelated parti PARTA Businesses are often faced with challenging decisions whether to discontinue a part of their overall business or close an entity RS 5 Non Current Assets Held for Sale and Discontinued Operations provides guidance on the accounting treatment in such situations. REQUIRED Explain the meaning of a non-current asset for held sale and a discontinued operation, (8 marks) PARTB Kitchen Decor Lid, whose financial year and is 31 December every year, is a company that sells Kitchen fittings in the domestic market. On 1 October 2020, the Directors of Kitchen Decor Lid decided to sell machine which was an excess to what is required. The machine had a cost of N500 000 on 1 January 2018 and was expected to sell for N$25 000. A buyer was found on 20 December 2020 at that price, though the sale was not completed until after the year end On 1 October 2020. the machine met the held for sale criteria of IFRS 5 The company charges depreciation on plant and equipment at 20% on cost REQUIRED: Explain how the machine will be presented in the statement of financial position of Kitchen Decor for the reporting period ended 31 December 2020 marks) PARTC Kitchen Decor Lod had a plant which they decided to dispose of All criteria for the classification of the plant as a held for sale asset was met on 1 January 2020, when the asset had the following account balances: Cost N$100 000 Accumulated depreciation N$20 000 (depreciation at 10% per annum with all residual value) Accumulated impairment losses: N$18 000 The value use of the plant was not readly available The fair value of te plant was determined to be N365 000 and the costs to sel ste NSS 000 The plant had been measured using the cost as per IAS 16 Property, Plant and Equipment On 31 December 2020. the fair value of the plant increased to N$90 000 while the costs to sell amounted to $5000 REQUIRED: Prepare the general joumal entries to account for the reclassification of the plant on 1 January 2020 Clearly indicate the clasifications of the set (PPE (10 Calculate the amount of any impairment tous Perversal of any) on 31 December 2020 marks) - Prepare the general journal entries to account for the plant on 31 December 2020 14 marks) NOTE: (for requirements and above) Clearly indicate the classifications of the asset in your journals (PPE, NCAHFS) PPE Property Plant and Equipment NCAMFS = non-current asset held for sale -Provide journal narrations Showarkings events jums mars Help me please now now QUESTION 3 (30 marks) This question comprises four interrelated parti PARTA Businesses are often faced with challenging decisions whether to discontinue a part of their overall business or close an entity RS 5 Non Current Assets Held for Sale and Discontinued Operations provides guidance on the accounting treatment in such situations. REQUIRED Explain the meaning of a non-current asset for held sale and a discontinued operation, (8 marks) PARTB Kitchen Decor Lid, whose financial year and is 31 December every year, is a company that sells Kitchen fittings in the domestic market. On 1 October 2020, the Directors of Kitchen Decor Lid decided to sell machine which was an excess to what is required. The machine had a cost of N500 000 on 1 January 2018 and was expected to sell for N$25 000. A buyer was found on 20 December 2020 at that price, though the sale was not completed until after the year end On 1 October 2020. the machine met the held for sale criteria of IFRS 5 The company charges depreciation on plant and equipment at 20% on cost REQUIRED: Explain how the machine will be presented in the statement of financial position of Kitchen Decor for the reporting period ended 31 December 2020 marks) PARTC Kitchen Decor Lod had a plant which they decided to dispose of All criteria for the classification of the plant as a held for sale asset was met on 1 January 2020, when the asset had the following account balances: Cost N$100 000 Accumulated depreciation N$20 000 (depreciation at 10% per annum with all residual value) Accumulated impairment losses: N$18 000 The value use of the plant was not readly available The fair value of te plant was determined to be N365 000 and the costs to sel ste NSS 000 The plant had been measured using the cost as per IAS 16 Property, Plant and Equipment On 31 December 2020. the fair value of the plant increased to N$90 000 while the costs to sell amounted to $5000 REQUIRED: Prepare the general joumal entries to account for the reclassification of the plant on 1 January 2020 Clearly indicate the clasifications of the set (PPE (10 Calculate the amount of any impairment tous Perversal of any) on 31 December 2020 marks) - Prepare the general journal entries to account for the plant on 31 December 2020 14 marks) NOTE: (for requirements and above) Clearly indicate the classifications of the asset in your journals (PPE, NCAHFS) PPE Property Plant and Equipment NCAMFS = non-current asset held for sale -Provide journal narrations Showarkings events jums mars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts