Question: help me please only if you can!! part c Crane Company's budgeted sales and direct materials purchases are as follows: Crane's sales are 40% cashand

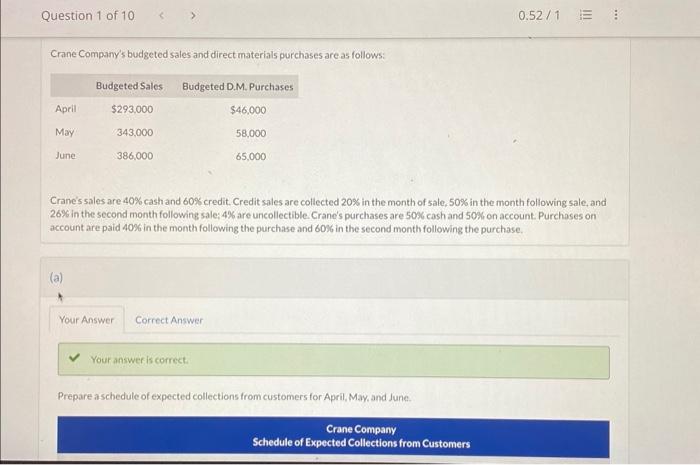

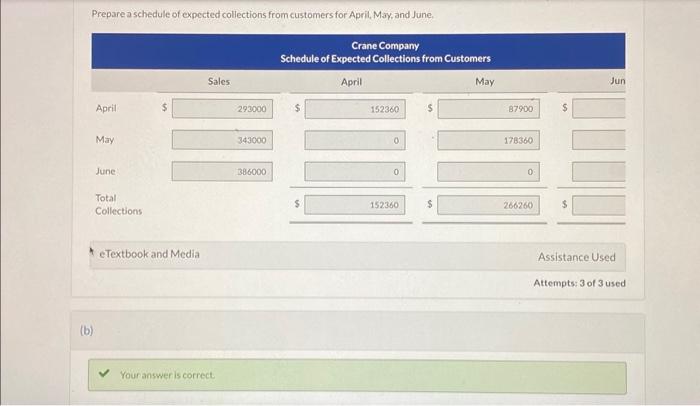

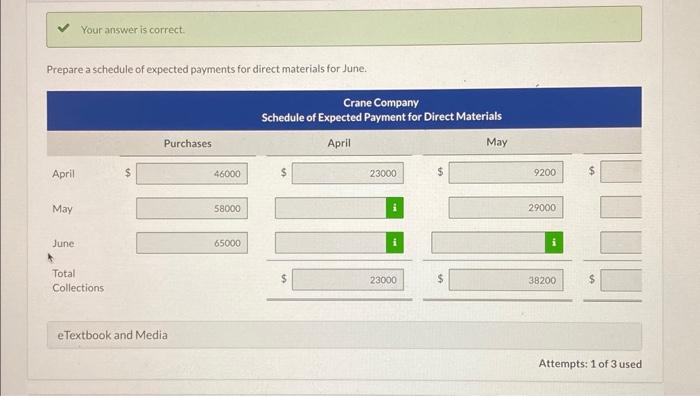

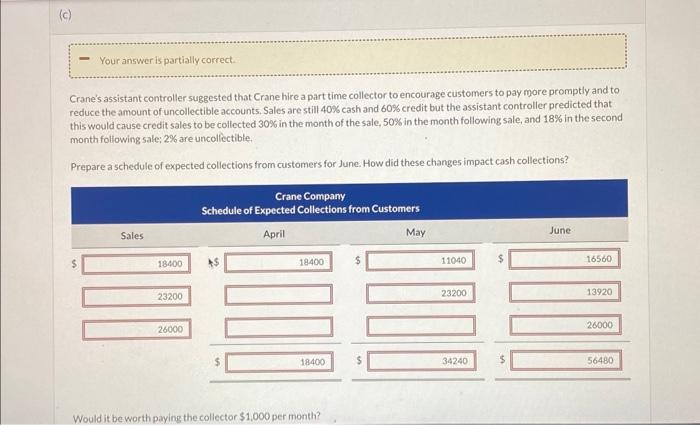

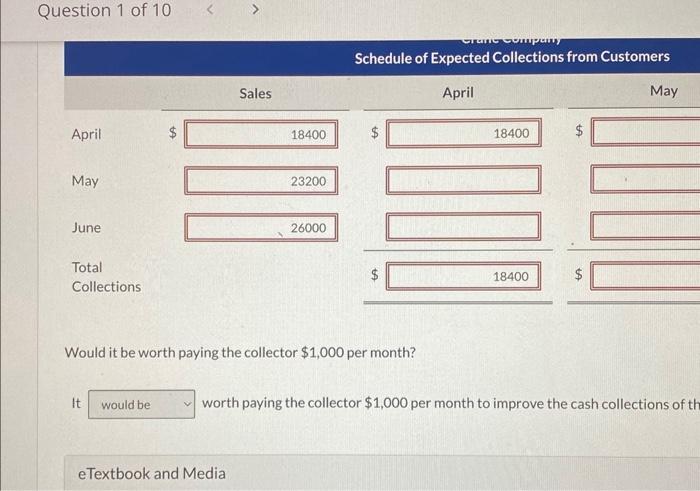

Crane Company's budgeted sales and direct materials purchases are as follows: Crane's sales are 40% cashand 60% credit. Credit sales are collected 20% in the month of sale, 50% in the month following sale, and 26% in the second month following sale: 4% are uncollectible. Crane's purchases are 50% cash and 50% on account: Purchases on account are paid 40% in the month following the purchase and 60% in the second month following the purchase. (a) Prepare a schedule of expected collections from customers for April, May, and June. Prepare a schedule of expected collections from customers for April, May, and June. Prepare a schedule of expected payments for direct materials for June. Crane's assistant controller suggested that Crane hire a part time collector to encourage customers to pay more promptly and to reduce the amount of uncollectible accounts, Sales are still 40% cash and 60% credit but the assistant controller predicted that this would cause credit sales to be collected 30% in the month of the sale, 50% in the month following sale, and 18% in the second month following sale; 2% are uncolfectible. Prepare a schedule of expected coliections from customers for June. How did these changes impact cash collections? Would it be worth paying the collector $1,000 per month? Question 1 of 10 Would it be worth paying the collector $1,000 per month? It worth paying the collector $1,000 per month to improve the cash collections of Crane Company's budgeted sales and direct materials purchases are as follows: Crane's sales are 40% cashand 60% credit. Credit sales are collected 20% in the month of sale, 50% in the month following sale, and 26% in the second month following sale: 4% are uncollectible. Crane's purchases are 50% cash and 50% on account: Purchases on account are paid 40% in the month following the purchase and 60% in the second month following the purchase. (a) Prepare a schedule of expected collections from customers for April, May, and June. Prepare a schedule of expected collections from customers for April, May, and June. Prepare a schedule of expected payments for direct materials for June. Crane's assistant controller suggested that Crane hire a part time collector to encourage customers to pay more promptly and to reduce the amount of uncollectible accounts, Sales are still 40% cash and 60% credit but the assistant controller predicted that this would cause credit sales to be collected 30% in the month of the sale, 50% in the month following sale, and 18% in the second month following sale; 2% are uncolfectible. Prepare a schedule of expected coliections from customers for June. How did these changes impact cash collections? Would it be worth paying the collector $1,000 per month? Question 1 of 10 Would it be worth paying the collector $1,000 per month? It worth paying the collector $1,000 per month to improve the cash collections of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts