Question: help me please please please please am in exam Question 1 (1 point) Futures contracts are standardized in terms of settlement dates True False Question

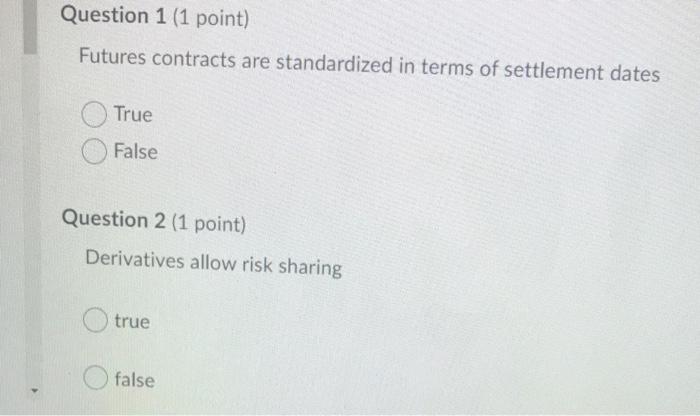

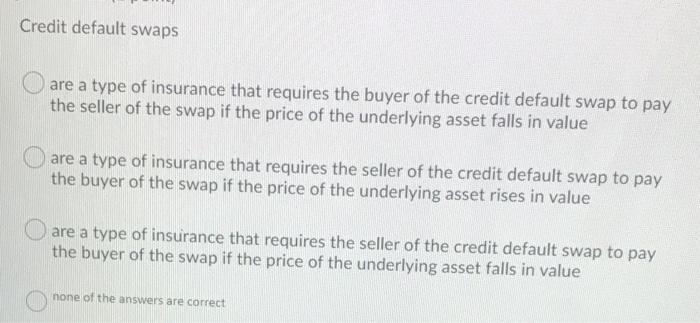

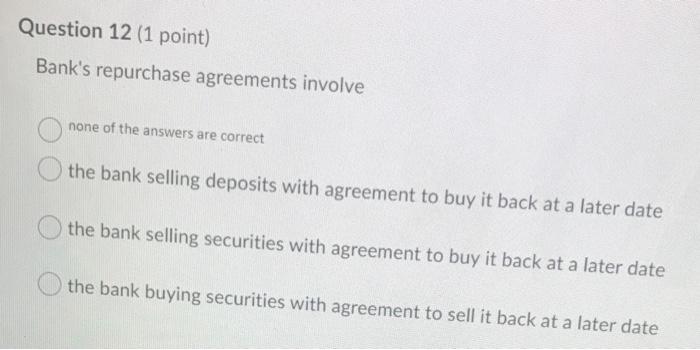

Question 1 (1 point) Futures contracts are standardized in terms of settlement dates True False Question 2 (1 point) Derivatives allow risk sharing true false Credit default swaps are a type of insurance that requires the buyer of the credit default swap to pay the seller of the swap if the price of the underlying asset falls in value are a type of insurance that requires the seller of the credit default swap to pay the buyer of the swap if the price of the underlying asset rises in value are a type of insurance that requires the seller of the credit default swap to pay the buyer of the swap if the price of the underlying asset falls in value none of the answers are correct Question 12 (1 point) Bank's repurchase agreements involve none of the answers are correct the bank selling deposits with agreement to buy it back at a later date the bank selling securities with agreement to buy it back at a later date the bank buying securities with agreement to sell it back at a later date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts