Question: help me please PP&E 30 points Part A 15. points BBQ Ltd sells and services commercial barbeques. BBQ Ltd purchased a truck on October 1,

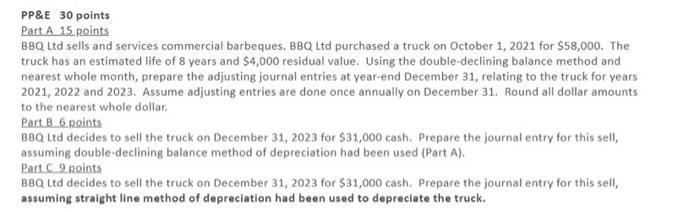

PP&E 30 points Part A 15. points BBQ Ltd sells and services commercial barbeques. BBQ Ltd purchased a truck on October 1, 2021 for $58,000. The truck has an estimated life of 8 years and $4,000 residual value. Using the double-declining balance method and nearest whole month, prepare the adjusting journal entries at year-end December 31, relating to the truck for years 2021, 2022 and 2023. Assume adjusting entries are done once annually on December 31. Round all dollar amounts to the nearest whole dollar, Part.8.6. Roints BBQ Ltd decides to sell the truck on December 31, 2023 for $31,000 cash. Prepare the journal entry for this sell, assuming double-declining balance method of depreciation had been used (Part A). Part.c.9. points BBQ Ltd decides to sell the truck on December 31, 2023 for $31,000 cash. Prepare the journal entry for this sell, assuming straight line method of depreciation had been used to depreciate the truck

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts