Question: help me please Question 18 (Mandatory) (1.5 points) Johnny Cake Ltd. has 10 million shares of stock outstanding selling at $20 per share and an

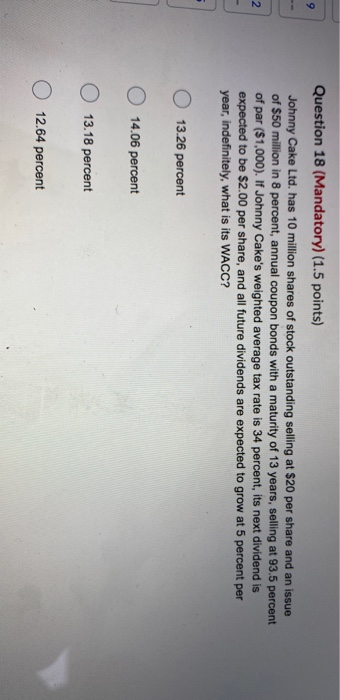

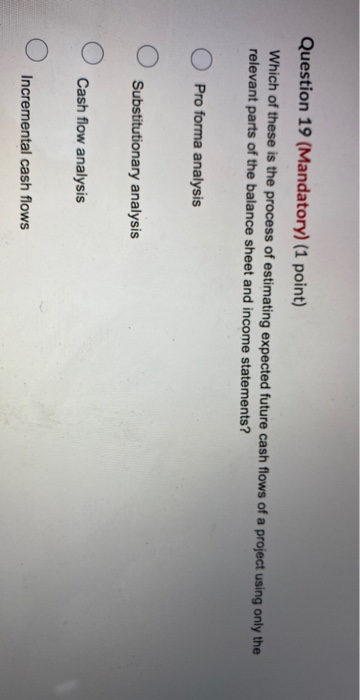

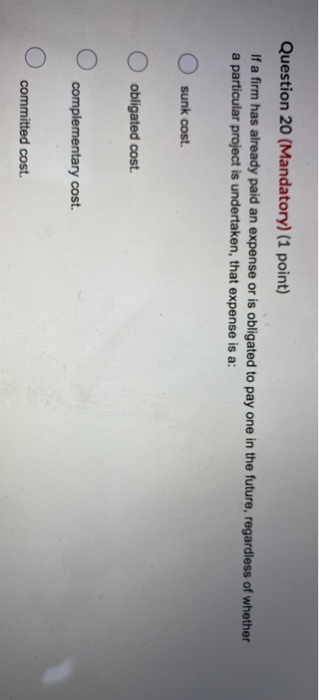

Question 18 (Mandatory) (1.5 points) Johnny Cake Ltd. has 10 million shares of stock outstanding selling at $20 per share and an issue of $50 million in 8 percent, annual coupon bonds with a maturity of 13 years, selling at 93.5 percent of par ($1.000). If Johnny Cake's weighted average tax rate is 34 percent, its next dividend is expected to be $2.00 per share, and all future dividends are expected to grow at 5 percent per year, indefinitely, what is its WACC? 13.26 percent 14.06 percent 13.18 percent O 12.64 percent Question 19 (Mandatory) (1 point) Which of these is the process of estimating expected future cash flows of a project using only the relevant parts of the balance sheet and income statements? O Pro forma analysis Substitutionary analysis Cash flow analysis Incremental cash flows Question 20 (Mandatory) (1 point) If a firm has already paid an expense or is obligated to pay one in the future, regardless of whether a particular project is undertaken, that expense is a: sunk cost. O obligated cost complementary cost. committed cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts