Question: help me please TCM is considering two mutually exclusive projects. TCM has a 9% cost of capital and follows the straight-line method of depreciation. The

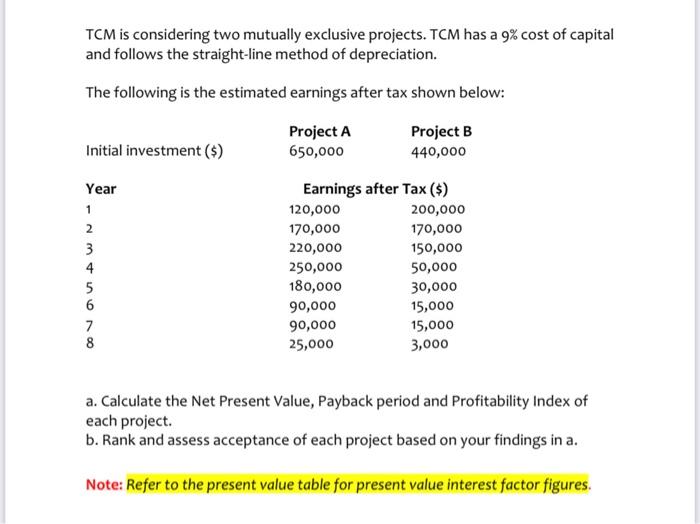

TCM is considering two mutually exclusive projects. TCM has a 9% cost of capital and follows the straight-line method of depreciation. The following is the estimated earnings after tax shown below: Initial investment ($) Project A 650,000 Project B 440,000 170,000 OOOWN Year 1 2 3 4 5 6 7 8 Earnings after Tax ($) 120,000 200,000 170,000 220,000 150,000 250,000 50,000 180,000 30,000 90,000 15,000 90,000 15,000 25,000 3,000 a. Calculate the Net Present Value, Payback period and Profitability Index of each project. b. Rank and assess acceptance of each project based on your findings in a. Note: Refer to the present value table for present value interest factor figures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts