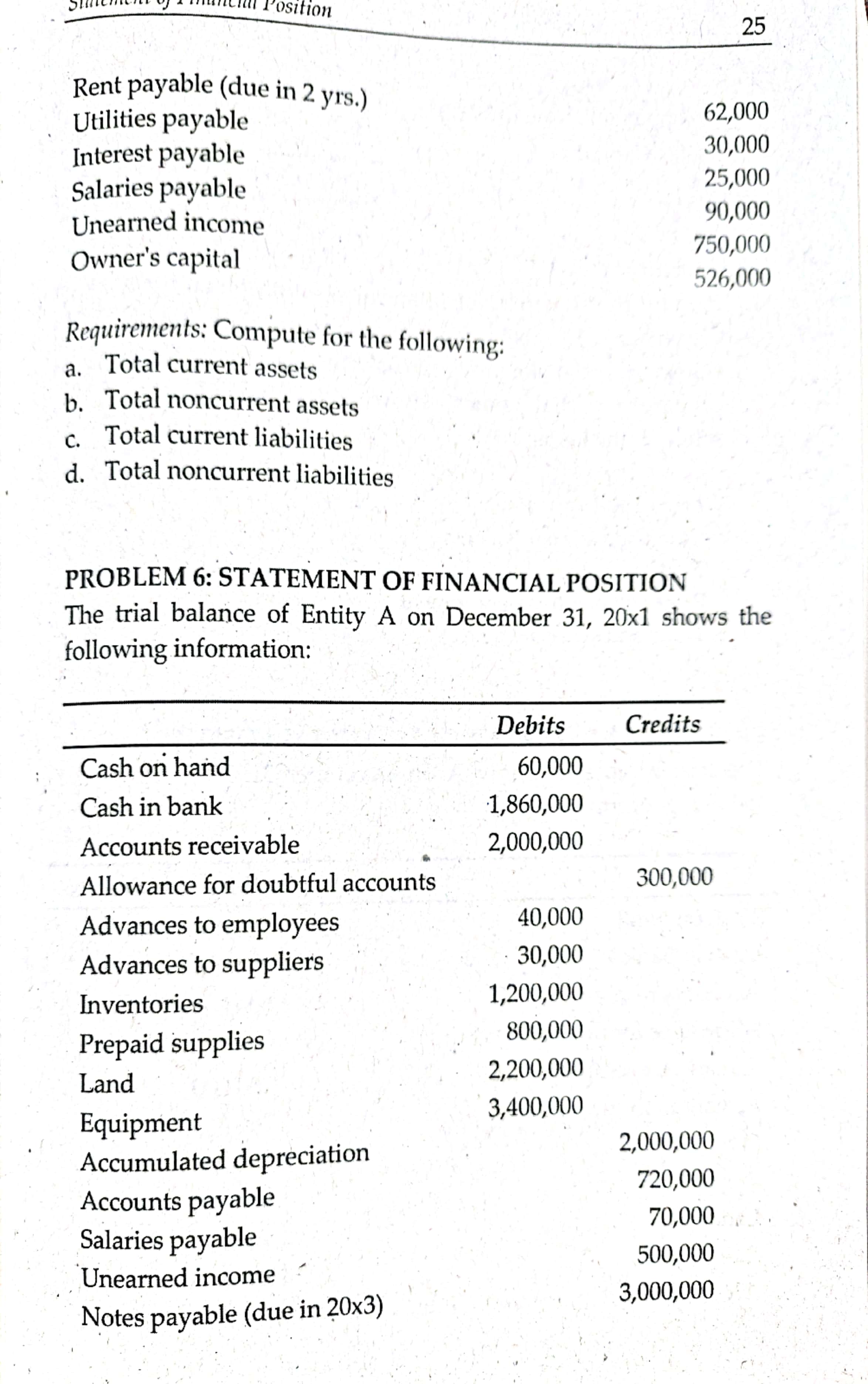

Question: Help me please with clear explanation. Thank You. a Position 25 Rent payable (due in 2 yrs.) Utilities payable 62,000 Interest payable 30,000 Salaries payable

Help me please with clear explanation. Thank You.

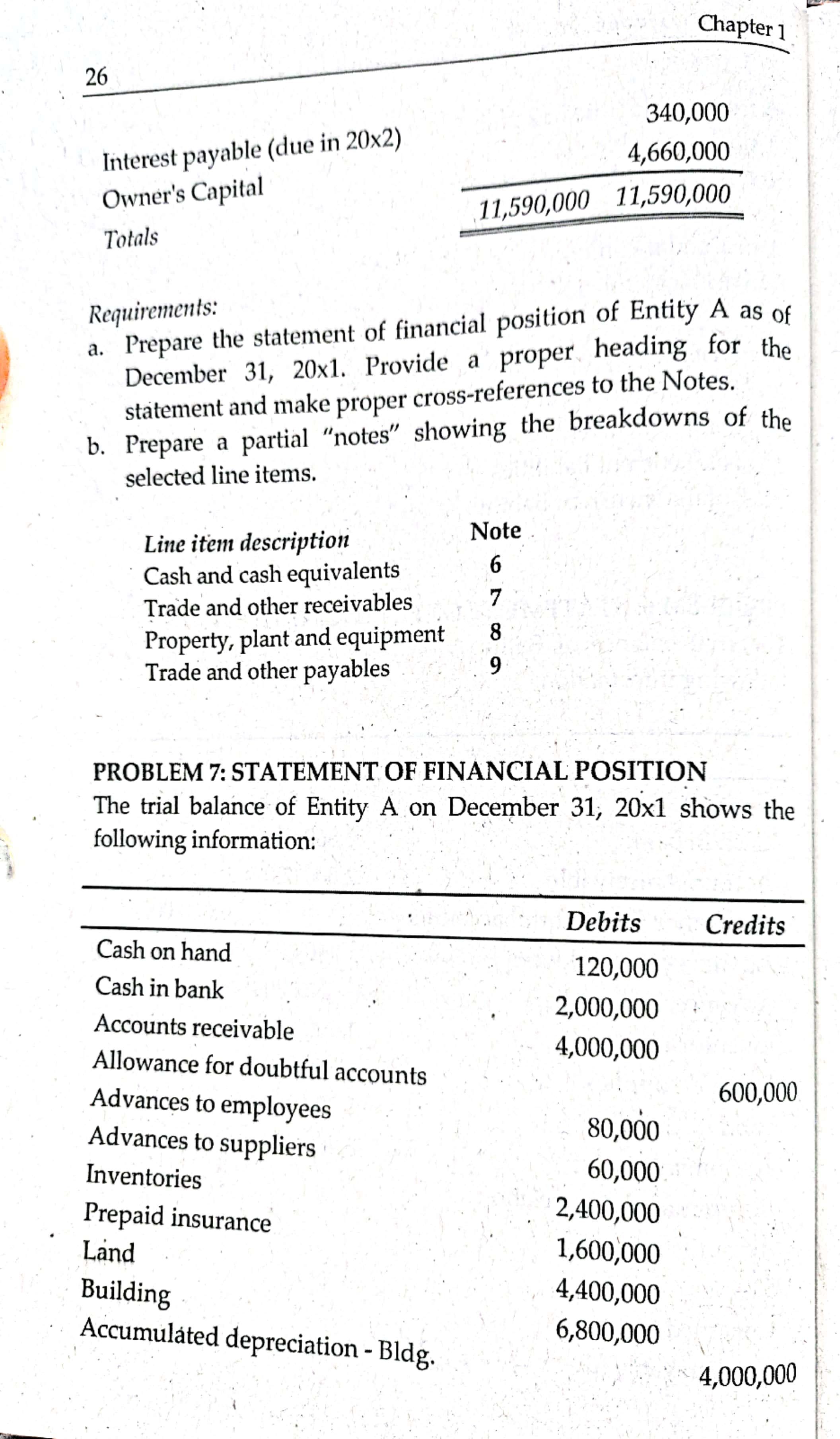

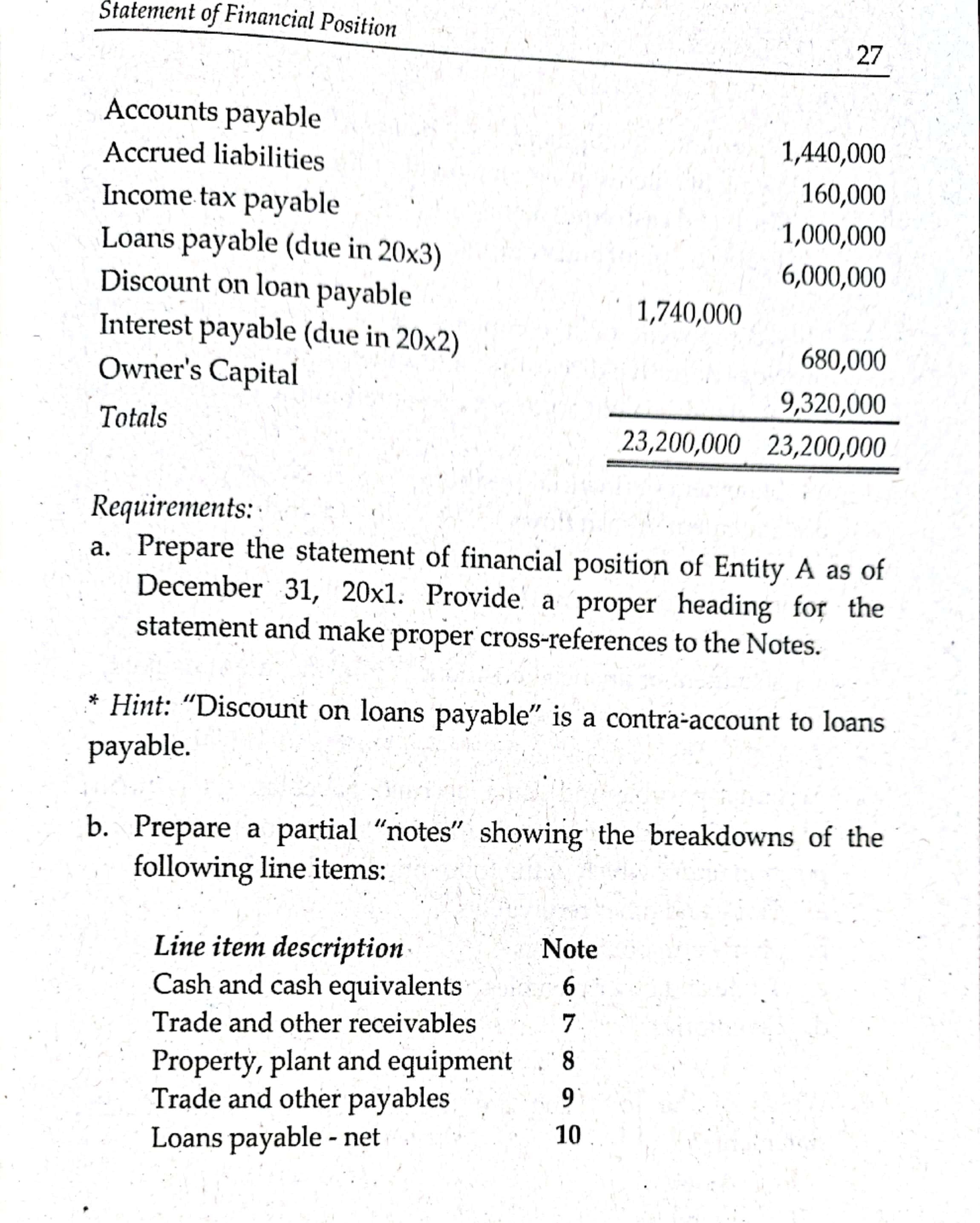

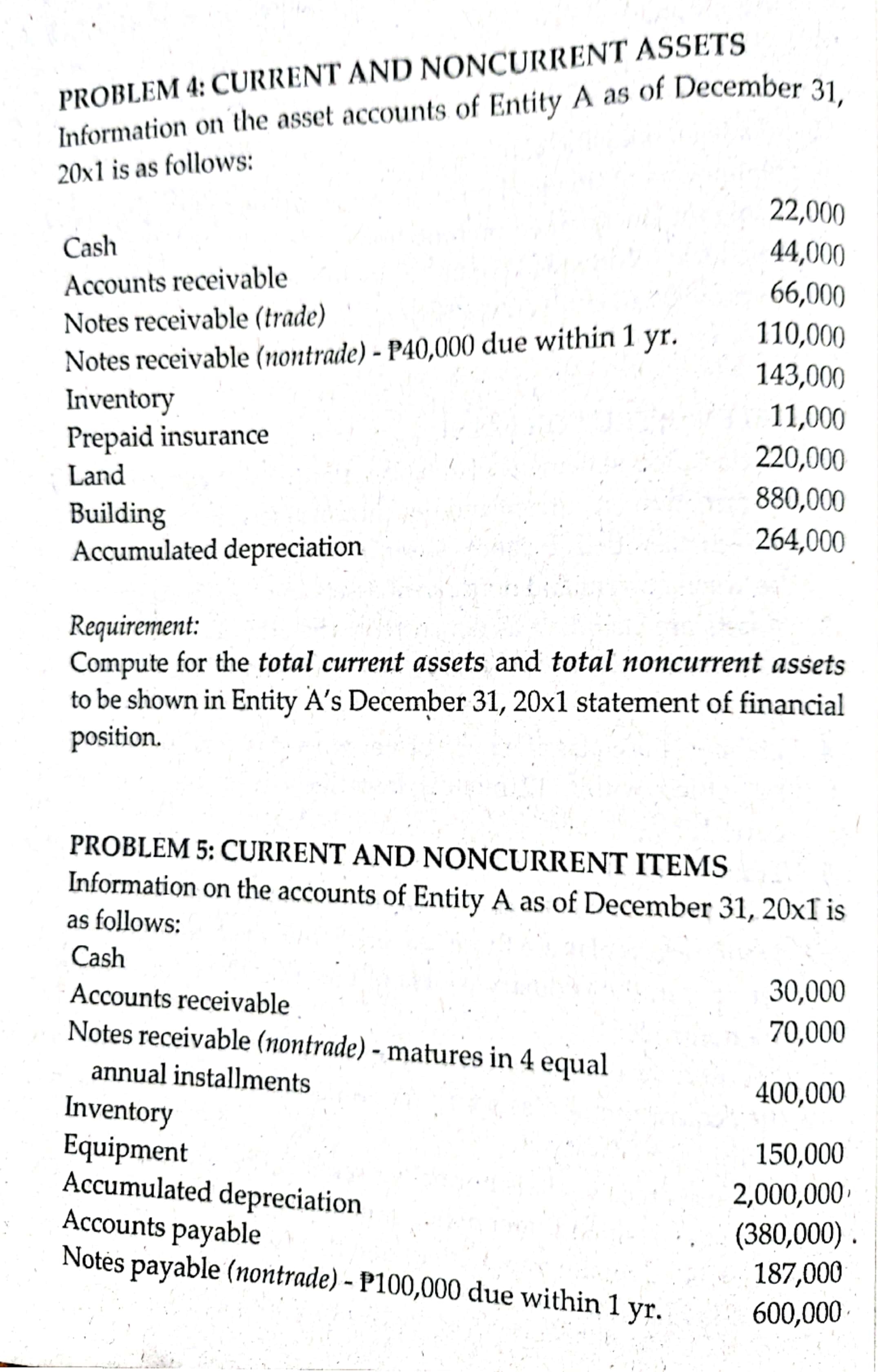

a Position 25 Rent payable (due in 2 yrs.) Utilities payable 62,000 Interest payable 30,000 Salaries payable 25,000 Unearned income 90,000 Owner's capital 750,000 526,000 Requirements: Compute for the following: a. Total current assets b. Total noncurrent assets c. Total current liabilities d. Total noncurrent liabilities PROBLEM 6: STATEMENT OF FINANCIAL POSITION The trial balance of Entity A on December 31, 20x1 shows the following information: Debits Credits Cash on hand 60,000 Cash in bank 1,860,000 Accounts receivable 2,000,000 Allowance for doubtful accounts 300,000 Advances to employees 40,000 Advances to suppliers 30,000 Inventories 1,200,000 Prepaid supplies 800,000 Land 2,200,000 Equipment 3,400,000 Accumulated depreciation 2,000,000 Accounts payable 720,000 Salaries payable 70,000 Unearned income 500,000 Notes payable (due in 20x3) 3,000,000Chapter 1 26 340,000 Interest payable (due in 20x2) 4,660,000 Owner's Capital 11,590,000 11,590,000 Totals Requirements: a. Prepare the statement of financial position of Entity A as of December 31, 20x1. Provide a proper heading for the statement and make proper cross-references to the Notes. b. Prepare a partial "notes" showing the breakdowns of the selected line items. Line item description Note Cash and cash equivalents Trade and other receivables Property, plant and equipment Trade and other payables PROBLEM 7: STATEMENT OF FINANCIAL POSITION The trial balance of Entity A on December 31, 20x1 shows the following information: Debits Credits Cash on hand 120,000 Cash in bank 2,000,000 Accounts receivable 4,000,000 Allowance for doubtful accounts 600,000 Advances to employees 80,000 Advances to suppliers Inventories 60,000 Prepaid insurance 2,400,000 Land 1,600,000 Building 4,400,000 Accumulated depreciation - Bldg. 6,800,000 4,000,000Statement of Financial Position 27 Accounts payable 1,440,000 Accrued liabilities 160,000 Income tax payable 1,000,000 Loans payable (due in 20x3) 6,000,000 Discount on loan payable 1,740,000 Interest payable (due in 20x2) 680,000 Owner's Capital 9,320,000 Totals 23,200,000 23,200,000 Requirements: a. Prepare the statement of financial position of Entity A as of December 31, 20x1. Provide a proper heading for the statement and make proper cross-references to the Notes. * Hint: "Discount on loans payable" is a contra-account to loans payable. b. Prepare a partial "notes" showing the breakdowns of the following line items: Line item description Note Cash and cash equivalents Trade and other receivables Property, plant and equipment Trade and other payables Loans payable - net 10PROBLEM 4: CURRENT AND NONCURRENT ASSETS Information on the asset accounts of Entity A as of December 31, 20x1 is as follows: 22,000 Cash 44,000 Accounts receivable 66,000 Notes receivable (trade) Notes receivable (nontrade) - P40,000 due within 1 yr. 110,000 143,000 Inventory 11,000 Prepaid insurance 220,000 Land 880,000 Building Accumulated depreciation 264,000 Requirement: Compute for the total current assets and total noncurrent assets to be shown in Entity A's December 31, 20x1 statement of financial position. PROBLEM 5: CURRENT AND NONCURRENT ITEMS Information on the accounts of Entity A as of December 31, 20x1 is as follows: Cash Accounts receivable 30,000 70,000 Notes receivable (nontrade) - matures in 4 equal annual installments 400,000 Inventory Equipment 150,000 Accumulated depreciation 2,000,000 Accounts payable (380,000) Notes payable (nontrade) - P100,000 due within 1 yr. 187,000 600,000