Question: Help me please with complete solution and clear explanation thank you. PROBLEM 10: STATEMENT OF CASH FLOWS - DIRECT Entity A's cash balance on January

Help me please with complete solution and clear explanation thank you.

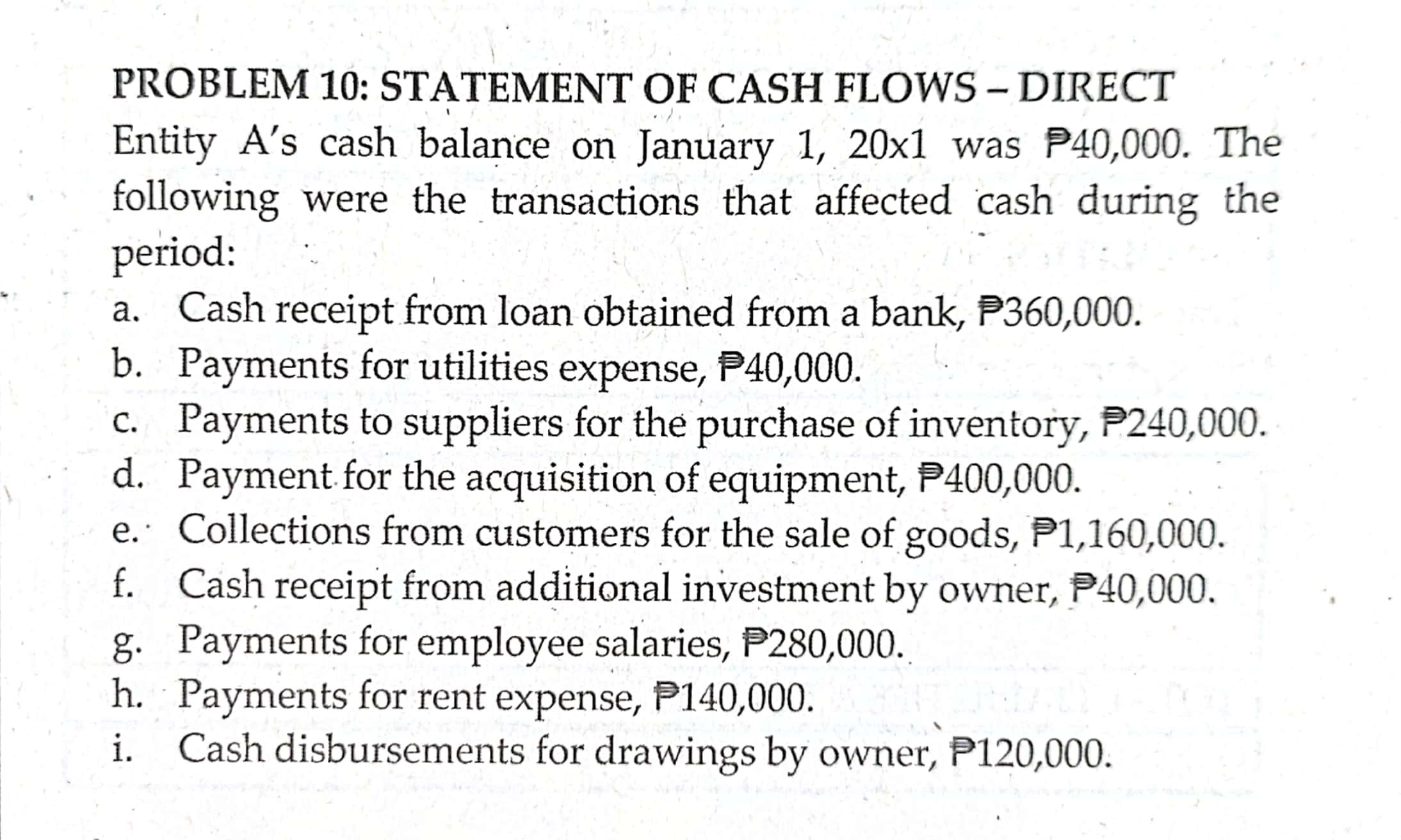

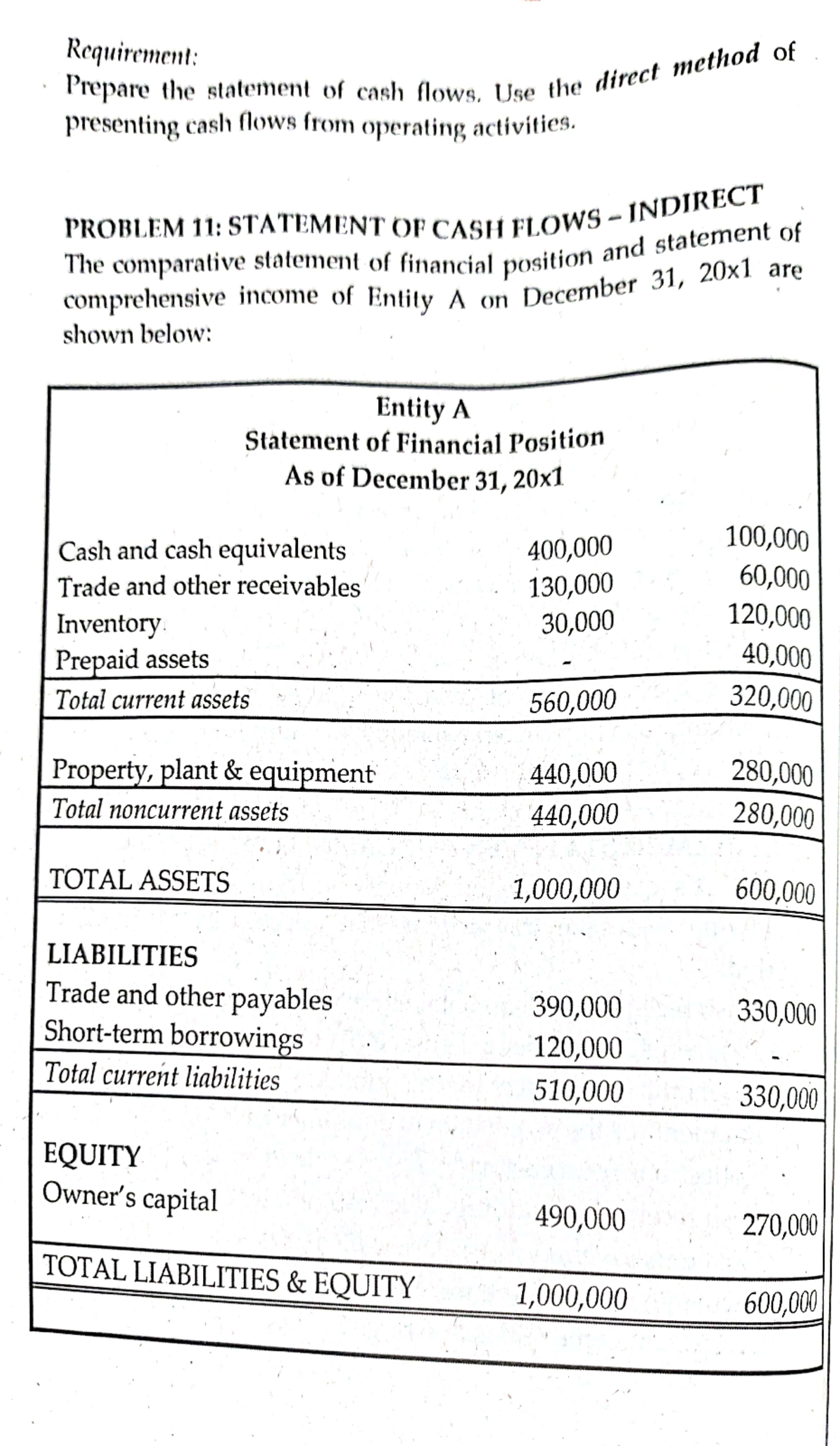

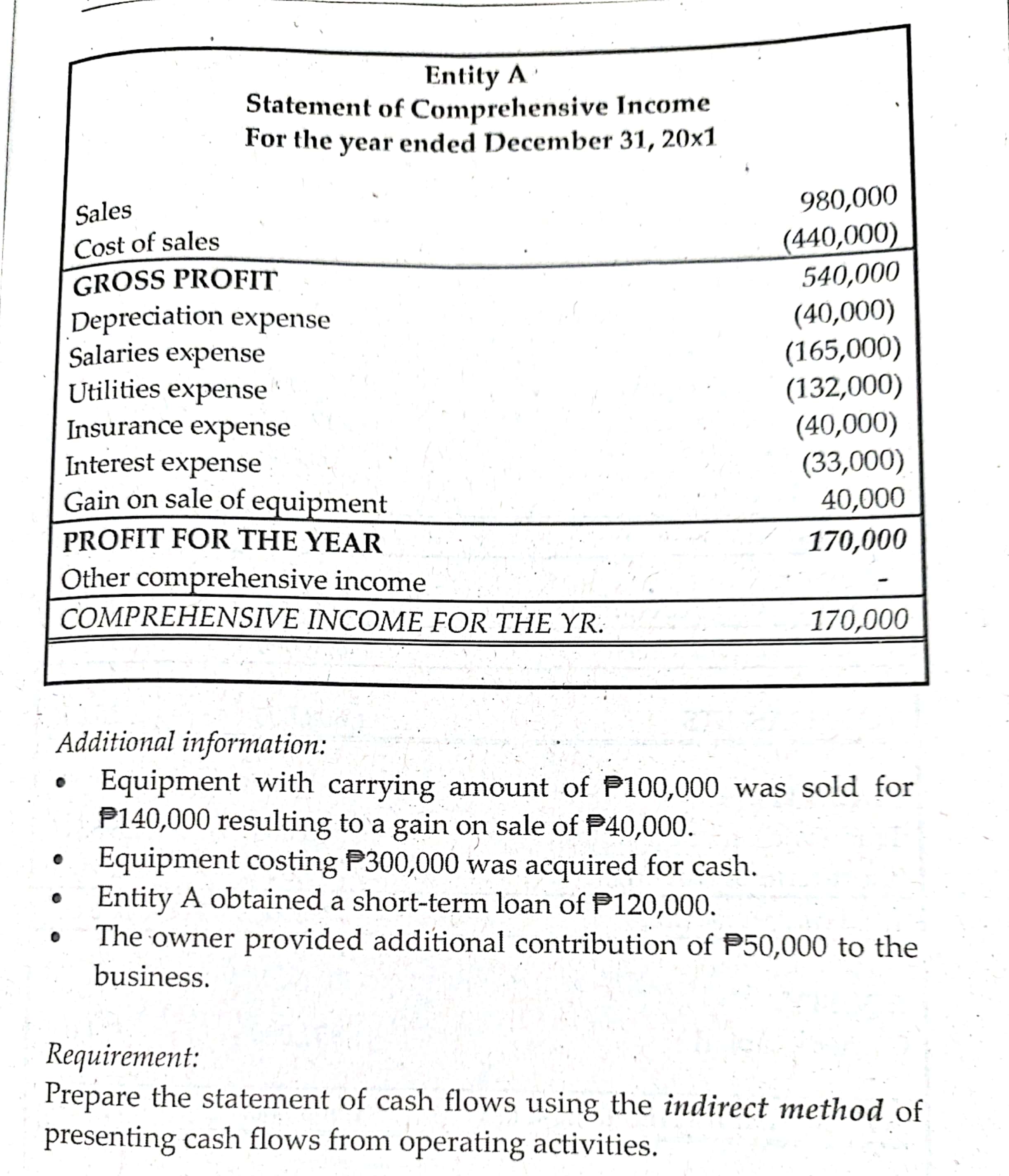

PROBLEM 10: STATEMENT OF CASH FLOWS - DIRECT Entity A's cash balance on January 1, 20x1 was P40,000. The following were the transactions that affected cash during the period: a. Cash receipt from loan obtained from a bank, P360,000. b. Payments for utilities expense, P40,000. c. Payments to suppliers for the purchase of inventory, P240,000. d. Payment for the acquisition of equipment, P400,000. e. . Collections from customers for the sale of goods, P1,160,000. f. Cash receipt from additional investment by owner, P40,000. g. Payments for employee salaries, P280,000. h. Payments for rent expense, P140,000. i. Cash disbursements for drawings by owner, P120,000.Requirement: Prepare the statement of cash flows. Use the direct method of presenting cash flows from operating activities. PROBLEM 11: STATEMENT OF CASH FLOWS - INDIRECT The comparative statement of financial position and statement of comprehensive income of Entity A on December 31, 20x1 are shown below: Entity A Statement of Financial Position As of December 31, 20x1 100,000 Cash and cash equivalents 400,000 Trade and other receivables 130,000 60,000 120,000 Inventory 30,000 Prepaid assets 40,000 Total current assets 560,000 320,000 Property, plant & equipment 440,000 280,000 Total noncurrent assets 440,000 280,000 TOTAL ASSETS 1,000,000 600,000 LIABILITIES Trade and other payables 390,000 330,000 Short-term borrowings 120,000 Total current liabilities 510,000 330,000 EQUITY Owner's capital 490,000 270,000 TOTAL LIABILITIES & EQUITY 1,000,000 600,000Entity A Statement of Comprehensive Income For the year ended December 31, 20x1 Sales 980,000 Cost of sales (440,000) GROSS PROFIT 540,000 Depreciation expense (40,000) Salaries expense (165,000) Utilities expense (132,000) Insurance expense (40,000) Interest expense (33,000) Gain on sale of equipment 40,000 PROFIT FOR THE YEAR 170,000 Other comprehensive income COMPREHENSIVE INCOME FOR THE YR. 170,000 Additional information: . Equipment with carrying amount of P100,000 was sold for P140,000 resulting to a gain on sale of P40,000. Equipment costing P300,000 was acquired for cash. . Entity A obtained a short-term loan of P120,000. The owner provided additional contribution of P50,000 to the business. Requirement: Prepare the statement of cash flows using the indirect method of presenting cash flows from operating activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts