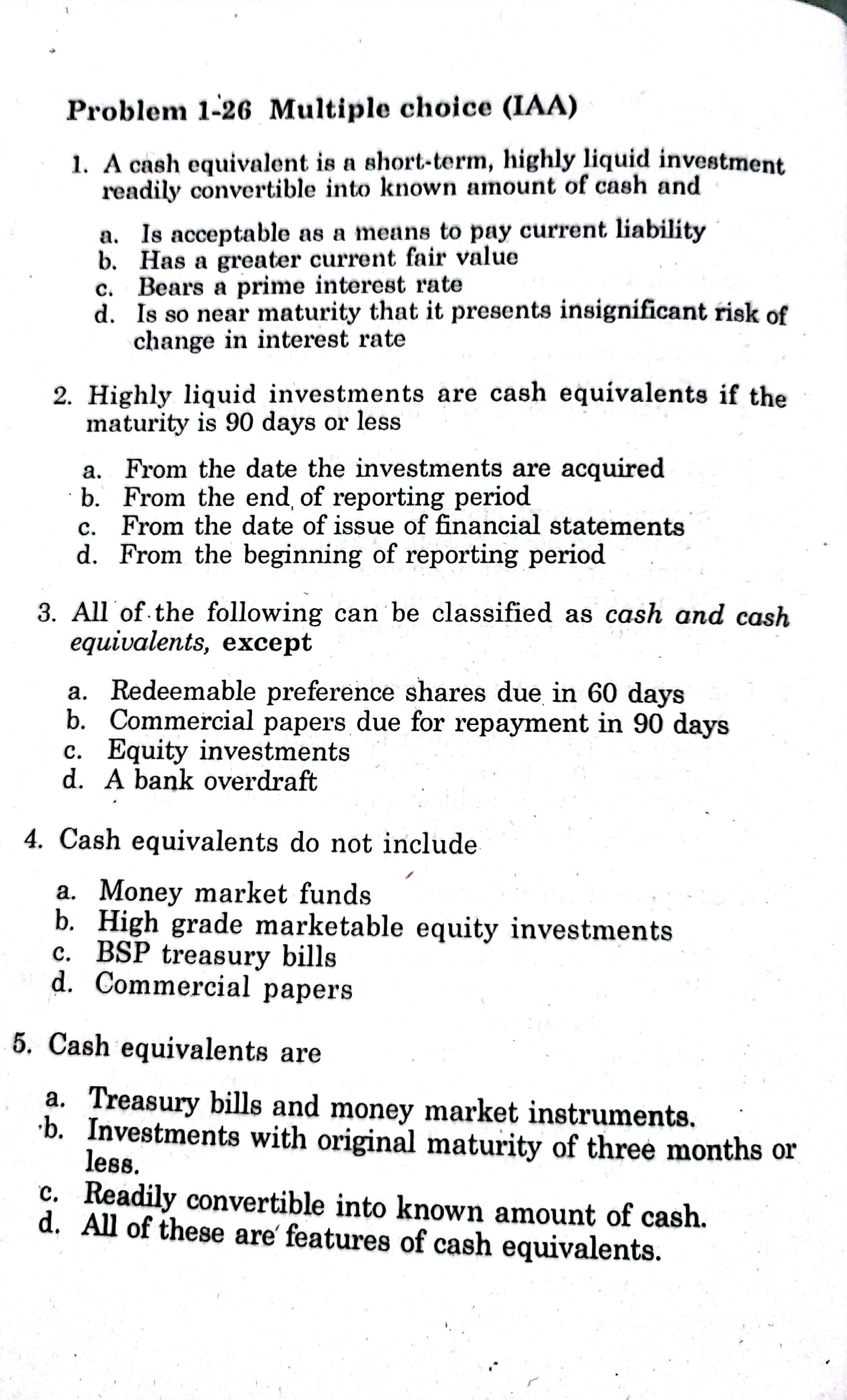

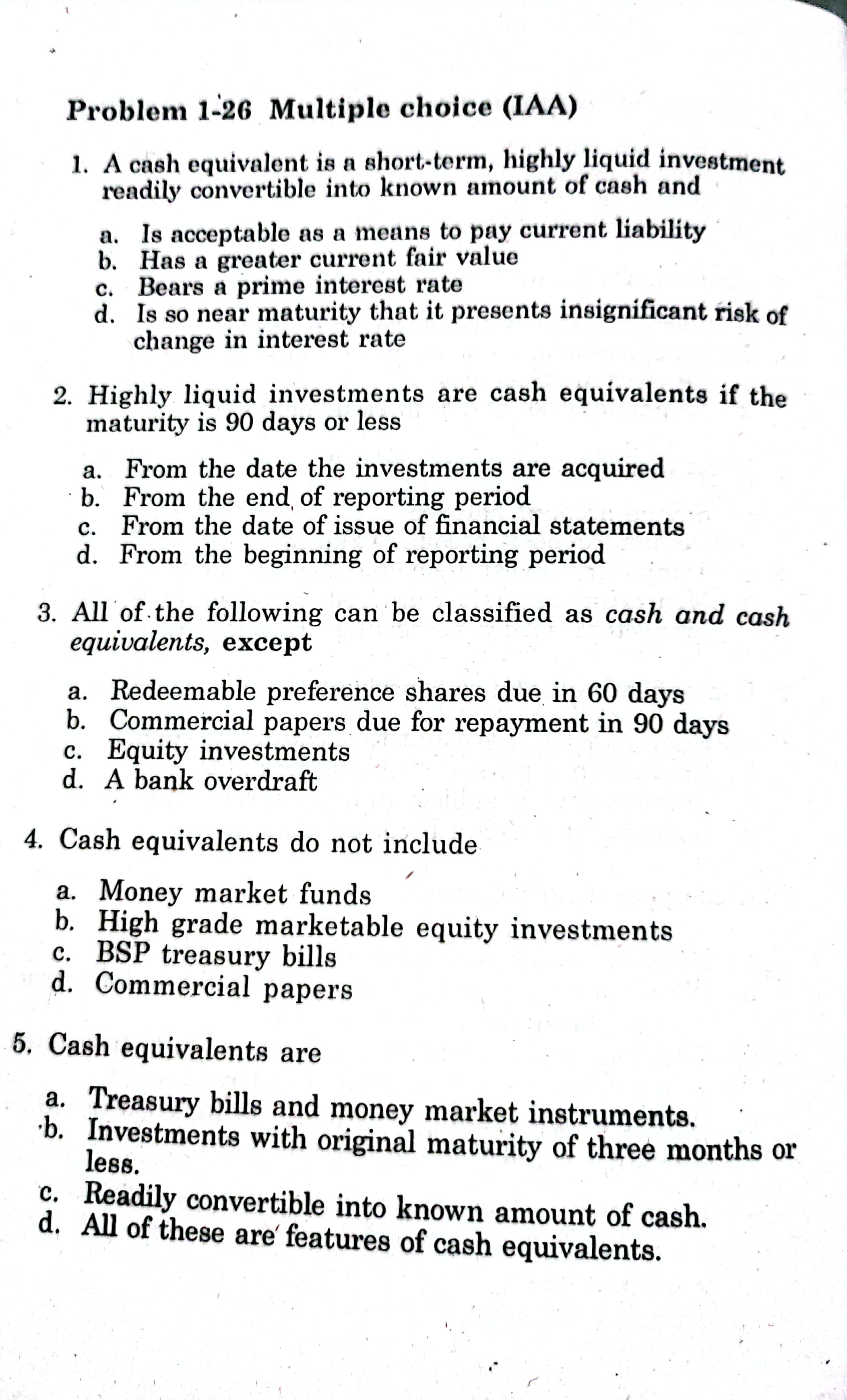

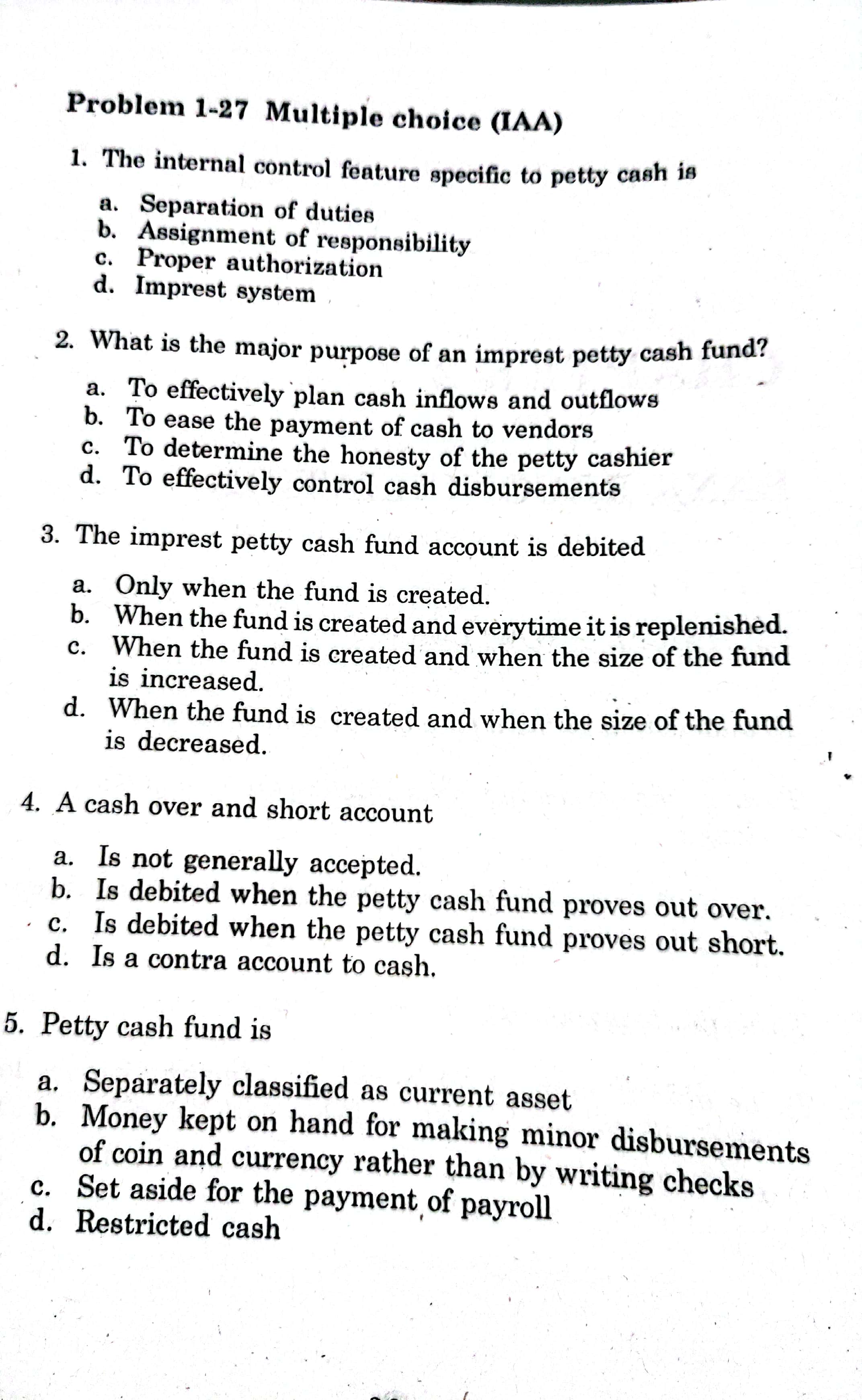

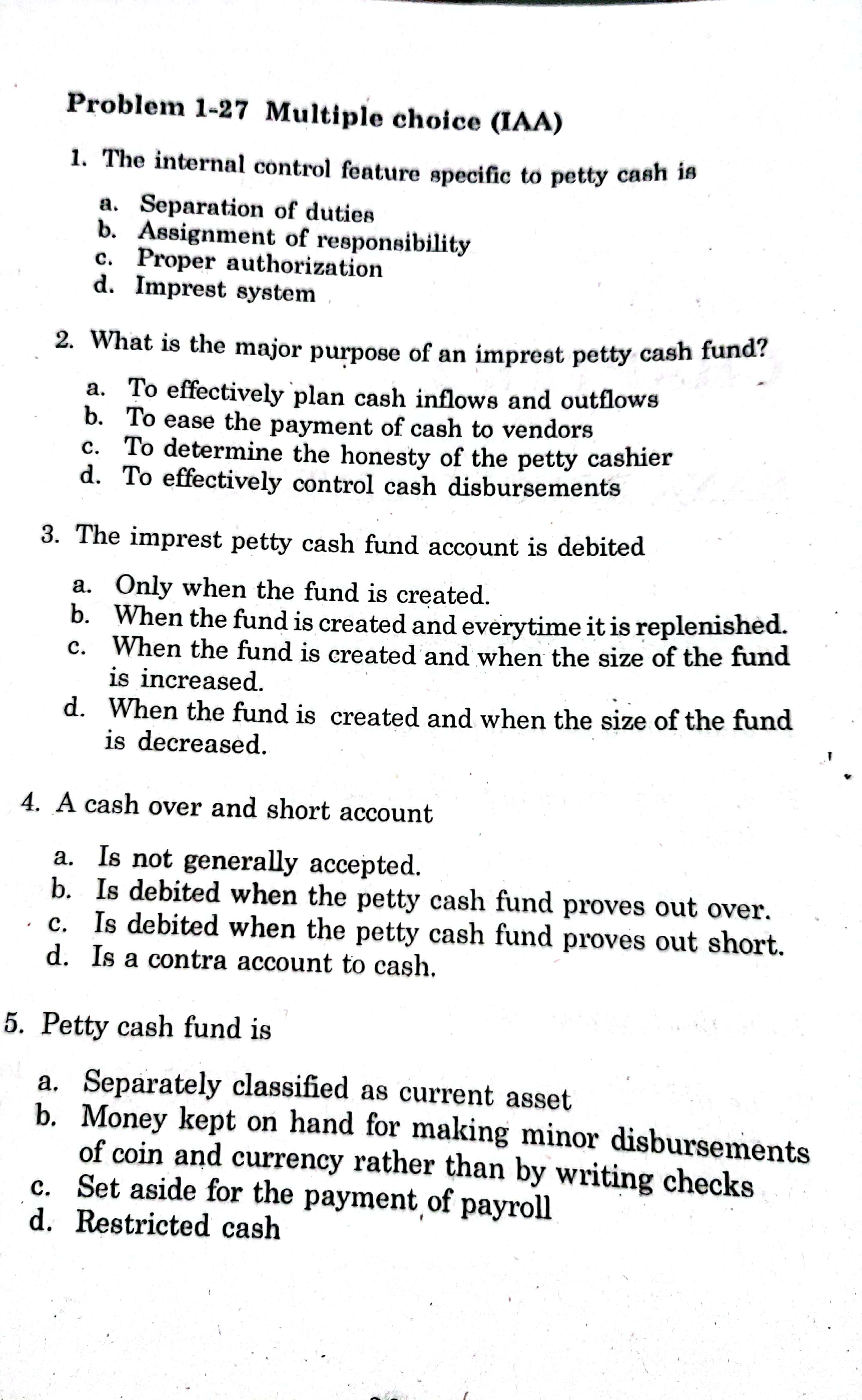

Question: Help me please with detailed and clear explanation Problem 1-26 Multiple choice (IAA) 1. A cash equivalent is a short-term, highly liquid investment readily convertible

Help me please with detailed and clear explanation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock