Question: help me please Yonan inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and

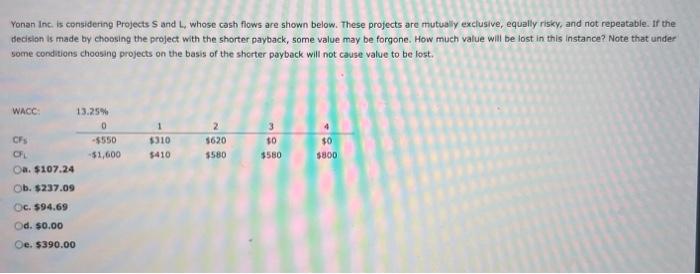

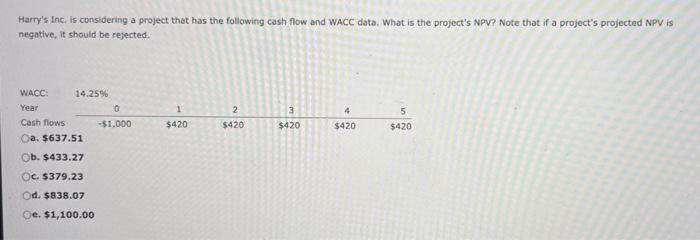

Yonan inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost. WhCC: 13.25\% Oa. 5107,24 b. $237.09 c. $94.69 d. 50,00 e. $390.00 Harry's Inc, is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's projected NPV is negative, it should be rejected. a. $637.51 b. $433.27 c. $379.23 d. $838.07 e. $1,100.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts