Question: help me pls i dont have alot of time solve all the question pls ution 2727 Question 27 2 points You purchase a TP note

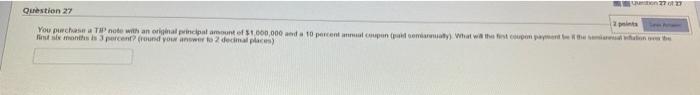

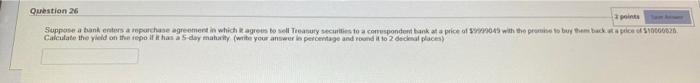

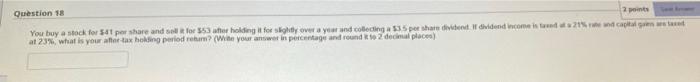

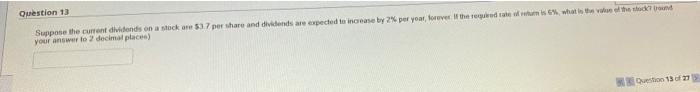

ution 2727 Question 27 2 points You purchase a TP note with an original principal amount of $1,000,000 and a 10 percent annual coupon (paid somiaruay) What will the first coupon payment be the real wone Best six months is 3 percent? (round your answer to 2 decimal places) Question 26 points Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a price of $9999045 with the promise to buy them back at a price of $10000820 Calculate the yield on the repo if it has a 5-day maharity (write your answer in percentage and round it to 2 decimal places) Question 18 2 points You buy a stock for $41 per share and sell it for $53 after holding it for slightly over a year and collecting a $3.5 per share dividend. If dividend income is tand at a 21% rate and capital gaien are taxed at 23%, what is your after-tax holding period rehum? (Write your answer in percentage and round it to 2 decimal places) Question 13 Suppose the current dividends on a stock are $3.7 per share and dividends are expected to increase by 2% per year, forever. If the required rate of return is 6%, what is the value of the stock? pound your answer to 2 decimal places) Question 13 of 27 15 ution 2727 Question 27 2 points You purchase a TP note with an original principal amount of $1,000,000 and a 10 percent annual coupon (paid somiaruay) What will the first coupon payment be the real wone Best six months is 3 percent? (round your answer to 2 decimal places) Question 26 points Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a price of $9999045 with the promise to buy them back at a price of $10000820 Calculate the yield on the repo if it has a 5-day maharity (write your answer in percentage and round it to 2 decimal places) Question 18 2 points You buy a stock for $41 per share and sell it for $53 after holding it for slightly over a year and collecting a $3.5 per share dividend. If dividend income is tand at a 21% rate and capital gaien are taxed at 23%, what is your after-tax holding period rehum? (Write your answer in percentage and round it to 2 decimal places) Question 13 Suppose the current dividends on a stock are $3.7 per share and dividends are expected to increase by 2% per year, forever. If the required rate of return is 6%, what is the value of the stock? pound your answer to 2 decimal places) Question 13 of 27 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts