Question: Help me pls. This question has me stressed out. All information needed is in the picture. P4-19 (similar to) Question Holp Pro forma balance sheet

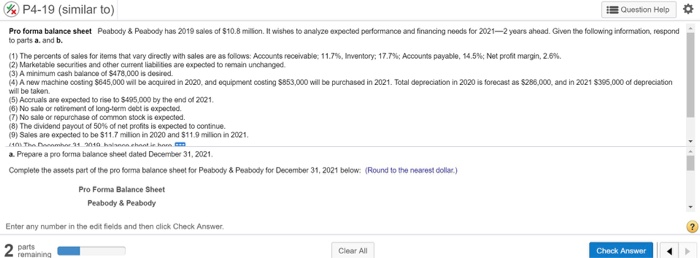

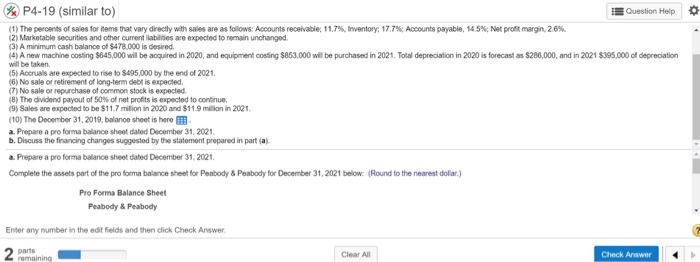

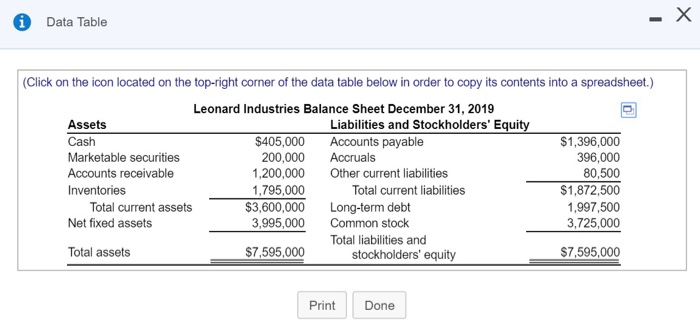

P4-19 (similar to) Question Holp Pro forma balance sheet Peabody & Peabody has 2019 sales of $10.8 million. It wishes to analyze expected performance and financing needs for 2021-2 years ahead. Given the following information, respond to parts a. and b. (1) The percents of sales for items that vary direcny with sales a e as flo s Acoorts receivable 1 1.7% Im entory: 17.7%; Aco ung payable. 14.5% Net profit margin, 26% 2) Marketable secunities and other current liablities are expected to remain unchanged (3) A minimum cash balance of $478,000 is desired 4) A new machine costing $645,000 will be acquired in 2020, and equipment costing $853,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $286,000, and in 2021 $36,000 of depreciaion wil be taken. (5) Accruals are expected to rise to $495,000 by the end of 2021 6) No salo or notiremend of long-term debt is expected. (7) No sale or repurohase of common stock is expected. (8)The dividend payout of 50% of net profits is expected to continue. (D) Sales are expected to be $11.7 milion in 2020 and $11.0 million in 2021 a Prepare a pro forma balance sheet dated December 31, 2021 Complete the assets part of the pro forma balance sheet for Peabody &Peabody for December 31, 2021 below: (Round to the nearest dollar) Pro Forma Balance Sheet Peabody & Peabody Enter any number in the edit fields and then click Check Answer Clear All Check Answer P4-19 (similar to) Question Help (1) The percents of sales to ner s that vary drectly with sales a e as fol ws: Accounts receivable 11.7%, Inventory: 17.7% Aocounts payable 14.5%; Net pr tt margin, 28%, 2) Marketable securities and other current liabiliies are expected to remain unchanged (3) A minimum cash balance of $478,000 is desired 4) A new machine oosting $845,000 ill be aoquired in 2020, and equipment costing $853,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $288,000, and in 2021 $395,000 of depreciation will be taken 5) Accruals are expected to rise to $495,000 by the end of 2021 (6) No sale or retirement of long-term debt is expected (7) No sale or repurchase of common stock is expected (8) The dvdnd payout of 50% of net profits is expected tooortnue. 9)Sales are expected to be $11.7 miltion in 2020 and $11.9 million in 2021 (10) The December 31, 2019, balance sheet is here a. Prepare a pro forma balance sheet dated December 31, 2021 b. Discuss the financing changes suggested by the statement prepared in part (a). Prepare a pro forma balance sheet dated December 31, 2021 Complete the assets part of the pro forma balaroe sheet for Peabody & Peabody for December 31, 2021 below: (Round to the nearest dolar.) Pro Forma Balance Sheet Peabody &Peabody Enter any number in the edit fields and then click Check Answer Clear All Check Arnswer Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Leonard Industries Balance Sheet December 31, 2019 Assets Cash Marketable securities Accounts receivable Inventories Liabilities and Stockholders' Equit $1,396,000 396,000 80,500 $1,872,500 1,997,500 3,725,000 $405,000 Accounts payable 200,000 Accruals 1,200,000 Other current liabilities 1,795,000 Total current liabilities Total current assets $3,600,000 Long-term debt Net fixed assets 3,995,000 Common stock Total liabilities and Total assets $7,595,000 stockholders' equity S7.595,000 PrintDone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts