Question: HELP ME!!! ?? Secure https www.mathxl.com. Student/Player Test aspx?testld 5214 44¢ erwin eyes The following table shows the cost of producing dollar notes of various

HELP ME!!! ??

HELP ME!!! ??

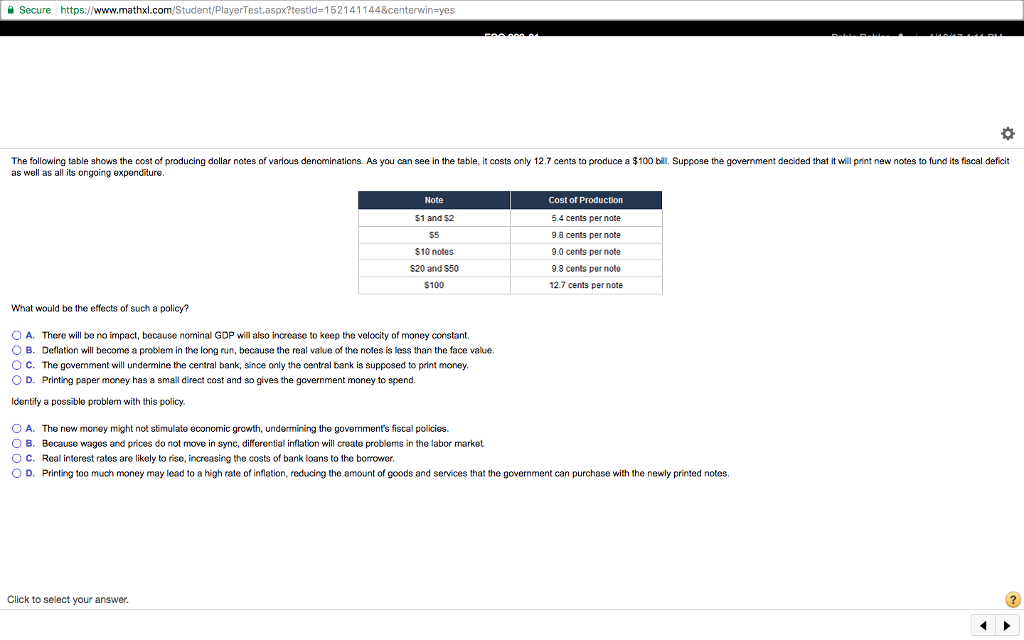

Secure https www.mathxl.com. Student/Player Test aspx?testld 5214 44¢ erwin eyes The following table shows the cost of producing dollar notes of various denominations. As you can see in the table, it costs only 12.7 cents to produce a $100 bill. Suppose the government decided that it will print new notes to fund its fiscal deficit as well as all its ongoing expenditure. Note Cost of Production $1 and $2 5.4 cents per note 5 9.8 cents per note s notes 9.0 cents per note $20 and $50 98 cents per note $100 12.7 cents per note What would be the effects of such a policy? O A. There will be no impact, because nominal GDP will also increase to keep the velocity of money constant. O B. Deflation will become a problem in the long run, because the real value of the notes is less than the face value. O C. The government will undermine the central bank, since only the central bank is supposed to print money. O D. Printing paper money has a small direct cost and so gives the government money to spend Identify a possible problem with this policy. O A. The new money might not stimulate economic growth, undermining the government's fiscal policies. O B. Because wages and prices do not move in sync, differential inflation will create problems in the labor market. O C. Real interest rates are likely to rise, increasing the costs of bank loans to the bomower. O D. Printing too much money may lead to a high rate of inflation, reducing the amount of goods and services that the government can purchase with the newly printed notes, Click to select your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts