Question: help me solve for recording asset exchanges! i provided the answer choices for all the entries Miley Corp. exchanges old equipment that costs $14,000 (accumulated

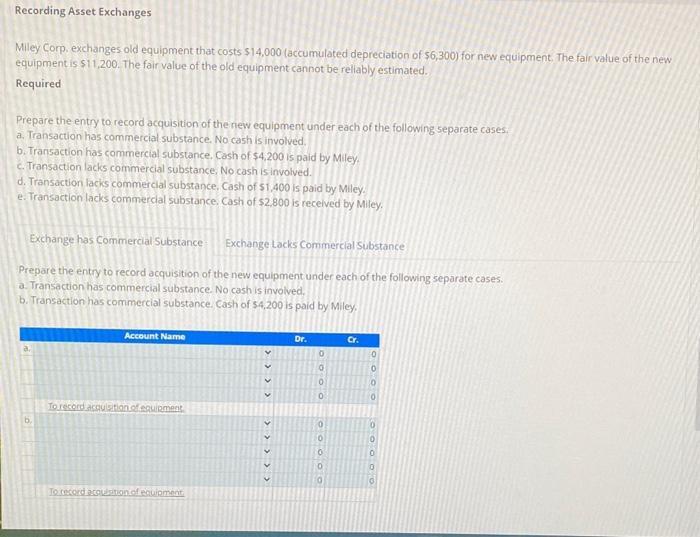

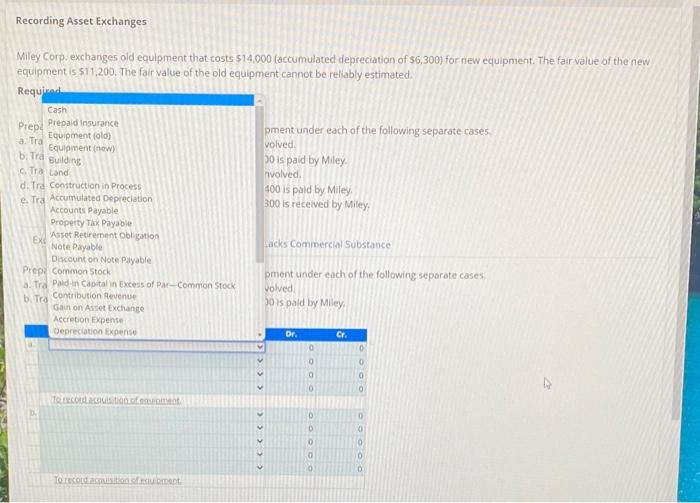

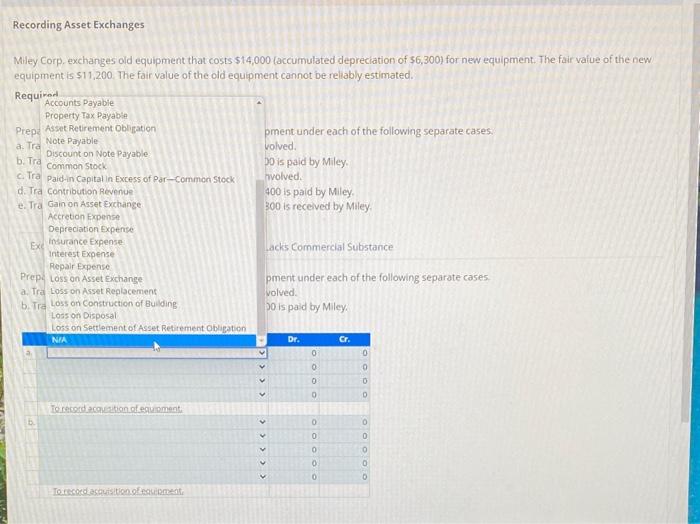

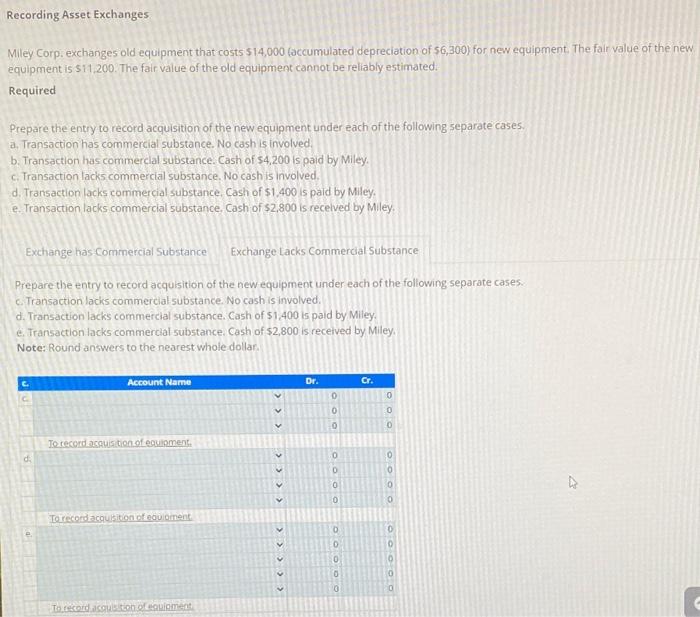

Miley Corp. exchanges old equipment that costs $14,000 (accumulated depreciation of $6,300 ) for new equipment. The fair value of the new equipment is $11,200. The fair value of the old equipment cannot be rellably estimated. Required Prepare the entry to record acquisition of the new equipment under each of the following separate cases: a. Transaction has commercial substance. No cash is involved. b. Transaction has commercial substance. Cash of $4,200 is paid by Miley. c. Transaction lacks commercial substance, No cash is involved. d. Transaction lacks commercial substance, Cash of $1,400 is paid by Miley. e. Transaction lacks commercial substance. Cash of $2.800 is received by Miley. Prepare the entry to record acquisition of the new equipment under each of the following separate cases. a. Transaction has commercial substance. No cash is involved. b. Transaction has commercial substance. Cash of $4,200 is paid by Miley. Miley Corp. exchanges old equipment that costs $14,000 (accumulated depreciation of $6,300 ) for new equipment. The fair value of the new equipment is 511,200 . The fair value of the old equipment cannot be reliably estimated. pment under each of the following separate cases. volved. bo is paid by Miley. Tivolved. 400 is paid by Miley. 300 is received by Miley. facks Commercial Substance pment under each of the following separate cases. volved. jois paid by Miley: Recording Asset Exchanges MHey Corp. exchanges old equipment that costs $14,000 (accumulated depreciation of $6,300 ) for new equipment. The fair value of the new equipment is $11,200. The fair value of the old equipment cannot be reliably estimated. Miley Corp. exchanges old equipment that costs 514,000 (accumulated depreciation of 56,300) for new equipment. The fair value of the new equipment is $11,200. The fair value of the old equipment cannot be reliably estimated. Required Prepare the entry to record acquisition of the new equipment under each of the following separate cases. a. Transaction has commercial substance. No cash is involved. b. Transaction has commerclal substance. Cash of $4,200 is paid by Miley. c. Transaction lacks commercial substance. No cash is involved. d. Transaction lacks commercial substance. Cash of $1,400 is pald by Miley. e. Transaction lacks commercial substance, Cash of $2,800 is recelved by Miley. Prepare the entry to record acquisition of the new equipment under each of the following separate cases. c. Transaction lacks commercial substance. No cash is involved. d. Transaction lacks commercial substance. Cash of $1,400 is paid by Miley. e. Transaction lacks commercial substance. Cash of $2,800 is received by Miley. Note: Round answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts