Question: HELP ME SOLVE MY FINANCE MULTIPLE CHOICE 10) The value of a bond is the amount that the Issuer must pay at maturity. B) present

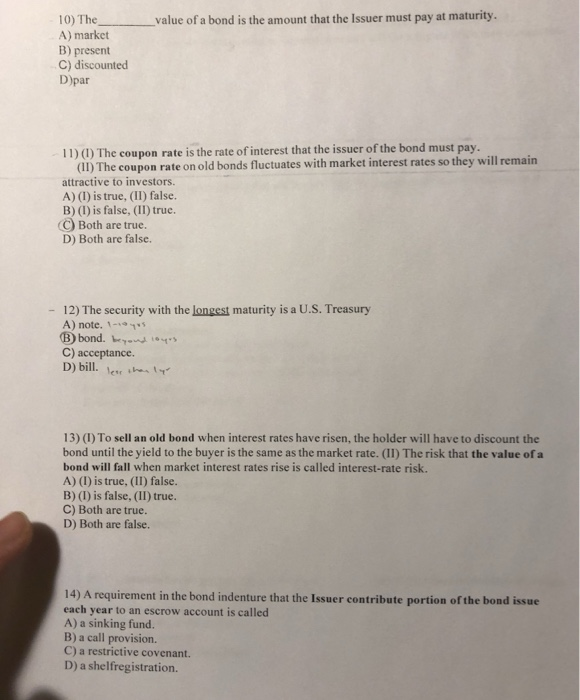

10) The value of a bond is the amount that the Issuer must pay at maturity. B) present C) discounted D)par II) The coupon rate is the rate of interest that the issuer of the bond must pay must pay. (II) The coupon rate on old bonds fluctuates with market interest rates so they will remain attractive to investors. A) (1) is true, (II) false. B) (I) is false, (II) true. C Both are true. D) Both are false. 12) The security with the longest maturity is a U.S. Treasury A) note, 1-10 #5 B bond. and o C) acceptance. 13) (I) To sell an old bond when interest rates have risen, the holder will have to discount the bond until the yield to the buyer is the same as the market rate. (II) The risk that the value of a bond will fall when market interest rates rise is called interest-rate risk. A) (I) is true, (II) false. B) (I) is false, (II) true. C) Both are true. D) Both are false. 14) A requirement in the bond indenture that the Issuer contribute portion of the bond issue each year to an escrow account is called A) a sinking fund. B) a call provision. C) a restrictive covenant. D) a shelfregistration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts