Question: help me solve Question 7 (10 points) Spartan has $25 million of bonds outstanding that were issued at a coupon rate of 8 percent five

help me solve

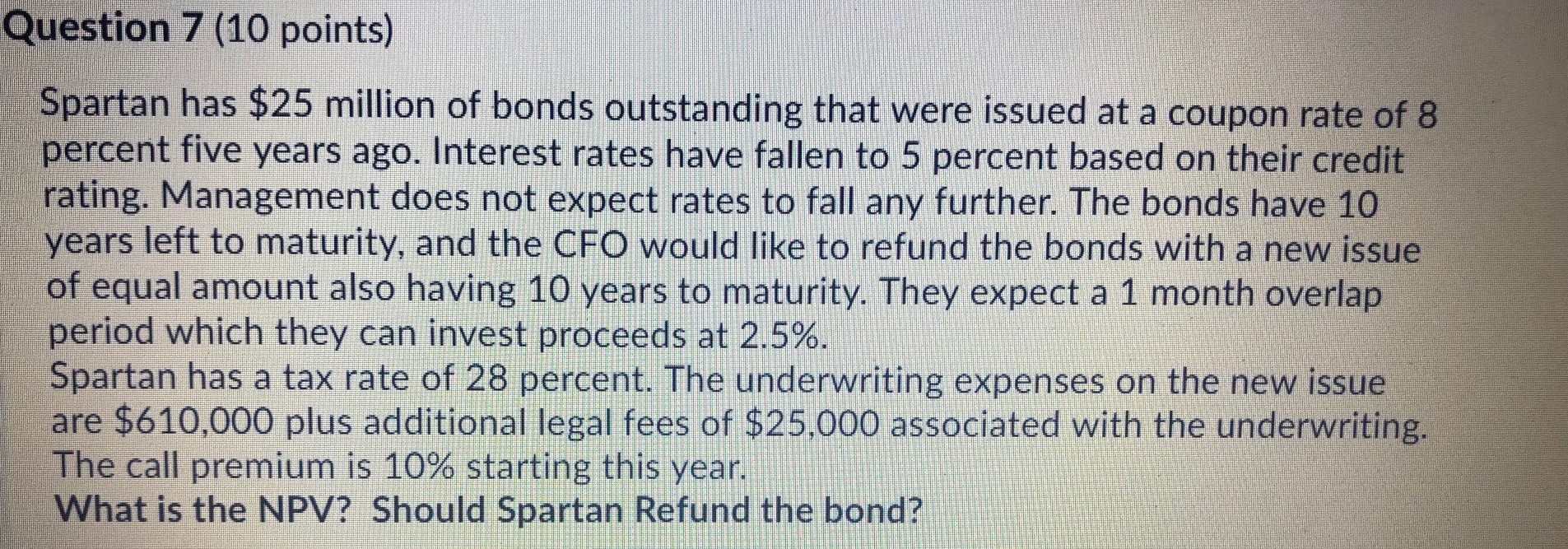

Question 7 (10 points) Spartan has $25 million of bonds outstanding that were issued at a coupon rate of 8 percent five years ago. Interest rates have fallen to 5 percent based on their credit rating. Management does not expect rates to fall any further. The bonds have 10 years left to maturity, and the CFO would like to refund the bonds with a new issue of equal amount also having 10 years to maturity. They expect a 1 month overlap period which they can invest proceeds at 2.5%. Spartan has a tax rate of 28 percent. The underwriting expenses on the new issue are $610,000 plus additional legal fees of $25,000 associated with the underwriting. The call premium is 10% starting this year. What is the NPV? Should Spartan Refund the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts