Question: Help me solve step by step please 18.Adam is currently 25 , and has started working for a company. Adam is expected to retire at

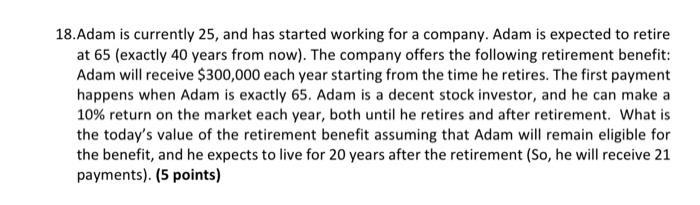

18.Adam is currently 25 , and has started working for a company. Adam is expected to retire at 65 (exactly 40 years from now). The company offers the following retirement benefit: Adam will receive $300,000 each year starting from the time he retires. The first payment happens when Adam is exactly 65 . Adam is a decent stock investor, and he can make a 10% return on the market each year, both until he retires and after retirement. What is the today's value of the retirement benefit assuming that Adam will remain eligible for the benefit, and he expects to live for 20 years after the retirement (So, he will receive 21 payments). (5 points) 18.Adam is currently 25 , and has started working for a company. Adam is expected to retire at 65 (exactly 40 years from now). The company offers the following retirement benefit: Adam will receive $300,000 each year starting from the time he retires. The first payment happens when Adam is exactly 65 . Adam is a decent stock investor, and he can make a 10% return on the market each year, both until he retires and after retirement. What is the today's value of the retirement benefit assuming that Adam will remain eligible for the benefit, and he expects to live for 20 years after the retirement (So, he will receive 21 payments). (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts