Question: help me solve these three problems asap please, and showing work would be appreciated! 5. Intercoastal Corporation recently paid a common stock dividend of $2.50.

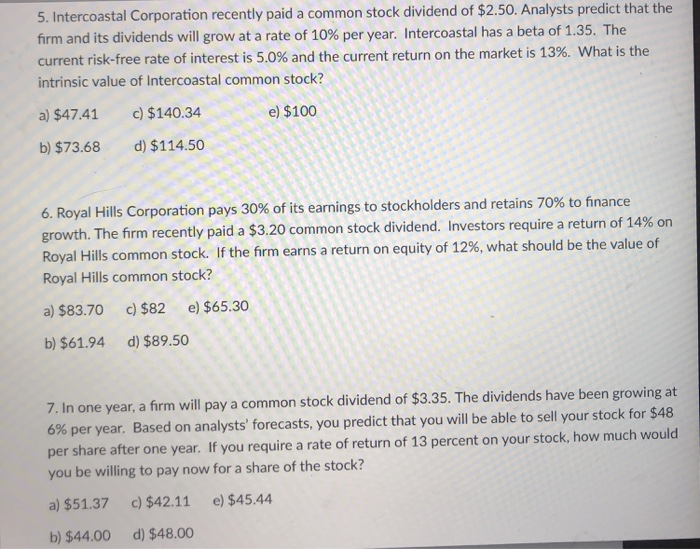

5. Intercoastal Corporation recently paid a common stock dividend of $2.50. Analysts predict that the firm and its dividends will grow at a rate of 10% per year. Intercoastal has a beta of 1.35. The current risk-free rate of interest is 5.0% and the current return on the market is 13%. What is the intrinsic value of Intercoastal common stock? a)$47.41 c)$140.34 e) $100 b) $73.68 d) $114.50 6. Royal Hills Corporation pays 30% of its earnings to stockholders and retains 70% to finance growth. The firm recently paid a $3.20 common stock dividend. Investors require a return of 14% on Royal Hills common stock. If the firm earns a return on equity of 12% Royal Hills common stock? what should be the value of a) $83.70 c) $82 e) $65.30 b) $61.94d) $89.50 7. In one year, a firm will pay a common stock dividend of $3.35. The dividends have been growing at 6% per year. Based on analysts, forecasts, you predict that you will be able to sell your stock for $48 per share after one year. If you require a rate of return of 13 percent on your stock, how much would you be willing to pay now for a share of the stock? a) $51.37 c)$42.11 e) $45.44 b) $44.00 d) $48.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts