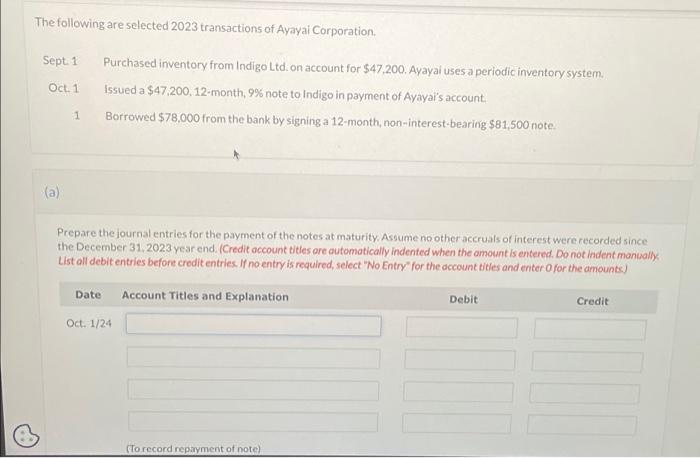

Question: The following are selected 2023 transactions of Ayayai Corporation. Sept. 1 Oct. 1 1 Purchased inventory from Indigo Ltd. on account for $47,200. Ayayai

The following are selected 2023 transactions of Ayayai Corporation. Sept. 1 Oct. 1 1 Purchased inventory from Indigo Ltd. on account for $47,200. Ayayai uses a periodic inventory system. Issued a $47,200, 12-month, 9% note to Indigo in payment of Ayayai's account. Borrowed $78,000 from the bank by signing a 12-month, non-interest-bearing $81,500 note. Prepare the journal entries for the payment of the notes at maturity. Assume no other accruals of interest were recorded since the December 31, 2023 year end. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Date Account Titles and Explanation Oct. 1/24 (To record repayment of note) Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Journal Entries for Repayment of Notes at Maturity Oct 1 2024 Here are the journal entries for the r... View full answer

Get step-by-step solutions from verified subject matter experts