Question: Help me solve this using the direct method Instruction a Financial information for Robinenn Inc follemex Acdituonat intormankw:- Ordinary shares were redcemed doning the year

Help me solve this using the direct method

Instruction a

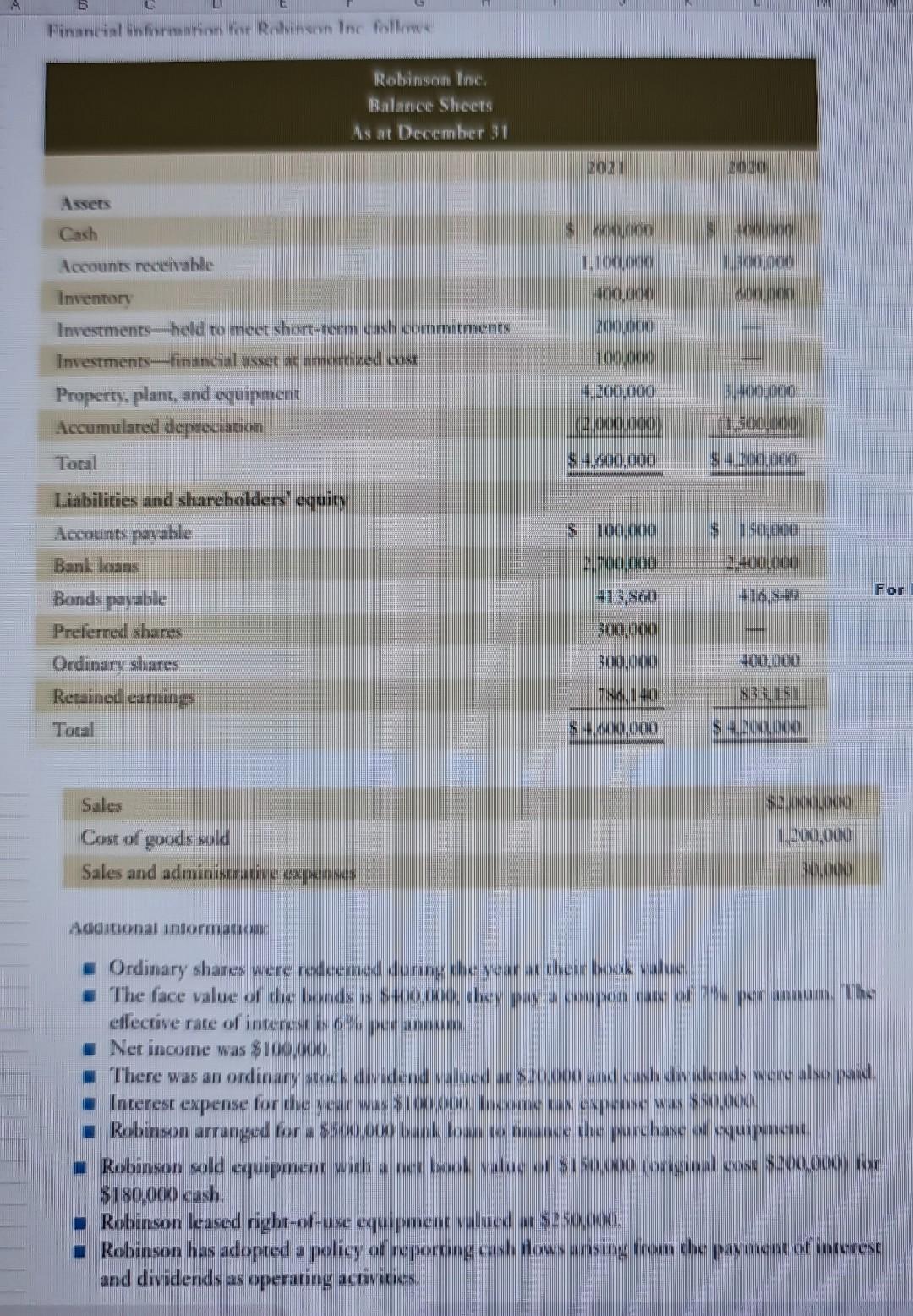

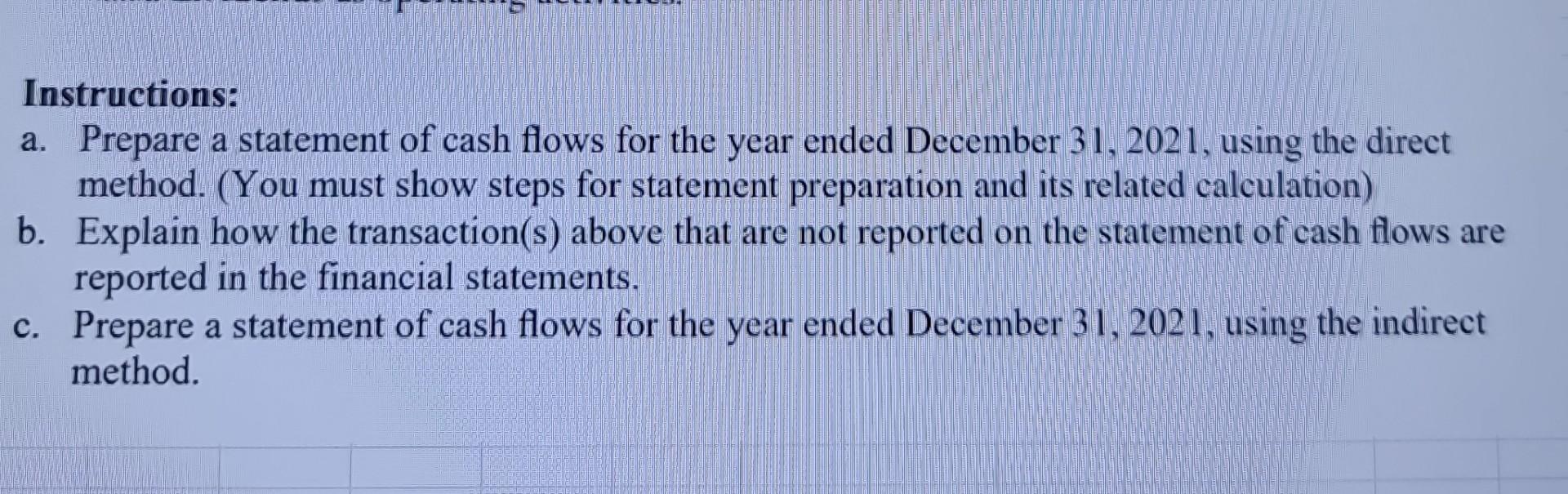

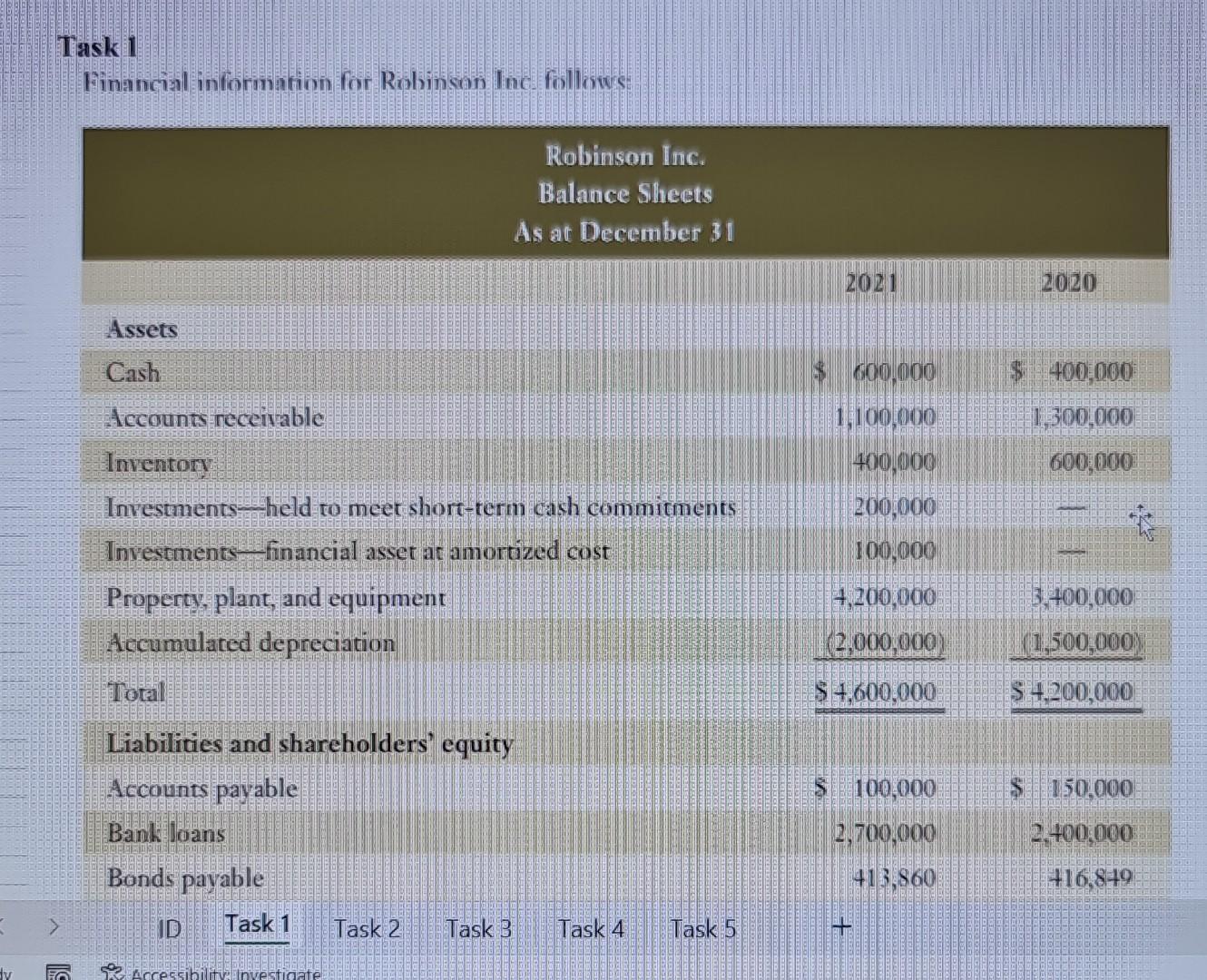

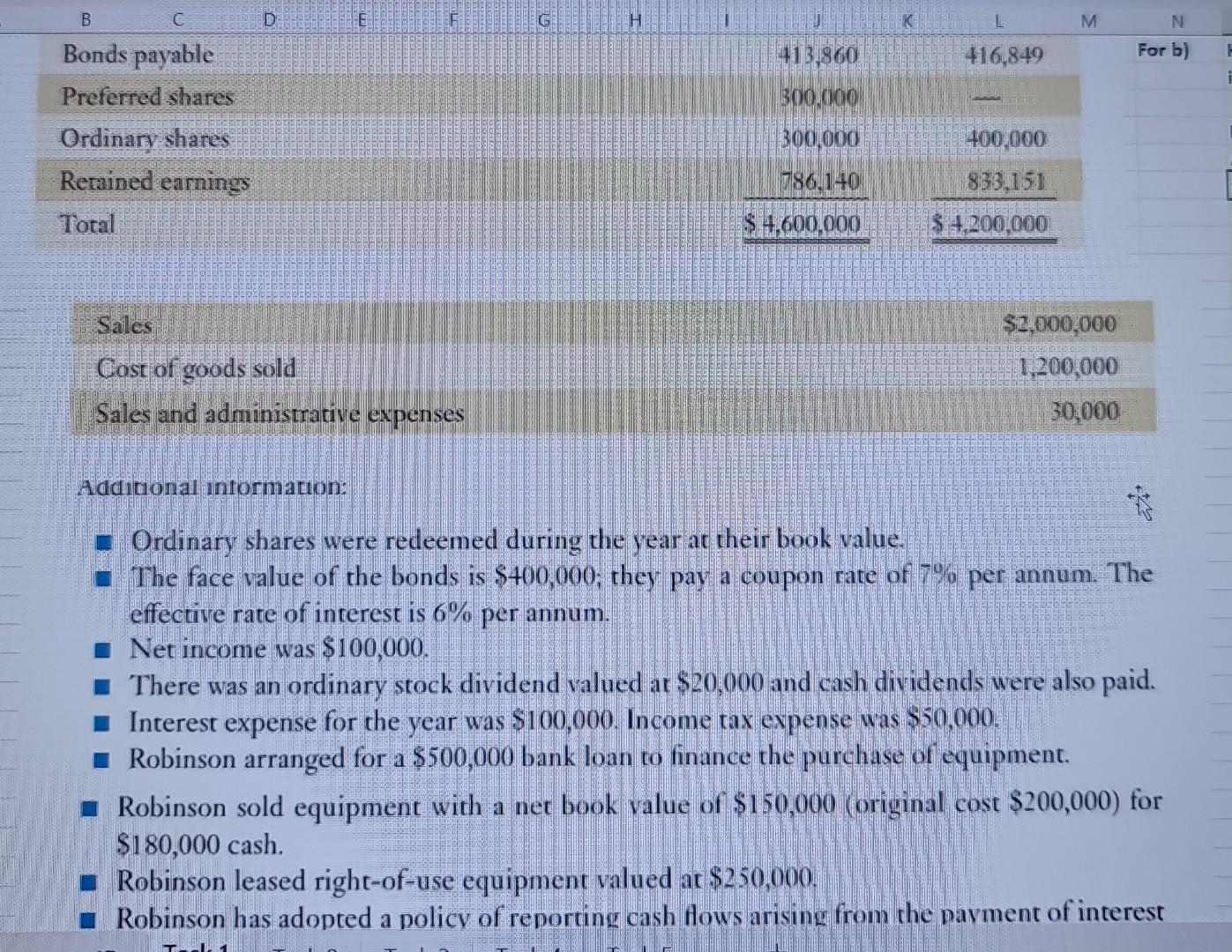

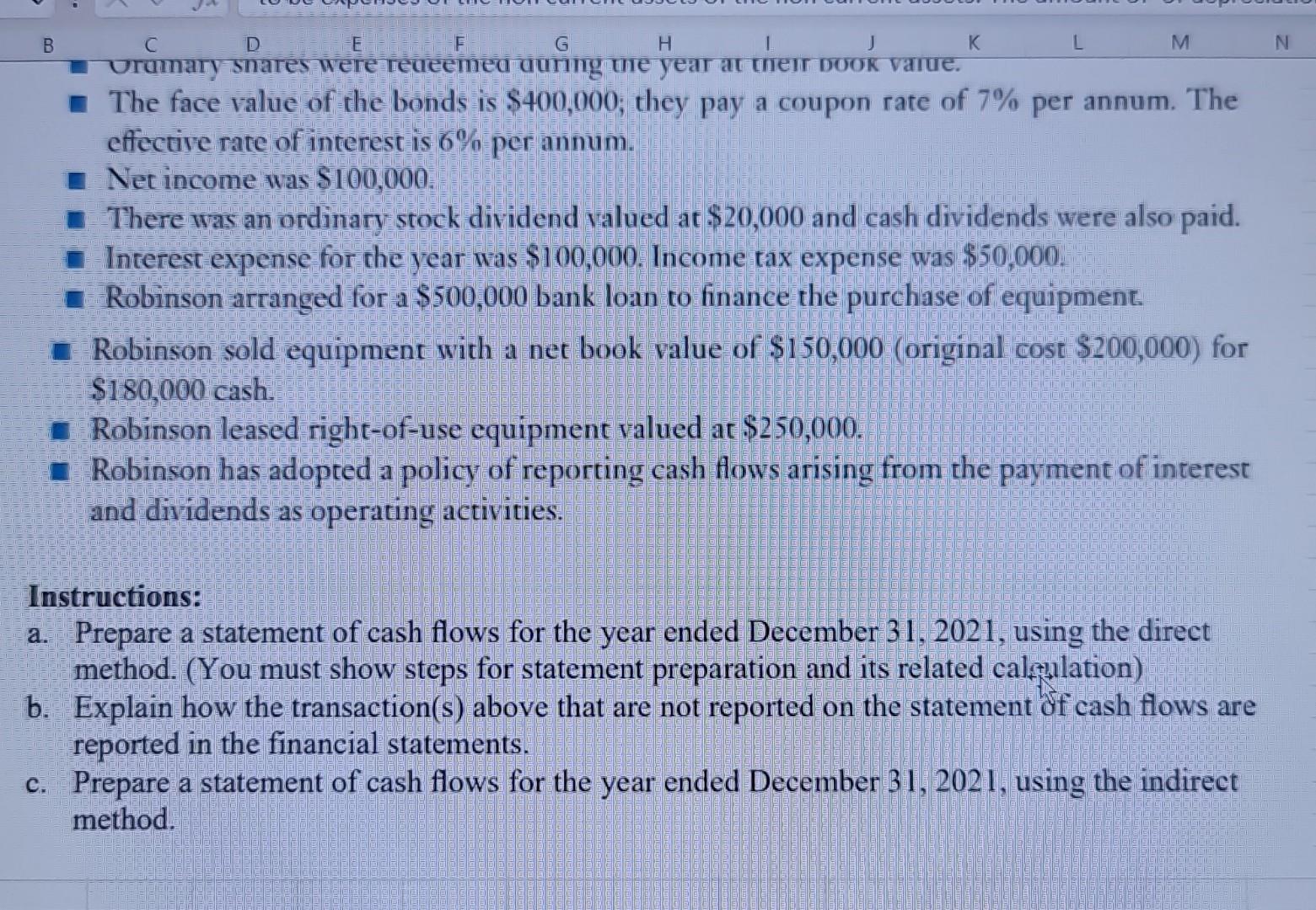

Financial information for Robinenn Inc follemex Acdituonat intormankw:- Ordinary shares were redcemed doning the year at them howk wallow: effective rate of interest is 6 o. Ner income was stovinnou. \$is0pocicash. Robinson leased right-of-use equapment walued ar 5250 motol. and dividends as operaring activitises. Instructions: a. Prepare a statement of cash flows for the year ended December 31,2021 , using the direct method. (You must show steps for statement preparation and its related calculation) b. Explain how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements. c. Prepare a statement of cash flows for the year ended December 31,2021 , using the indirect method. Task 1 Pinancial information for Robinson Inc follows: Addibional intormation: Ordinary shares were redeemed during the year at their book value. The face value of the bonds is $400,000; they pay a coupon rate of 7% per annum. The effective rate of interest is 6% per annum. Net income was $100,000. There was an ordinary stock dividend valued at $20,000 and cash dividends were also paid. Interest expense for the year was $100,000. Income tax expense was $50,000. Robinson arranged for a $500,000 bank loan to finance the purchase of equipment. Robinson sold equipment with a net book value of $150,000 (original cost $200,000 ) for $180,000 cash. Robinson leased right-of-use equipment valued at $250,000. Robinson has adopted a policy of reporting cash flows arising from the payment of interest B Crumary snares were reacemed auming the year at thelr Dook varue. The face value of the bonds is $400,000; they pay a coupon rate of 7% per annum. The effective rate of interest is 6% per annum. Net income was $100,000 There was an ordinary stock dividend valued at $20,000 and cash dividends were also paid. Interest expense for the year was $100,000. Income tax expense was $50,000. Robinson arranged for a $500,000 bank loan to finance the purchase of equipment. Robinson sold equipment with a net book value of $150,000 (original cost $200,000 ) for $180,000 cash. * Robinson leased right-of-use equipment valued at $250,000. - Robinson has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating activities. Instructions: a. Prepare a statement of cash flows for the year ended December 31,2021 , using the direct method. (You must show steps for statement preparation and its related calepulation) b. Explain how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements. c. Prepare a statement of cash flows for the year ended December 31,2021 , using the indirect method. Financial information for Robinenn Inc follemex Acdituonat intormankw:- Ordinary shares were redcemed doning the year at them howk wallow: effective rate of interest is 6 o. Ner income was stovinnou. \$is0pocicash. Robinson leased right-of-use equapment walued ar 5250 motol. and dividends as operaring activitises. Instructions: a. Prepare a statement of cash flows for the year ended December 31,2021 , using the direct method. (You must show steps for statement preparation and its related calculation) b. Explain how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements. c. Prepare a statement of cash flows for the year ended December 31,2021 , using the indirect method. Task 1 Pinancial information for Robinson Inc follows: Addibional intormation: Ordinary shares were redeemed during the year at their book value. The face value of the bonds is $400,000; they pay a coupon rate of 7% per annum. The effective rate of interest is 6% per annum. Net income was $100,000. There was an ordinary stock dividend valued at $20,000 and cash dividends were also paid. Interest expense for the year was $100,000. Income tax expense was $50,000. Robinson arranged for a $500,000 bank loan to finance the purchase of equipment. Robinson sold equipment with a net book value of $150,000 (original cost $200,000 ) for $180,000 cash. Robinson leased right-of-use equipment valued at $250,000. Robinson has adopted a policy of reporting cash flows arising from the payment of interest B Crumary snares were reacemed auming the year at thelr Dook varue. The face value of the bonds is $400,000; they pay a coupon rate of 7% per annum. The effective rate of interest is 6% per annum. Net income was $100,000 There was an ordinary stock dividend valued at $20,000 and cash dividends were also paid. Interest expense for the year was $100,000. Income tax expense was $50,000. Robinson arranged for a $500,000 bank loan to finance the purchase of equipment. Robinson sold equipment with a net book value of $150,000 (original cost $200,000 ) for $180,000 cash. * Robinson leased right-of-use equipment valued at $250,000. - Robinson has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating activities. Instructions: a. Prepare a statement of cash flows for the year ended December 31,2021 , using the direct method. (You must show steps for statement preparation and its related calepulation) b. Explain how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements. c. Prepare a statement of cash flows for the year ended December 31,2021 , using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts