Question: help me step 1 & step 2 for this problem The effect of tax rate on WACC K. Bell Jewelers wishes to explore the effect

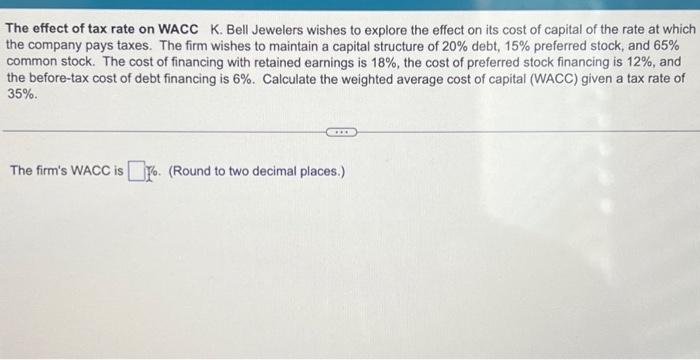

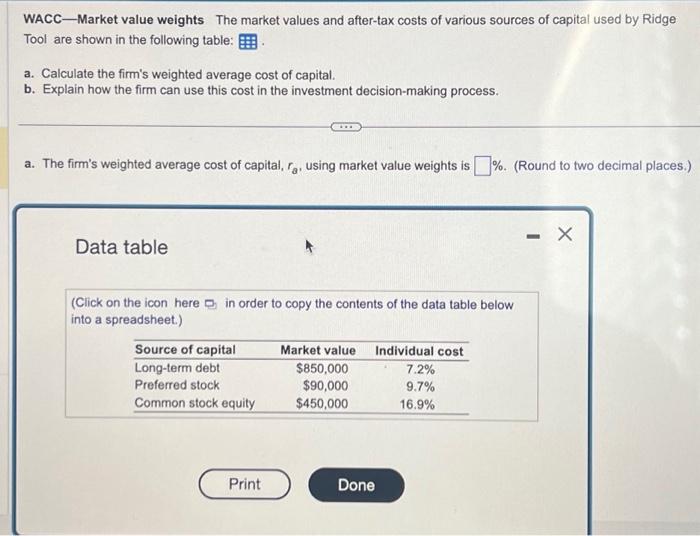

The effect of tax rate on WACC K. Bell Jewelers wishes to explore the effect on its cost of capital of the rate at which the company pays taxes. The firm wishes to maintain a capital structure of 20% debt, 15% preferred stock, and 65% common stock. The cost of financing with retained earnings is 18%, the cost of preferred stock financing is 12%, and the before-tax cost of debt financing is 6%. Calculate the weighted average cost of capital (WACC) given a tax rate of 35% The firm's WACC is [10. (Round to two decimal places.) WACC-Market value weights The market values and after-tax costs of various sources of capital used by Ridge Tool are shown in the following table: a. Calculate the firm's weighted average cost of capital. b. Explain how the firm can use this cost in the investment decision-making process. a. The firm's weighted average cost of capital, ra, using market value weights is \%. (Round to two decimal places.) Data table (Click on the icon here n in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts