Question: help me study and i will give a good rating. Hank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In

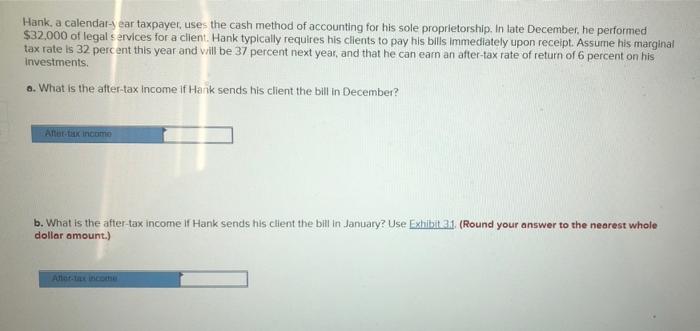

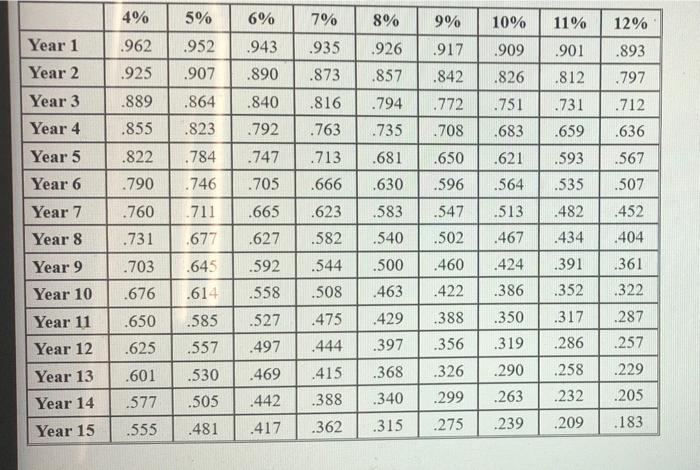

Hank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December, he performed $32,000 of legal services for a client. Hank typically requires his clients to pay his bilis immediately upon receipt. Assume his marginal tax rate is 32 percent this year and will be 37 percent next year, and that he can ear an after-tax rate of return of 6 percent on his Investments o. What is the after-tax income if Hank sends his client the bill in December? Altri income b. What is the after-tax income If Hank sends his client the bill in January? Use Exhibit 31 (Round your answer to the nearest whole dollar amount.) 4% 5% 6% 7% 9% 10% 11% 12% Year 1 .952 .943 .935 8% .926 .857 .909 .901 .962 .925 .893 .907 .890 .873 .826 Year 2 Year 3 .917 .842 .772 .708 .812 .731 .840 .816 1.794 .889 .855 .822 .864 .823 .751 .683 .797 .712 .636 .792 .763 .735 Year 4 Year 5 Year 6 .659 .784 .713 .621 .681 .630 .593 .535 .567 .507 .790 .746 .564 .513 .482 Year 7 Year 8 .760 .731 .711 .677 .747 .705 .665 .627 .592 .558 .452 .404 .650 .596 .547 .502 .460 422 .467 .434 .391 Year 9 .703 .645 .424 .666 .623 .582 .544 .508 475 .444 .415 .361 .583 .540 .500 .463 .429 .397 .676 .614 .386 352 .322 Year 10 Year 11 Year 12 .650 .527 .350 .317 .287 .257 .625 .497 .319 .286 .585 .557 .530 .505 1388 .356 .326 .299 Year 13 .601 .258 .469 .442 .290 .263 .229 .205 .388 .368 .340 .315 Year 14 Year 15 .232 .577 .555 .481 .417 .362 .275 .239 .209 .183

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts