Question: help me study this one question please and i will give a good rating. Required information [The following information applies to the questions displayed below.]

![below.] The partnership agreement of the G\&P general partnership states that Gary](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67162a1621fb9_81367162a159b589.jpg)

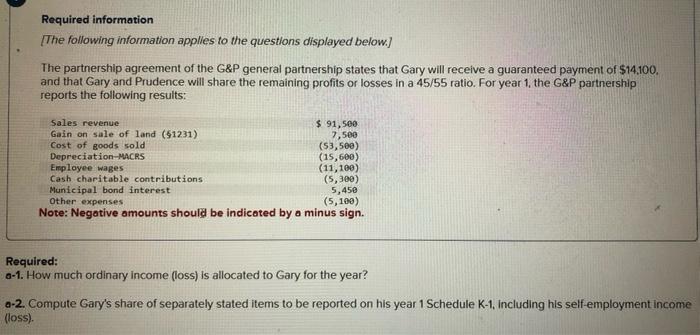

Required information [The following information applies to the questions displayed below.] The partnership agreement of the G\&P general partnership states that Gary will receive a guaranteed payment of $14,100. and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1 , the G\&P partnership reports the following results: Required: a-1. How much ordinary income (loss) is allocated to Gary for the year? a-2. Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employment income (loss). How much ordinary income (loss) is allocated to Gary for the year? Note: Round your intermediate computations to the nearest whole dollar amount. Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employment income (loss). Note: Round your intermediate computations and final answers to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts