Question: Help me to answer E Carla Vista Inc. is preparing its annual budgets for the year ending December 31,2022 . Accounting assistants furnish the following.

Help me to answer E

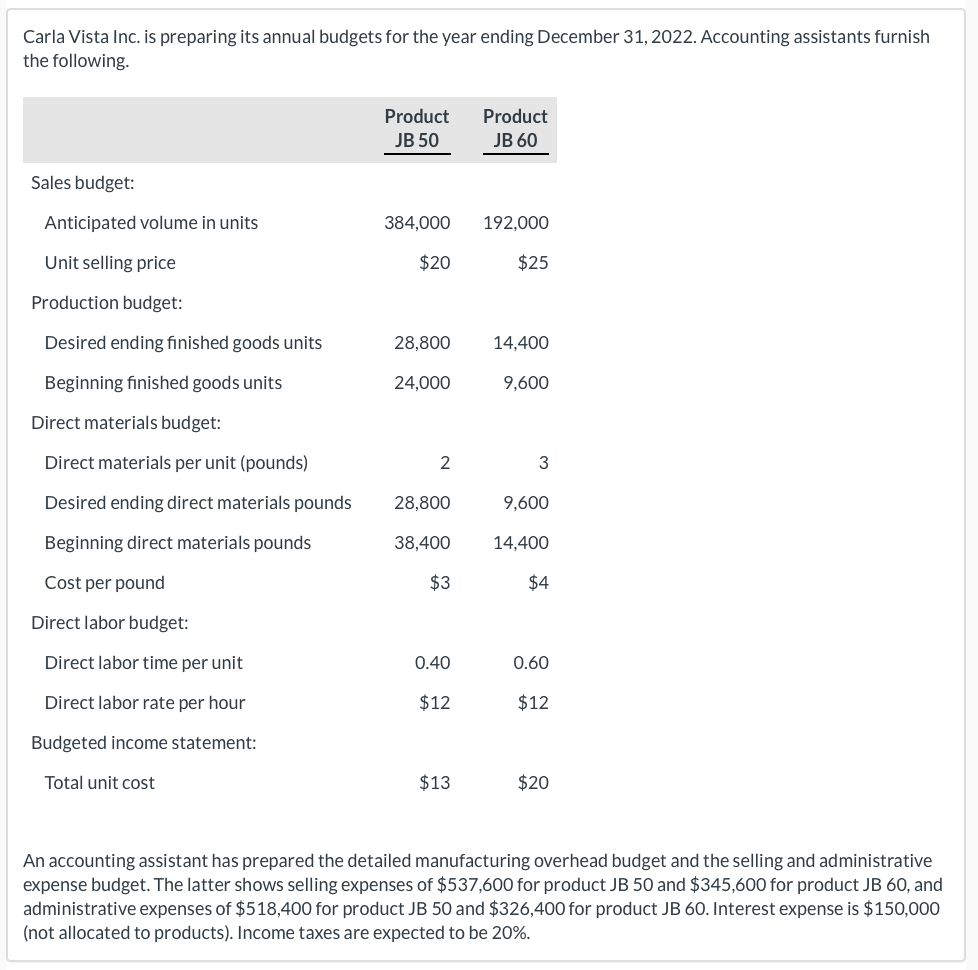

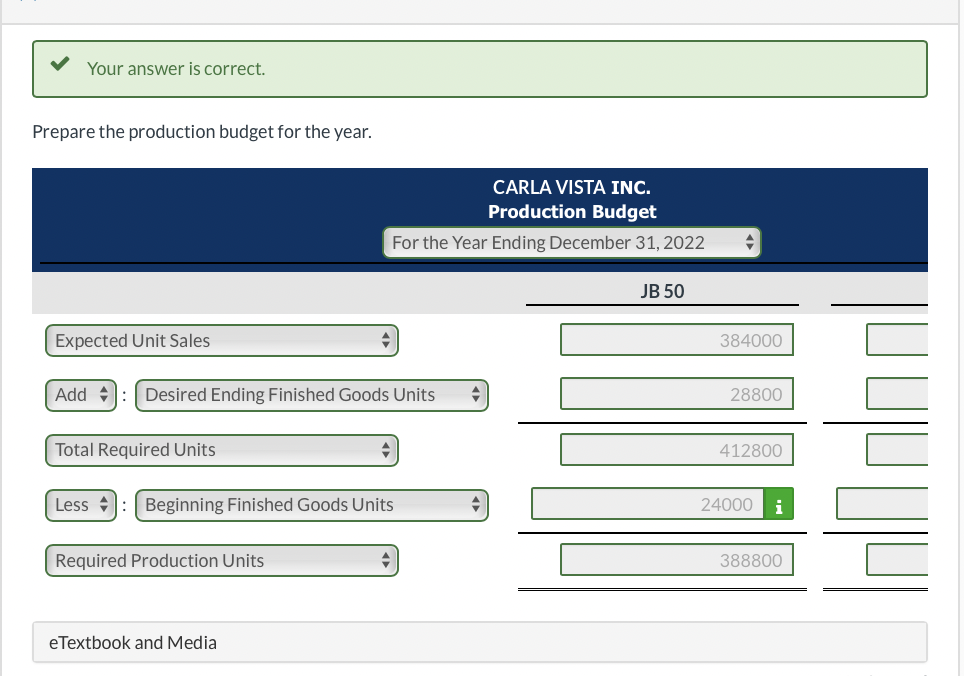

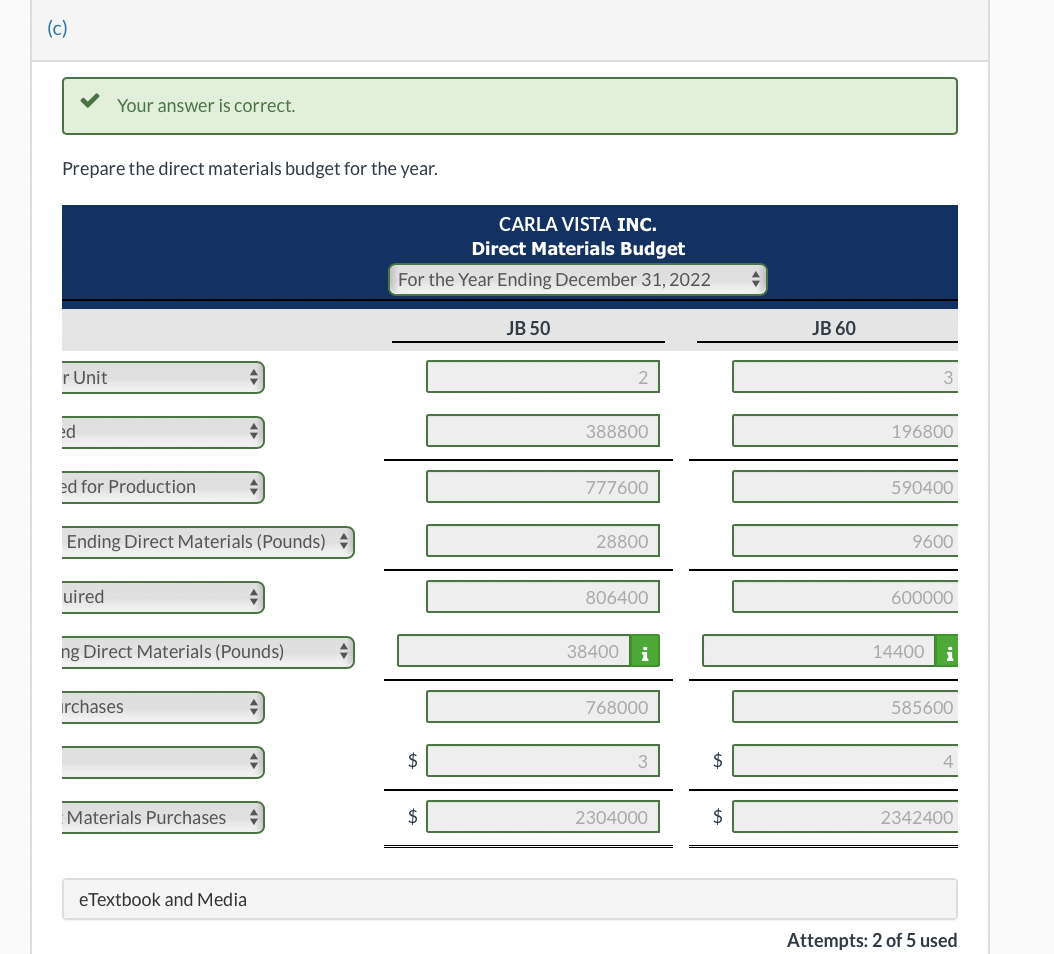

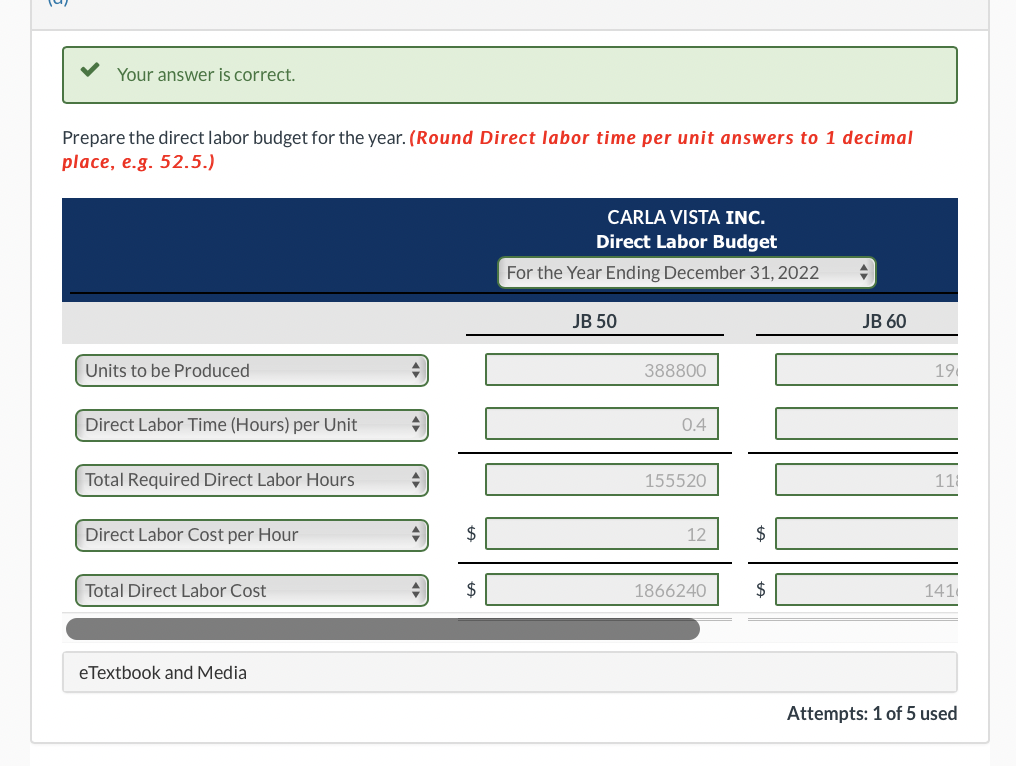

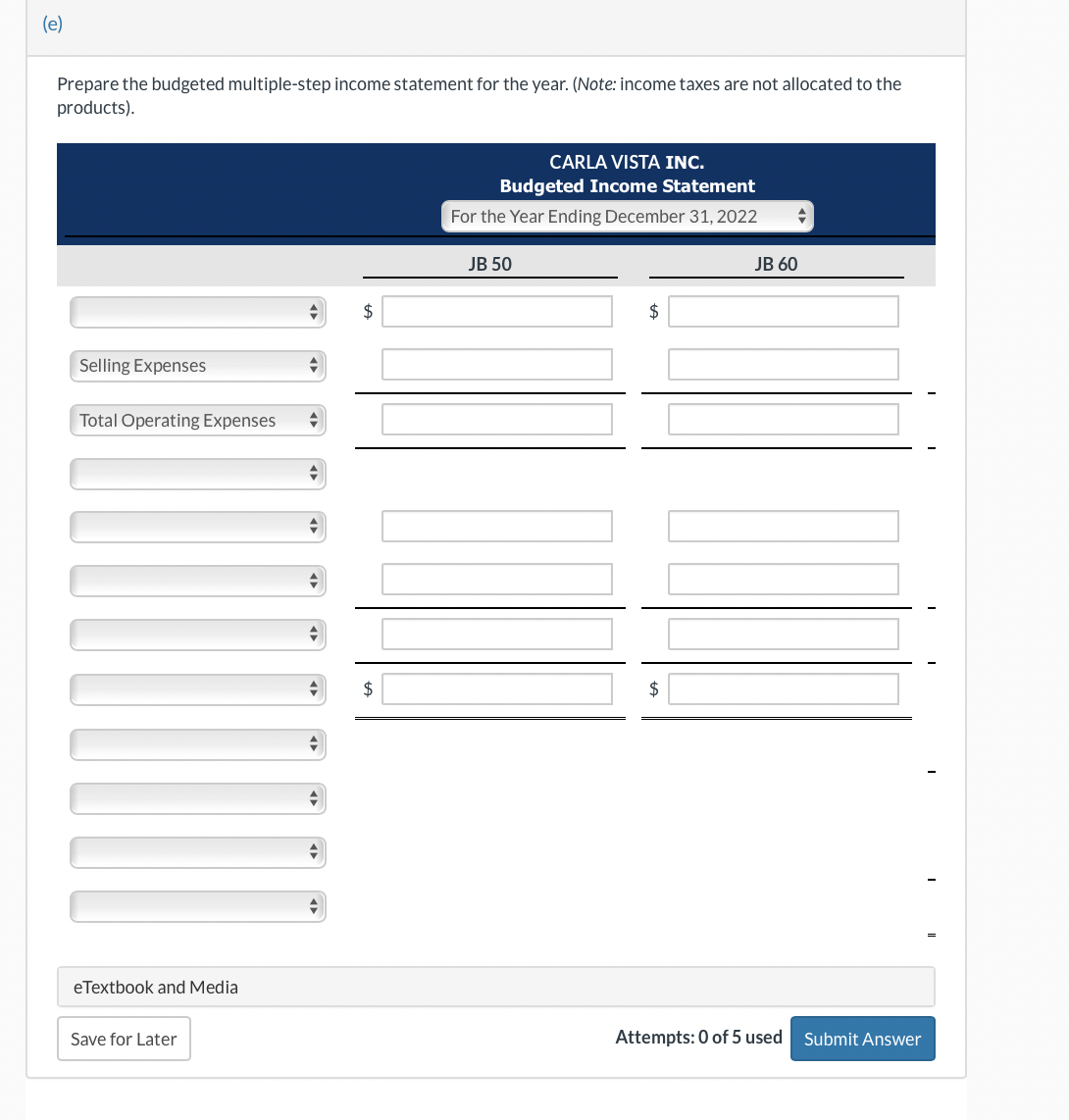

Carla Vista Inc. is preparing its annual budgets for the year ending December 31,2022 . Accounting assistants furnish the following. An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $537,600 for product JB 50 and $345,600 for product JB 60, and administrative expenses of $518,400 for product JB 50 and $326,400 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes are expected to be 20%. (a) Prepare the sales budget for the year. Prebare the production budget for the vear. Prebare the direct materials budget for the vear. Prepare the direct labor budget for the year. (Round Direct labor time per unit answers to 1 decimal place, e.g. 52.5.) Prepare the budgeted multiple-step income statement for the year. (Note: income taxes are not allocated to the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts