Question: Help me to answer this finance question Question Please use the data in the accompanying spreadsheet to answer the questions 1-15. Using the return data

Help me to answer this finance question Question

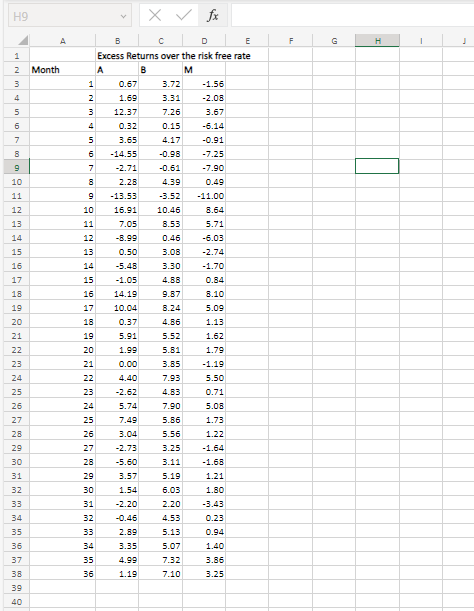

Please use the data in the accompanying spreadsheet to answer the questions 1-15. Using the return data on portfolios A and B provided in the accompanying spreadsheet, compute the average return for portfolio A. Round off your answer to three digits after the decimal point. State your answer as a percentage point, such as 1.234.

Using the return data on portfolios A and B provided in the accompanying spreadsheet, compute the return volatility for portfolio B. Round off your answer to three digits after the decimal point. State your answer as a percentage point, such as 1.234.

What is the Sharpe ratio for portfolio A? Round off your answer to three digits after the decimal point, as in 1.234.

What is portfolio B's CAPM alpha? Use portfolio M as the market portfolio proxy. Round off your answer to three digits after the decimal points. State your answer as a percentage point as 1.234. What is portfolio A's CAPM beta based on your analysis? Round off your answer to three digits after the decimal points. State your answer as a percentage point as 1.234. Compute the Treynor measure for portfolio B. Round off your answer to three digits after the decimal point. State your answer as 1.234 What is the R-squared for your CAPM model for portfolio B? State your answer as a percentage point such as 10.1

Compute the residual risk measure for portfolio A. Round off your final answer to three digits after the decimal point.? Compute the appraisal ratio for portfolio A. Round off your final answer to three digits after the decimal point. ?

Compute the information ratio for portfolio A. Round off your answer to three digits after the decimal point. ?

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & A & B & c & D & E & F & G & H & 1 \\ \hline 1 & & \multicolumn{4}{|c|}{ Excess Returns over the risk free rate } & & & & \\ \hline 2 & Month & A & B & M & & & & & \\ \hline 3 & 1 & 0.67 & 3.72 & -1.56 & & & & & \\ \hline 4 & 2 & 1.69 & 3.31 & -2.08 & & & & & \\ \hline 5 & 3 & 12.37 & 7.26 & 3.67 & & & & & \\ \hline 6 & 4 & 0.32 & 0.15 & -6.14 & & & & & \\ \hline 7 & 5 & 3.65 & 4.17 & -0.91 & & & & & \\ \hline 8 & 6 & -14.55 & -0.98 & -7.25 & & & & & \\ \hline 9 & 7 & -2.71 & -0.61 & -7.90 & & & & & \\ \hline 10 & 8 & 2.28 & 4.39 & 0.49 & & & & & \\ \hline 11 & 9 & -13.53 & -3.52 & -11.00 & & & & & \\ \hline 12 & 10 & 16.91 & 10.46 & 8.64 & & & & & \\ \hline 13 & 11 & 7.05 & 8.53 & 5.71 & & & & & \\ \hline 14 & 12 & -8.99 & 0.46 & -6.03 & & & & & \\ \hline 15 & 13 & 0.50 & 3.08 & -2.74 & & & & & \\ \hline 16 & 14 & -5.48 & 3.30 & -1.70 & & & & & \\ \hline 17 & 15 & -1.05 & 4.88 & 0.84 & & & & & \\ \hline 18 & 16 & 14.19 & 9.87 & 8.10 & & & & & \\ \hline 19 & 17 & 10.04 & 8.24 & 5.09 & & & & & \\ \hline 20 & 18 & 0.37 & 4.86 & 1.13 & & & & & \\ \hline 21 & 19 & 5.91 & 5.52 & 1.62 & & & & & \\ \hline 22 & 20 & 1.99 & 5.81 & 1.79 & & & & & \\ \hline 23 & 21 & 0.00 & 3.85 & -1.19 & & & & & \\ \hline 24 & 22 & 4.40 & 7.93 & 5.50 & & & & & \\ \hline 25 & 23 & -2.62 & 4.83 & 0.71 & & & & & \\ \hline 26 & 24 & 5.74 & 7.90 & 5.08 & & & & & \\ \hline 27 & 25 & 7.49 & 5.86 & 1.73 & & & & & \\ \hline 28 & 26 & 3.04 & 5.56 & 1.22 & & & & & \\ \hline 29 & 27 & -2.73 & 3.25 & -1.64 & & & & & \\ \hline 30 & 28 & -5.60 & 3.11 & -1.68 & & & & & \\ \hline 31 & 29 & 3.57 & 5.19 & 1.21 & & & & & \\ \hline 32 & 30 & 1.54 & 6.03 & 1.80 & & & & & \\ \hline 33 & 31 & -2.20 & 2.20 & -3.43 & & & & & \\ \hline 34 & 32 & -0.46 & 4.53 & 0.23 & & & & & \\ \hline 35 & 33 & 2.89 & 5.13 & 0.94 & & & & & \\ \hline 36 & 34 & 3.35 & 5.07 & 1.40 & & & & & \\ \hline 37 & 35 & 4.99 & 7.32 & 3.86 & & & & & \\ \hline 38 & 36 & 1.19 & 7.10 & 3.25 & & & & & \\ \hline 39 & & & & & & & & & \\ \hline 40 & & & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts