Question: Help me to solve this difficult question. Minds Inc. issued 51,700,000 of 4 percent, 10-year bonds payable and received cash proceeds of $1,579,793 on March

Help me to solve this difficult question.

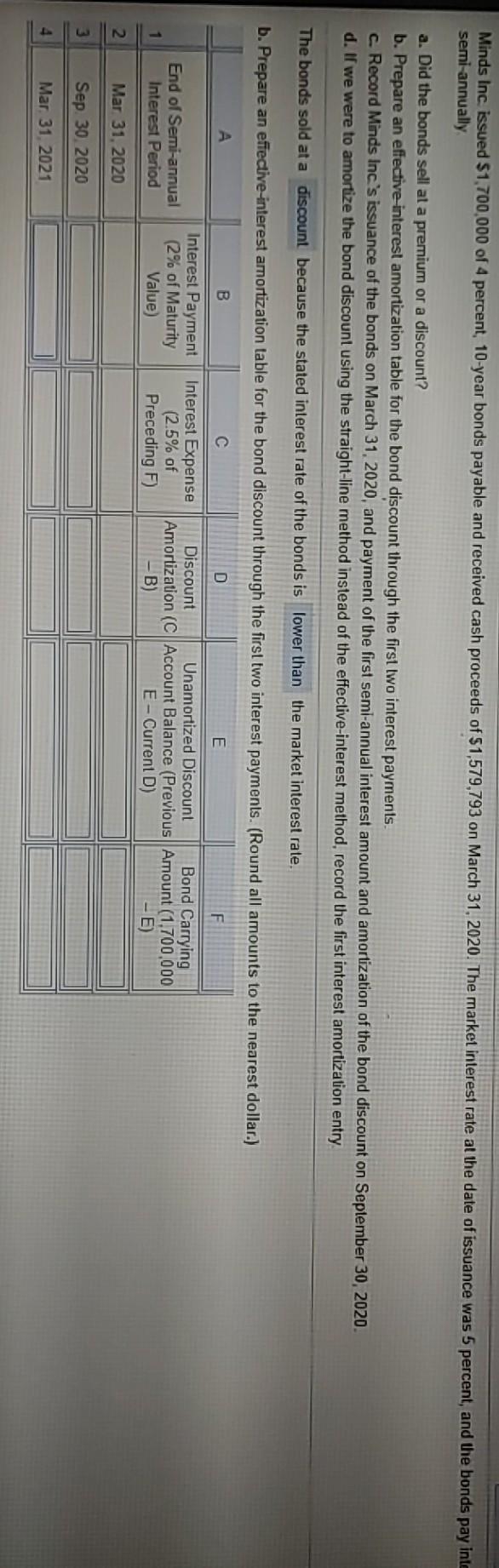

Minds Inc. issued 51,700,000 of 4 percent, 10-year bonds payable and received cash proceeds of $1,579,793 on March 31, 2020. The market interest rate at the date of issuance was 5 percent, and the bonds pay inte semi-annually a. Did the bonds sell at a premium or a discount? b. Prepare an effective interest amortization table for the bond discount through the first lwo interest payments. c. Record Minds Inc.'s issuance of the bonds on March 31, 2020, and payment of the first semi-annual interest amount and amortization of the bond discount on September 30, 2020 d. If we were to amortize the bond discount using the straight-line method instead of the effective interest method, record the first interest amortization entry The bonds sold at a discount because the stated interest rate of the bonds is lower than the market interest rate, b. Prepare an effective-interest amortization table for the bond discount through the first two interest payments. (Round all amounts to the nearest dollar.) B. D E F End of Semi-annual Interest Period Interest Payment (2% of Maturity Value) Interest Expense (2.5% of Preceding F) Discount Unamortized Discount Bond Carrying Amortization (C Account Balance (Previous Amount (1.700.000 E-Current D) -E) -B) 2 Mar 31, 2020 3 Sep 30, 2020 4 Mar 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts