Question: help me Question B: Algoma Holiday Services [12 Marks] [18 Minutes] Algoma Holiday Services (AHS) incurred the following transactions during 2022. They would like you

![help me Question B: Algoma Holiday Services [12 Marks] [18 Minutes]](https://s3.amazonaws.com/si.experts.images/answers/2024/06/665dd231d3ce8_689665dd23172e93.jpg)

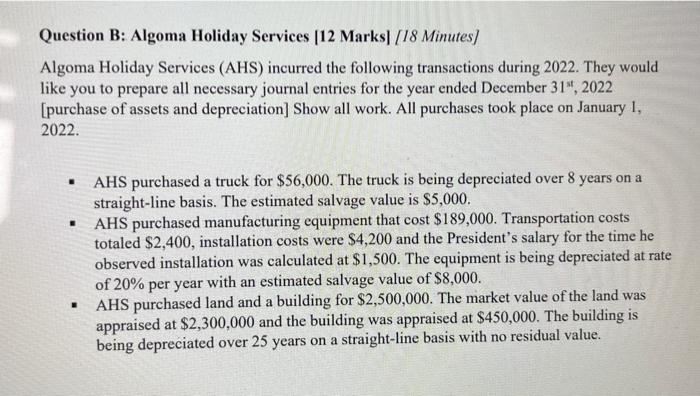

Question B: Algoma Holiday Services [12 Marks] [18 Minutes] Algoma Holiday Services (AHS) incurred the following transactions during 2022. They would like you to prepare all necessary journal entries for the year ended December 31st,2022 [purchase of assets and depreciation] Show all work. All purchases took place on January 1 , 2022. - AHS purchased a truck for $56,000. The truck is being depreciated over 8 years on a straight-line basis. The estimated salvage value is $5,000. - AHS purchased manufacturing equipment that cost $189,000. Transportation costs totaled $2,400, installation costs were $4,200 and the President's salary for the time he observed installation was calculated at $1,500. The equipment is being depreciated at rate of 20% per year with an estimated salvage value of $8,000. - AHS purchased land and a building for $2,500,000. The market value of the land was appraised at $2,300,000 and the building was appraised at $450,000. The building is being depreciated over 25 years on a straight-line basis with no residual value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts