Question: help me unserstand the math solving. thanks Use Worksheet 5.2 and Exhibit 5.6. Emma Sanchez is currently renting an apartment for $625 per month and

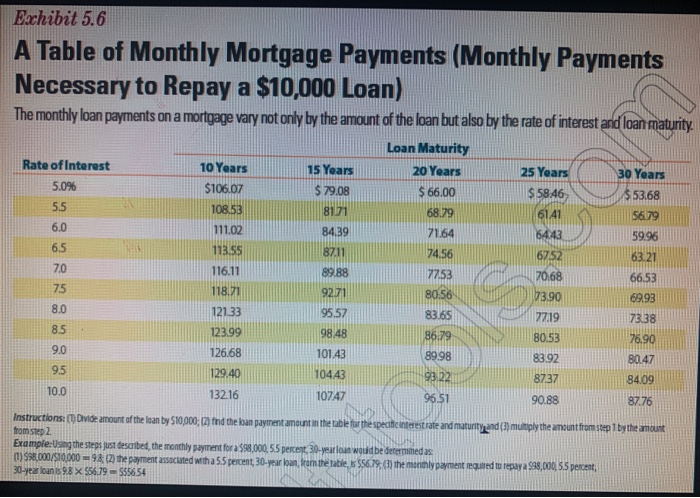

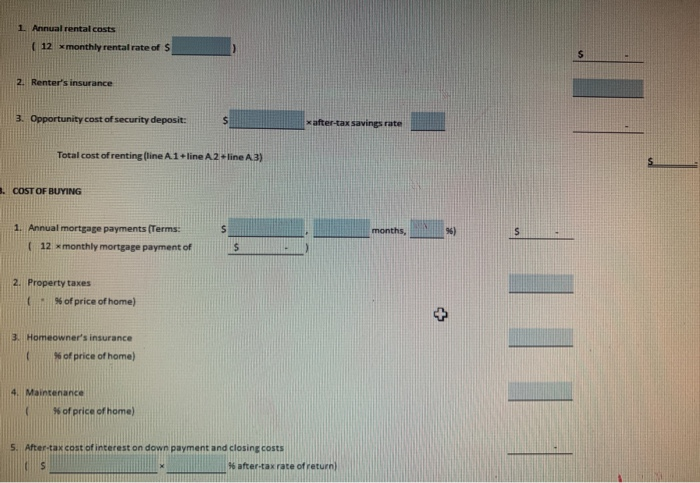

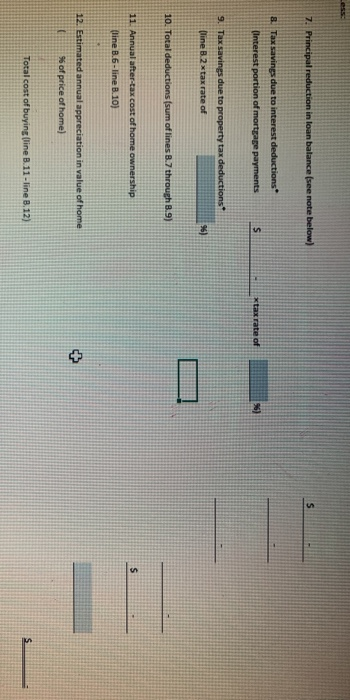

Use Worksheet 5.2 and Exhibit 5.6. Emma Sanchez is currently renting an apartment for $625 per month and paying $325 annually for renter's Insurance. She just found a small townhouse she can buy for $175,000. She has enough cash for a $10,000 down payment and $4,100 in closing costs. Emma estimated the following costs as a percentage of the home's prices property taxes, 2.5 percent; homeowner's insurance, 0.5 percent; and maintenance, 0.7 percent. She is in the 25 percent tax bracket and does not plan to itemize deductions on her taxes. Using Worksheet 5.2, calculate the cost of each alternative and recommend the least costly option - rent or buy for Emma. Assume Emma's security deposit is equal to one month's rent of $625. Also assume a 4% after tax rate return on her savings, a 3% annual appreciation in home price, and a 6% mortgage interest rate for 30 years. a. Cost of renting. Round the answer to the nearest dollar. b. Cost of buying. Round the answer to to the nearest dollar. c. Emma should -Select the home. 20 Years 6141 5443 Exhibit 5.6 A Table of Monthly Mortgage Payments (Monthly Payments Necessary to Repay a $10,000 Loan) The monthly loan payments on a mortgage vary not only by the amount of the loan but also by the rate of interest and loan maturity. Loan Maturity Rate of Interest 10 Years 15 Years 25 Years 30 Years 5.0% $106.07 5 79.08 $66.00 $ 5846 $ 53.68 108.53 68.79 56179 111.02 84.39 59.96 118.5S 6752 116.11 7753 70.68 66.53 118.71 92.71 80. 56 6 3.90 69.93 121.33 95.57 83.65 77.19 7338 123.99 98.48 80.53 76.90 126.68 101.43 89.98 83.92 80.47 129.40 10443 8737 10.0 132.16 10747 96.51 90.88 Instructions: (1) Divide annount of the loan by 510,000; (2) find the ban payment amount in the table for the specific interest rate and maturity and (3) multiply the amount from step 1 by the am from step 2 Example:Using the steps just described the monthly payment for SSD would be determinadas ) S3,000/S10,000 98.(2) the payment associated with a 5.5 percent, 30-year loan, from the table, 556.78 (1) the monthly payment required to repaya 598,000, 55 percent 30-year loan is 9.8 x 556.79 555654 71.64 74.56 8409 1 Annual rental costs ( 12 monthly rental rate of s 2. Renter's insurance 3. Opportunity cost of security deposit: xafte savingsrate Total cost of renting (line A1+line A 2-line A3) 3. COST OF BUYING 1. Annual mortgage payments (Terms: 12 x monthly mortgage payment of 2. Property taxes % of price of home) 3. Homeowner's insurance of price of home) % of price of home) 5. After-tax cost of interest on down payment and closing costs 46 after-tax rate of return 7. Principal reduction in loan balance (see note below) 8. Tax savings due to interest deductions Interest portion of mortgage payments 9. Tax savings due to property tax deductions (line 8 2xtax rate of 10. Total deductions (sum of lines B.7 through 8.9) 11 Annual after-tax cost of home ownership (line B.6-line B. 10) 12. Estimated annual appreciation in value of home so of price of home) Total cost of buying line 8.11 - line 8.12) Use Worksheet 5.2 and Exhibit 5.6. Emma Sanchez is currently renting an apartment for $625 per month and paying $325 annually for renter's Insurance. She just found a small townhouse she can buy for $175,000. She has enough cash for a $10,000 down payment and $4,100 in closing costs. Emma estimated the following costs as a percentage of the home's prices property taxes, 2.5 percent; homeowner's insurance, 0.5 percent; and maintenance, 0.7 percent. She is in the 25 percent tax bracket and does not plan to itemize deductions on her taxes. Using Worksheet 5.2, calculate the cost of each alternative and recommend the least costly option - rent or buy for Emma. Assume Emma's security deposit is equal to one month's rent of $625. Also assume a 4% after tax rate return on her savings, a 3% annual appreciation in home price, and a 6% mortgage interest rate for 30 years. a. Cost of renting. Round the answer to the nearest dollar. b. Cost of buying. Round the answer to to the nearest dollar. c. Emma should -Select the home. 20 Years 6141 5443 Exhibit 5.6 A Table of Monthly Mortgage Payments (Monthly Payments Necessary to Repay a $10,000 Loan) The monthly loan payments on a mortgage vary not only by the amount of the loan but also by the rate of interest and loan maturity. Loan Maturity Rate of Interest 10 Years 15 Years 25 Years 30 Years 5.0% $106.07 5 79.08 $66.00 $ 5846 $ 53.68 108.53 68.79 56179 111.02 84.39 59.96 118.5S 6752 116.11 7753 70.68 66.53 118.71 92.71 80. 56 6 3.90 69.93 121.33 95.57 83.65 77.19 7338 123.99 98.48 80.53 76.90 126.68 101.43 89.98 83.92 80.47 129.40 10443 8737 10.0 132.16 10747 96.51 90.88 Instructions: (1) Divide annount of the loan by 510,000; (2) find the ban payment amount in the table for the specific interest rate and maturity and (3) multiply the amount from step 1 by the am from step 2 Example:Using the steps just described the monthly payment for SSD would be determinadas ) S3,000/S10,000 98.(2) the payment associated with a 5.5 percent, 30-year loan, from the table, 556.78 (1) the monthly payment required to repaya 598,000, 55 percent 30-year loan is 9.8 x 556.79 555654 71.64 74.56 8409 1 Annual rental costs ( 12 monthly rental rate of s 2. Renter's insurance 3. Opportunity cost of security deposit: xafte savingsrate Total cost of renting (line A1+line A 2-line A3) 3. COST OF BUYING 1. Annual mortgage payments (Terms: 12 x monthly mortgage payment of 2. Property taxes % of price of home) 3. Homeowner's insurance of price of home) % of price of home) 5. After-tax cost of interest on down payment and closing costs 46 after-tax rate of return 7. Principal reduction in loan balance (see note below) 8. Tax savings due to interest deductions Interest portion of mortgage payments 9. Tax savings due to property tax deductions (line 8 2xtax rate of 10. Total deductions (sum of lines B.7 through 8.9) 11 Annual after-tax cost of home ownership (line B.6-line B. 10) 12. Estimated annual appreciation in value of home so of price of home) Total cost of buying line 8.11 - line 8.12)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts