Question: help me with a clear and detailed explanation Problem 2-5 (IAA) Zodiac Company provided the following information: Balance per book, March 31 800,000 Cash receipts

help me with a clear and detailed explanation

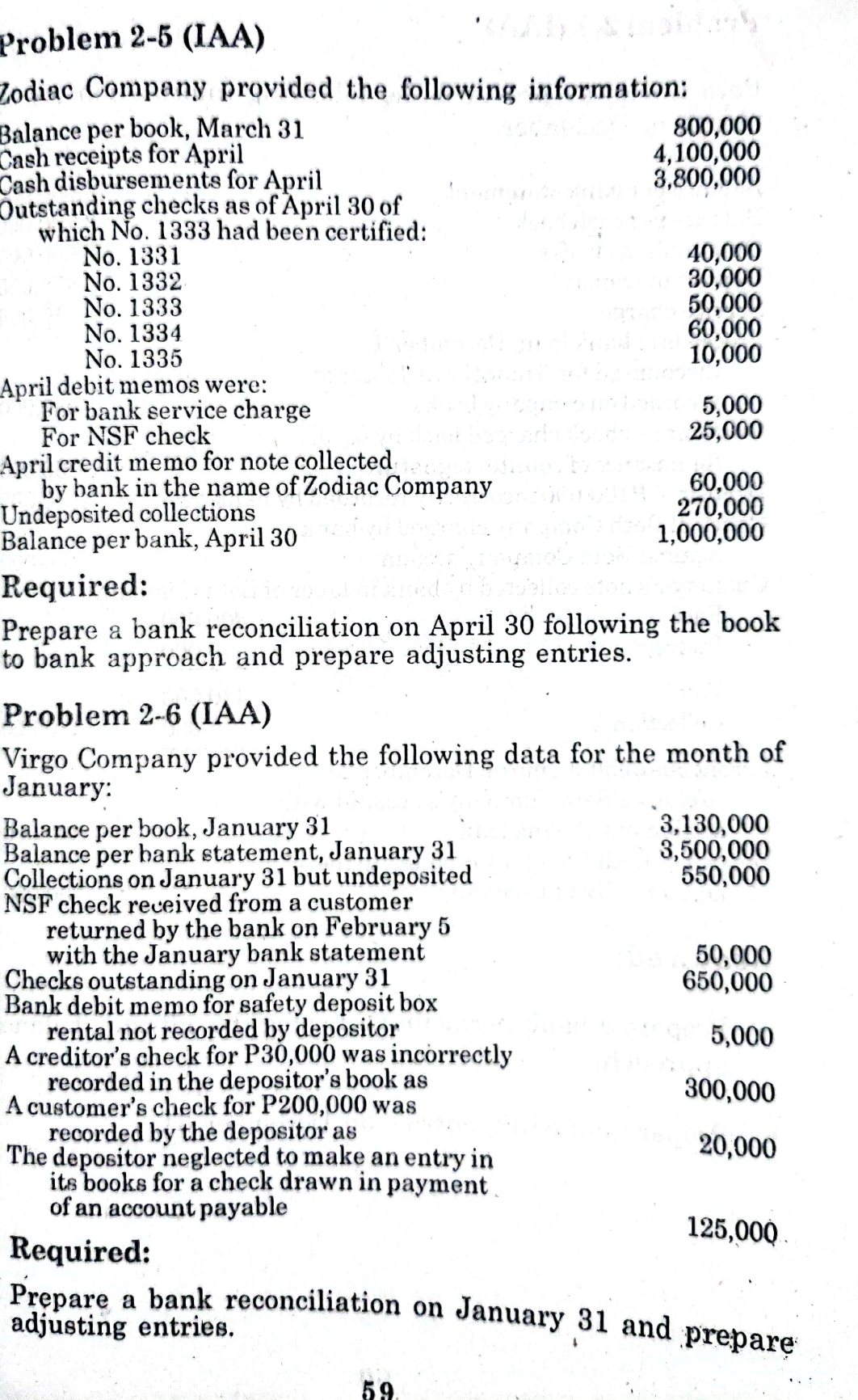

Problem 2-5 (IAA) Zodiac Company provided the following information: Balance per book, March 31 800,000 Cash receipts for April 4,100,000 Cash disbursements for April 3,800,000 Outstanding checks as of April 30 of which No. 1333 had been certified: No. 1331 40,000 No. 1332 30,000 No. 1333 50,000 No. 1334 60,000 No. 1335 10,000 April debit memos were: For bank service charge 5,000 For NSF check 25,000 April credit memo for note collected by bank in the name of Zodiac Company 60,000 Undeposited collections 270,000 Balance per bank, April 30 1,000,000 Required: Prepare a bank reconciliation on April 30 following the book to bank approach and prepare adjusting entries. Problem 2-6 (IAA) Virgo Company provided the following data for the month of January: Balance per book, January 31 3,130,000 Balance per bank statement, January 31 3,500,000 Collections on January 31 but undeposited 550,000 NSF check received from a customer returned by the bank on February 5 with the January bank statement 50,000 Checks outstanding on January 31 650,000 Bank debit memo for safety deposit box rental not recorded by depositor A creditor's check for P30,000 was incorrectly 5,000 recorded in the depositor's book as A customer's check for P200,000 was 300,000 recorded by the depositor as The depositor neglected to make an entry in 20,000 its books for a check drawn in payment of an account payable Required: 125,000 Prepare a bank reconciliation on January 31 and prepare adjusting entries. 59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts