Question: help me with the analysis please here is the adjusted, unadjusted, and post closing income statements. On January 1, 2024, the general ledger of TNT

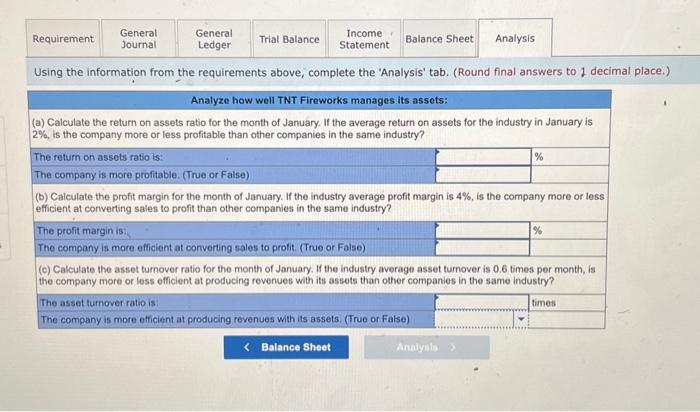

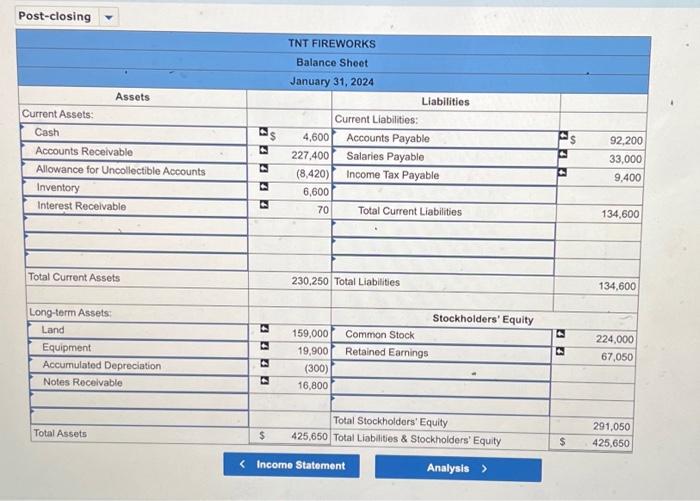

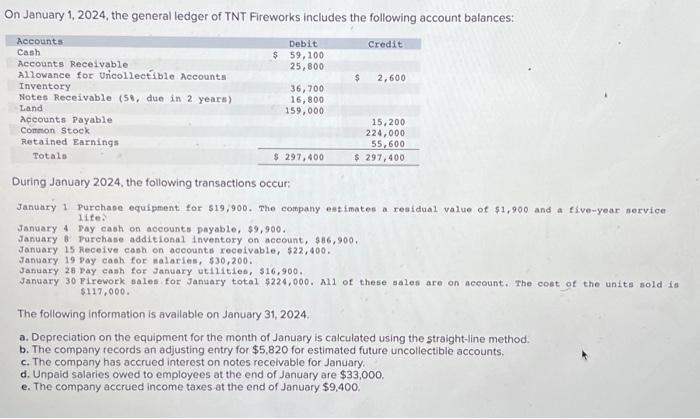

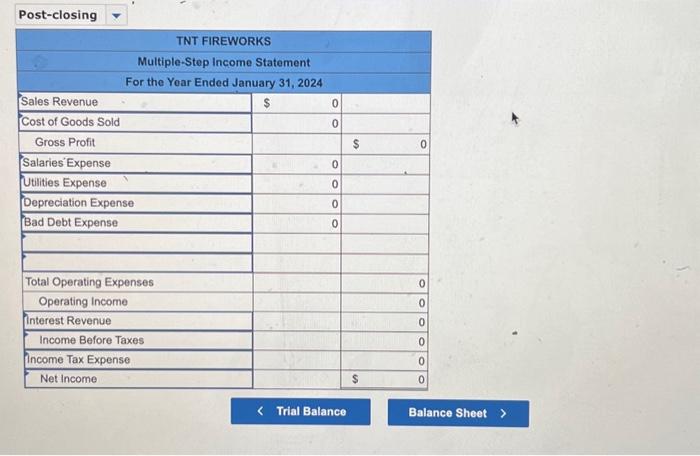

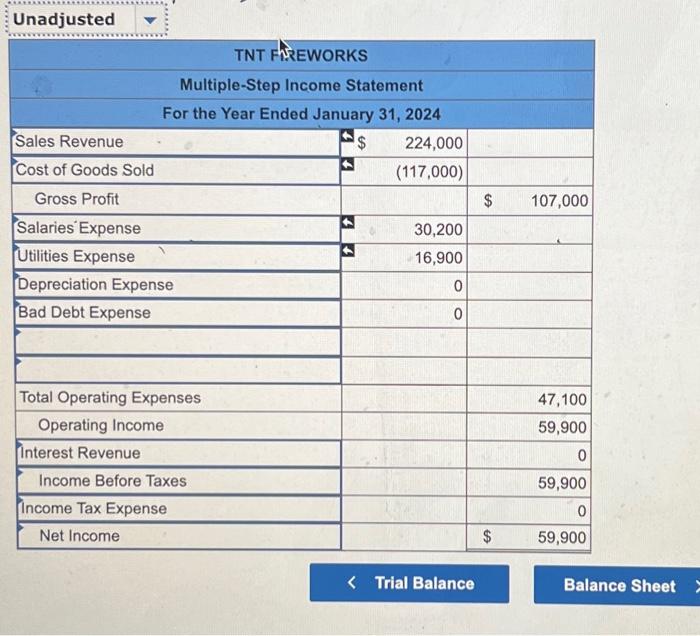

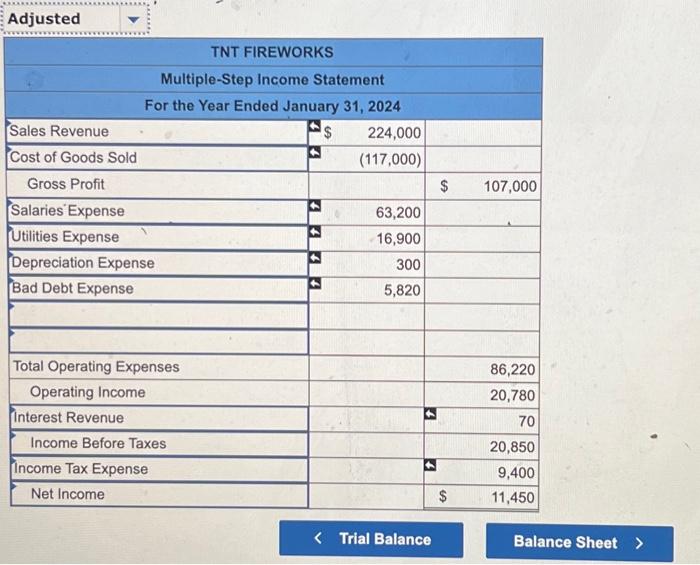

On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: During January 2024, the following transactions occur: lite: January 4 Pay cash on accounts payable, $9,900. January 8. purchase additional inventory on aceount, $86,900, January 15 Receive cash on accounts receivable, $22,400. January 19 Pay cash for nalarien, $30,200. January 28 Day cash for January utilities, $16,900, $117,000. The following information is avallable on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $5,820 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. d. Unpaid salaries owed to employees at the end of January are $33,000. e. The company accrued income taxes at the end of January $9,400. Post-closing \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ TNT FIREWORKS } \\ \hline \multicolumn{6}{|c|}{ Balance Sheet } \\ \hline \multicolumn{6}{|c|}{ January 31,2024} \\ \hline Assets & & & Liabilities & & \\ \hline Current Assets: & & ? & Current Liabilities: & & \\ \hline Cash & DS & 4,600 & Accounts Payable & eS & 92,200 \\ \hline Accounts Receivable & ( & 227,400 & Salaries Payable & & 33,000 \\ \hline Allowance for Uncollectible Accounts & & (8,420) & Income Tax Payable & & 9,400 \\ \hline Inventory & & 6,600 & 2 & & \\ \hline Interest Recelvable & & 70 & Total Current Liabilities & & 134,600 \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline Total Current Assets & & 230,250 & Total Liabilities & & 134,600 \\ \hline & & & & & \\ \hline Long-term Assets: & & & Stockholders' E & & 3 \\ \hline Land & & 159,000 & Common Stock & & 224,000 \\ \hline Equipment & a & 19,900 & Retained Earnings & (a) & 67,050 \\ \hline Accumulated Depreciation & (s) & (300)2 & - & & \\ \hline Notes Rocelvable & a & 16,800 & & & \\ \hline & & & & & \\ \hline & & & Total Stockholders' Equity & & 291.050 \\ \hline Total Assets & $ & 425,650 & Total Liabilities \& Stockholders' Equity & $ & 425,650 \\ \hline \end{tabular} (a) Calculate the return on assets ratio for the month of January. If the average return on assets for the industry in January is 2%, is the company more or less profitable than other companies in the same industry? The return on assets ratio is: The company is more profitable. (True or False) (b) Calculate the profit margin for the month of January. If the industry average profit margin is 4%, is the company more or less efficient at converting sales to profit than other companies in the same industry? (c) Calculate the asset turnover ratio for the month of January. If the industry average asset turnover is 0.6 times per month, is the company more or less efficient at producing revenues with its assets than other companies in the same industry? On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: During January 2024, the following transactions occur: lite: January 4 Pay cash on accounts payable, $9,900. January 8. purchase additional inventory on aceount, $86,900, January 15 Receive cash on accounts receivable, $22,400. January 19 Pay cash for nalarien, $30,200. January 28 Day cash for January utilities, $16,900, $117,000. The following information is avallable on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $5,820 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. d. Unpaid salaries owed to employees at the end of January are $33,000. e. The company accrued income taxes at the end of January $9,400. Adjusted TNT FIREWORKS Multiple-Step Income Statement For the Year Ended January 31, 2024 Trial Balance Balance Sheet > Unadjusted Trial Balance Balance Sheet Post-closing TNT FIREWORKS Multiple-Step Income Statement For the Year Ended January 31, 2024 \begin{tabular}{|l|r|r|} \hline Sales Revenue & $ & \\ \hline Cost of Goods Sold & 0 & \\ \hline Gross Profit & & $ \\ \hline Salaries' Expense & 0 & \\ \hline Utilities Expense & 0 & \\ \hline Depreciation Expense & 0 & \\ \hline Bad Debt Expense & 0 & \\ \hline & & \\ \hline & & \\ \hline Total Operating Expenses & & \\ \hline Operating Income & & \\ \hline Interest Revenue & & \\ \hline Income Before Taxes & & 0 \\ \hline Income Tax Expense & & 0 \\ \hline Net Income & & 0 \\ \hline \end{tabular} On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: During January 2024, the following transactions occur: lite: January 4 Pay cash on accounts payable, $9,900. January 8. purchase additional inventory on aceount, $86,900, January 15 Receive cash on accounts receivable, $22,400. January 19 Pay cash for nalarien, $30,200. January 28 Day cash for January utilities, $16,900, $117,000. The following information is avallable on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $5,820 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. d. Unpaid salaries owed to employees at the end of January are $33,000. e. The company accrued income taxes at the end of January $9,400. Post-closing \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ TNT FIREWORKS } \\ \hline \multicolumn{6}{|c|}{ Balance Sheet } \\ \hline \multicolumn{6}{|c|}{ January 31,2024} \\ \hline Assets & & & Liabilities & & \\ \hline Current Assets: & & ? & Current Liabilities: & & \\ \hline Cash & DS & 4,600 & Accounts Payable & eS & 92,200 \\ \hline Accounts Receivable & ( & 227,400 & Salaries Payable & & 33,000 \\ \hline Allowance for Uncollectible Accounts & & (8,420) & Income Tax Payable & & 9,400 \\ \hline Inventory & & 6,600 & 2 & & \\ \hline Interest Recelvable & & 70 & Total Current Liabilities & & 134,600 \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline Total Current Assets & & 230,250 & Total Liabilities & & 134,600 \\ \hline & & & & & \\ \hline Long-term Assets: & & & Stockholders' E & & 3 \\ \hline Land & & 159,000 & Common Stock & & 224,000 \\ \hline Equipment & a & 19,900 & Retained Earnings & (a) & 67,050 \\ \hline Accumulated Depreciation & (s) & (300)2 & - & & \\ \hline Notes Rocelvable & a & 16,800 & & & \\ \hline & & & & & \\ \hline & & & Total Stockholders' Equity & & 291.050 \\ \hline Total Assets & $ & 425,650 & Total Liabilities \& Stockholders' Equity & $ & 425,650 \\ \hline \end{tabular} (a) Calculate the return on assets ratio for the month of January. If the average return on assets for the industry in January is 2%, is the company more or less profitable than other companies in the same industry? The return on assets ratio is: The company is more profitable. (True or False) (b) Calculate the profit margin for the month of January. If the industry average profit margin is 4%, is the company more or less efficient at converting sales to profit than other companies in the same industry? (c) Calculate the asset turnover ratio for the month of January. If the industry average asset turnover is 0.6 times per month, is the company more or less efficient at producing revenues with its assets than other companies in the same industry? On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: During January 2024, the following transactions occur: lite: January 4 Pay cash on accounts payable, $9,900. January 8. purchase additional inventory on aceount, $86,900, January 15 Receive cash on accounts receivable, $22,400. January 19 Pay cash for nalarien, $30,200. January 28 Day cash for January utilities, $16,900, $117,000. The following information is avallable on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $5,820 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. d. Unpaid salaries owed to employees at the end of January are $33,000. e. The company accrued income taxes at the end of January $9,400. Adjusted TNT FIREWORKS Multiple-Step Income Statement For the Year Ended January 31, 2024 Trial Balance Balance Sheet > Unadjusted Trial Balance Balance Sheet Post-closing TNT FIREWORKS Multiple-Step Income Statement For the Year Ended January 31, 2024 \begin{tabular}{|l|r|r|} \hline Sales Revenue & $ & \\ \hline Cost of Goods Sold & 0 & \\ \hline Gross Profit & & $ \\ \hline Salaries' Expense & 0 & \\ \hline Utilities Expense & 0 & \\ \hline Depreciation Expense & 0 & \\ \hline Bad Debt Expense & 0 & \\ \hline & & \\ \hline & & \\ \hline Total Operating Expenses & & \\ \hline Operating Income & & \\ \hline Interest Revenue & & \\ \hline Income Before Taxes & & 0 \\ \hline Income Tax Expense & & 0 \\ \hline Net Income & & 0 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts