Question: help me with the solution with breif explanation Question 2 Opting Inc. has a very generous stock option plan that allows all of their long

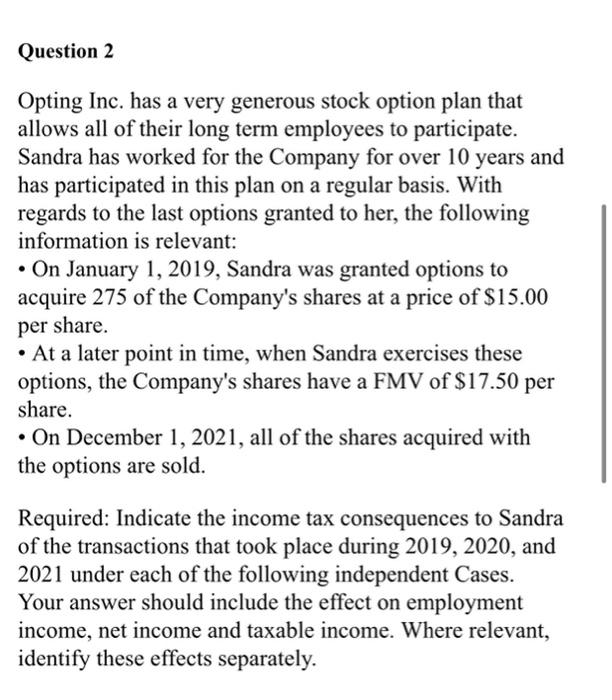

Question 2 Opting Inc. has a very generous stock option plan that allows all of their long term employees to participate. Sandra has worked for the Company for over 10 years and has participated in this plan on a regular basis. With regards to the last options granted to her, the following information is relevant: On January 1, 2019, Sandra was granted options to acquire 275 of the Company's shares at a price of $15.00 per share. At a later point in time, when Sandra exercises these options, the Company's shares have a FMV of $17.50 per share. On December 1, 2021, all of the shares acquired with the options are sold. Required: Indicate the income tax consequences to Sandra of the transactions that took place during 2019, 2020, and 2021 under each of the following independent Cases. Your answer should include the effect on employment income, net income and taxable income. Where relevant, identify these effects separately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts