Question: Help me with this chart please Adj. Parent Subsidiary Consolidation Non- Consolidated 20X1 20X1 Adjustments Controlling 20X1 Pro Forma Pro Forma Debit Credit Interest Pro

Help me with this chart please

| Adj. Parent | Subsidiary | Consolidation | Non- | Consolidated | |||||

| 20X1 | 20X1 | Adjustments | Controlling | 20X1 | |||||

| Pro Forma | Pro Forma | Debit | Credit | Interest | Pro Forma | ||||

| Sales | $ - | - | |||||||

| Cost of Goods Sold | - | - | |||||||

| Operating Expenses | - | - | |||||||

| Interest Expense | - | - | |||||||

| Income Tax Expense | |||||||||

| Equity in Subsidiary income | - | - | |||||||

| Income Before Taxes | - | - | |||||||

| Income Tax Expense | - | - | |||||||

| Noncontrolling interest expense | |||||||||

| Net Income | |||||||||

| Retained Earnings, January 1 | |||||||||

| Add: Net Income | |||||||||

| Less: Dividends | |||||||||

| Retained Earnings, December 31 | |||||||||

| Cash | |||||||||

| Accounts Receivable | |||||||||

| Inventory | |||||||||

| Property, Plant, & Equipment | |||||||||

| Less: Accumulated Depreciation | |||||||||

| Investment in Subsiidiary | |||||||||

| Goodwill | |||||||||

| Total Assets | |||||||||

| Accounts Payable | |||||||||

| Interest Payable | |||||||||

| Bonds Payable | |||||||||

| Noncontrolling interest in Sub.1/1/X1 | |||||||||

| Noncontrolling interest in Sub.12/31/X1 | |||||||||

| Common Stock | |||||||||

| Paid-In Capital in Excess of Par | |||||||||

| Retained Earnings | |||||||||

| Total Liabilities & Equities | |||||||||

I need help with the journal entries

| S entry | ||

| A entry | ||

| I entry | ||

| D entry | ||

| E entry | ||

| TI entry | ||

| G entry |

Data is provided

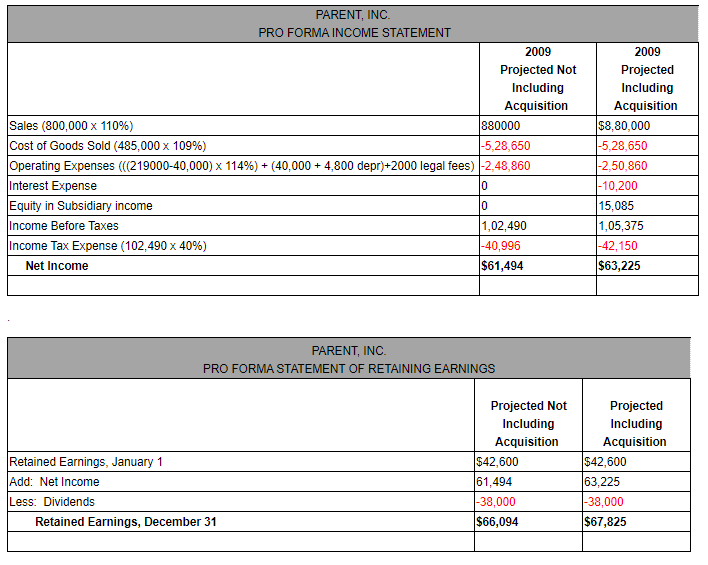

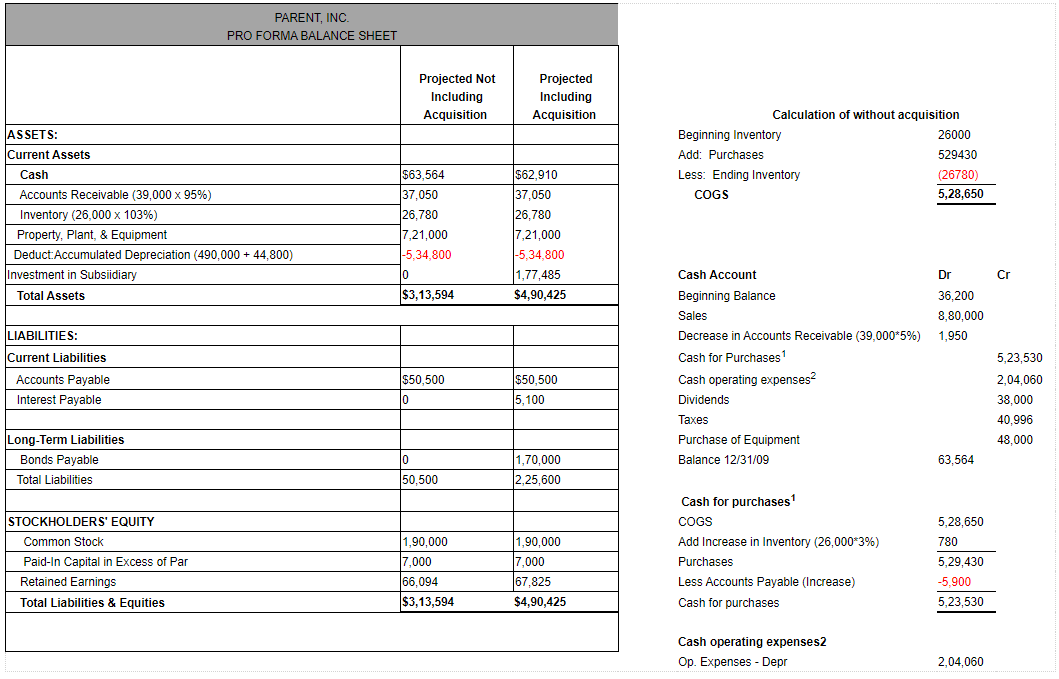

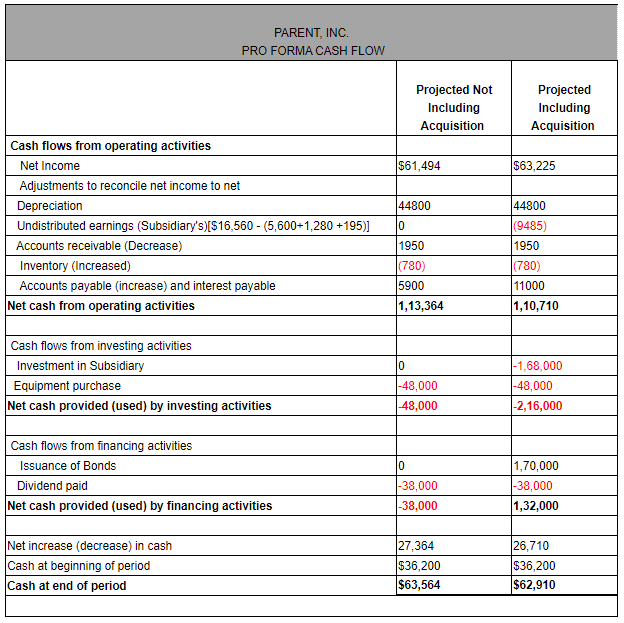

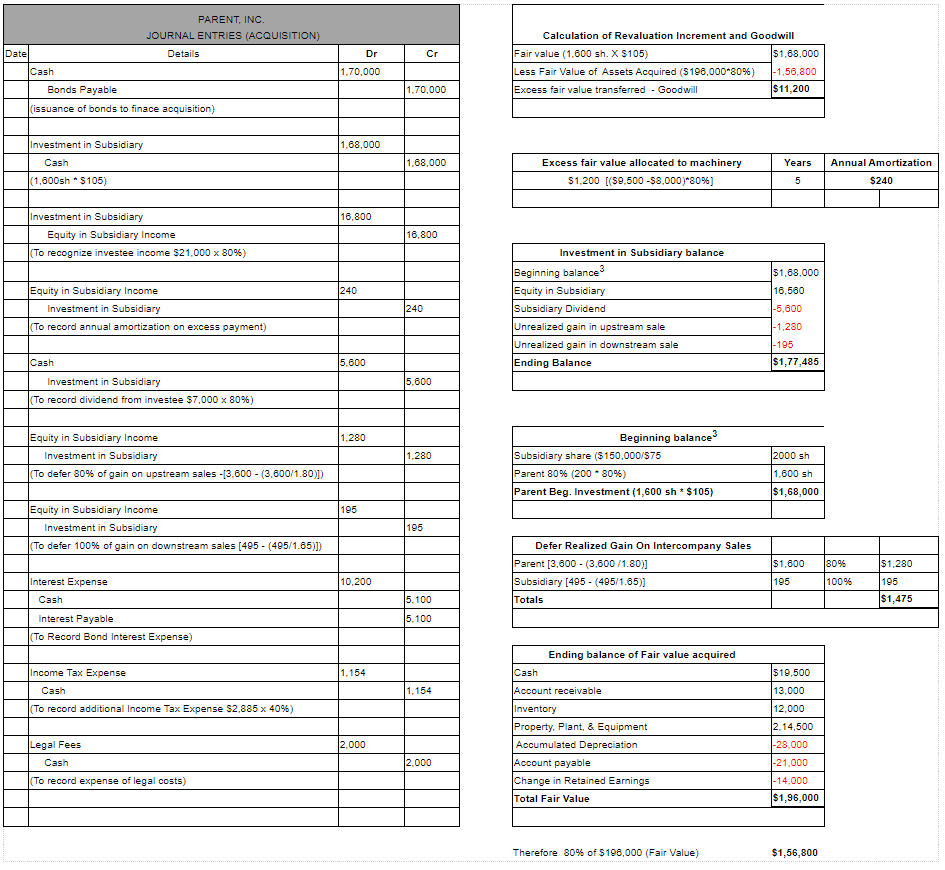

PARENT, INC PRO FORMA INCOME STATEMENT 2009 Projected Not Including Acquisition Sales (800,000 x 110%) 880000 Cost of Goods Sold (485,000 x 109%) -5,28,650 Operating Expenses (219000-40,000) x 114%) + (40,000 + 4,800 depr)+2000 legal fees) -2,48,860 Interest Expense 0 Equity in Subsidiary income 0 Income Before Taxes 1,02,490 Income Tax Expense (102,490 x 40%) |-40,996 Net Income $61,494 2009 Projected Including Acquisition $8,80,000 |-5,28,650 |-2,50,860 |-10,200 15,085 1,05,375 |-42,150 $63,225 PARENT, INC. PRO FORMA STATEMENT OF RETAINING EARNINGS Retained Earnings, January 1 Add: Net Income Less: Dividends Retained Earnings, December 31 Projected Not Including Acquisition $42,600 61,494 -38,000 $66,094 Projected Including Acquisition $42,600 63,225 |-38,000 $67,825 PARENT, INC PRO FORMA BALANCE SHEET Projected Not Including Acquisition Projected Including Acquisition Calculation of without acquisition Beginning Inventory 26000 Add: Purchases 529430 Less: Ending Inventory (26780) COGS 5,28,650 ASSETS: Current Assets Cash Accounts Receivable (39,000 x 95%) Inventory (26.000 x 103%) Property, Plant, & Equipment Deduct Accumulated Depreciation (490,000 + 44.800) Investment in Subsidiary Total Assets $63,564 37,050 26,780 7,21,000 -5.34.800 0 $3,13,594 $62,910 37,050 26,780 7,21,000 -5,34,800 1,77,485 $4,90,425 + Cr LIABILITIES: Current Liabilities Accounts Payable Interest Payable Cash Account Dr Beginning Balance 36.200 Sales 8.80,000 Decrease in Accounts Receivable (39,000*5%) 1,950 Cash for Purchases 1 Cash operating expenses Dividends Taxes Purchase of Equipment Balance 12/31/09 63,564 $50,500 $50,500 5,100 0 5,23,530 2,04.060 38,000 40,996 48.000 Long-Term Liabilities Bonds Payable Total Liabilities 10 1,70,000 2,25,600 50.500 STOCKHOLDERS' EQUITY Common Stock Paid-In Capital in Excess of Par Retained Earnings Total Liabilities & Equities 1,90,000 7,000 66,094 $3,13,594 1,90,000 17,000 67,825 $4,90,425 Cash for purchases COGS Add Increase in Inventory (26,000*3%) Purchases Less Accounts Payable (Increase) Cash for purchases 5,28,650 780 5,29,430 -5.900 5,23,530 Cash operating expenses2 Op. Expenses - Depr 2,04,060 PARENT, INC. PRO FORMA CASH FLOW Projected Not Including Acquisition Projected Including Acquisition $61,494 $63,225 44800 Cash flows from operating activities Net Income Adjustments to reconcile net income to net Depreciation Undistributed earnings (Subsidiary's)[$16,560 - (5,600+1,280 +195)] Accounts receivable (Decrease) Inventory (Increased) Accounts payable (increase) and interest payable Net cash from operating activities 0 1950 44800 (9485) 1950 (780) 11000 1,10,710 (780) 5900 1,13,364 Cash flows from investing activities Investment in Subsidiary Equipment purchase Net cash provided (used) by investing activities 0 -48,000 -48,000 -1,68,000 -48,000 -2,16,000 0 Cash flows from financing activities Issuance of Bonds Dividend paid Net cash provided (used) by financing activities -38,000 -38,000 1,70,000 |-38,000 1,32,000 Net increase (decrease) in cash Cash at beginning of period Cash at end of period 27,364 $36,200 $63,564 26,710 $36,200 $62,910 PARENT, INC. JOURNAL ENTRIES (ACQUISITION) Details Date Dr Cr Calculation of Revaluation Increment and Goodwill Fair value (1.600 sh. X S105) $1,88.000 Less Fair Value of Assets Acquired (5196,000*30%) |-1,56.800 Excess fair value transferred - Goodwill $11,200 1.70,000 Cash Bonds Payable 1.70.000 (issuance of bonds to finace acquisition) 1.68.000 Investment in Subsidiary Cash 1.68,000 Annual Amortization Excess fair value allocated to machinery $1.200 [(50,500 -58,000)*80%] Years 5 (1.600sh * $105) $240 16,800 Investment in Subsidiary Equity in Subsidiary Income (To recognize investee income $21.000 x 80%) 16.800 $1,88.000 16,560 240 Equity in Subsidiary Income Investment in Subsidiary (To record annual amortization on excess payment) 240 Investment in Subsidiary balance Beginning balance 3 Equity in Subsidiary Subsidiary Dividend Unrealized gain in upstream sale Unrealized gain in downstream sale Ending Balance -5,600 |-1,280 -195 $1,77,485 5.600 Cash Investment in Subsidiary (To record dividend from investee $7,000 x 809) 5,600 1.280 Equity in Subsidiary Income Investment in Subsidiary (To defer 80% of gain on upstream sales -[3.600 - (3,800/1.80)) 1.280 2000 sh Beginning balance Subsidiary share ($150,000/$75 Parent 80% (200 - 80%) Parent Beg. Investment (1,600 sh * $105) 1.600 sh $1,68,000 195 Equity in Subsidiary Income Investment in Subsidiary (To defer 100% of gain on downstream sales [495 - (495/1.65)]) 195 80% Defer Realized Gain On Intercompany Sales Parent (3,600 - (3,600 /1.80)] Subsidiary [495 - (495/1.65)] Totals $1,800 195 $1,280 195 10,200 100% Interest Expense Cash 5.100 $1,475 15.100 Interest Payable (To Record Bond Interest Expense) 1.154 Ending balance of Fair value acquired Cash Account receivable Income Tax Expense Cash (To record additional Income Tax Expense $2.885 x 40%) $19,500 1.154 2.000 Legal Fees Cash (To record expense of legal costs) Inventory Property. Plant, & Equipment Accumulated Depreciation Account payable Change in Retained Earnings Total Fair Value 13,000 12,000 2.14,500 |-28.000 -21.000 |-14.000 $1,96,000 2.000 Therefore 80% of $190.000 (Fair Value) $1,56,800 PARENT, INC PRO FORMA INCOME STATEMENT 2009 Projected Not Including Acquisition Sales (800,000 x 110%) 880000 Cost of Goods Sold (485,000 x 109%) -5,28,650 Operating Expenses (219000-40,000) x 114%) + (40,000 + 4,800 depr)+2000 legal fees) -2,48,860 Interest Expense 0 Equity in Subsidiary income 0 Income Before Taxes 1,02,490 Income Tax Expense (102,490 x 40%) |-40,996 Net Income $61,494 2009 Projected Including Acquisition $8,80,000 |-5,28,650 |-2,50,860 |-10,200 15,085 1,05,375 |-42,150 $63,225 PARENT, INC. PRO FORMA STATEMENT OF RETAINING EARNINGS Retained Earnings, January 1 Add: Net Income Less: Dividends Retained Earnings, December 31 Projected Not Including Acquisition $42,600 61,494 -38,000 $66,094 Projected Including Acquisition $42,600 63,225 |-38,000 $67,825 PARENT, INC PRO FORMA BALANCE SHEET Projected Not Including Acquisition Projected Including Acquisition Calculation of without acquisition Beginning Inventory 26000 Add: Purchases 529430 Less: Ending Inventory (26780) COGS 5,28,650 ASSETS: Current Assets Cash Accounts Receivable (39,000 x 95%) Inventory (26.000 x 103%) Property, Plant, & Equipment Deduct Accumulated Depreciation (490,000 + 44.800) Investment in Subsidiary Total Assets $63,564 37,050 26,780 7,21,000 -5.34.800 0 $3,13,594 $62,910 37,050 26,780 7,21,000 -5,34,800 1,77,485 $4,90,425 + Cr LIABILITIES: Current Liabilities Accounts Payable Interest Payable Cash Account Dr Beginning Balance 36.200 Sales 8.80,000 Decrease in Accounts Receivable (39,000*5%) 1,950 Cash for Purchases 1 Cash operating expenses Dividends Taxes Purchase of Equipment Balance 12/31/09 63,564 $50,500 $50,500 5,100 0 5,23,530 2,04.060 38,000 40,996 48.000 Long-Term Liabilities Bonds Payable Total Liabilities 10 1,70,000 2,25,600 50.500 STOCKHOLDERS' EQUITY Common Stock Paid-In Capital in Excess of Par Retained Earnings Total Liabilities & Equities 1,90,000 7,000 66,094 $3,13,594 1,90,000 17,000 67,825 $4,90,425 Cash for purchases COGS Add Increase in Inventory (26,000*3%) Purchases Less Accounts Payable (Increase) Cash for purchases 5,28,650 780 5,29,430 -5.900 5,23,530 Cash operating expenses2 Op. Expenses - Depr 2,04,060 PARENT, INC. PRO FORMA CASH FLOW Projected Not Including Acquisition Projected Including Acquisition $61,494 $63,225 44800 Cash flows from operating activities Net Income Adjustments to reconcile net income to net Depreciation Undistributed earnings (Subsidiary's)[$16,560 - (5,600+1,280 +195)] Accounts receivable (Decrease) Inventory (Increased) Accounts payable (increase) and interest payable Net cash from operating activities 0 1950 44800 (9485) 1950 (780) 11000 1,10,710 (780) 5900 1,13,364 Cash flows from investing activities Investment in Subsidiary Equipment purchase Net cash provided (used) by investing activities 0 -48,000 -48,000 -1,68,000 -48,000 -2,16,000 0 Cash flows from financing activities Issuance of Bonds Dividend paid Net cash provided (used) by financing activities -38,000 -38,000 1,70,000 |-38,000 1,32,000 Net increase (decrease) in cash Cash at beginning of period Cash at end of period 27,364 $36,200 $63,564 26,710 $36,200 $62,910 PARENT, INC. JOURNAL ENTRIES (ACQUISITION) Details Date Dr Cr Calculation of Revaluation Increment and Goodwill Fair value (1.600 sh. X S105) $1,88.000 Less Fair Value of Assets Acquired (5196,000*30%) |-1,56.800 Excess fair value transferred - Goodwill $11,200 1.70,000 Cash Bonds Payable 1.70.000 (issuance of bonds to finace acquisition) 1.68.000 Investment in Subsidiary Cash 1.68,000 Annual Amortization Excess fair value allocated to machinery $1.200 [(50,500 -58,000)*80%] Years 5 (1.600sh * $105) $240 16,800 Investment in Subsidiary Equity in Subsidiary Income (To recognize investee income $21.000 x 80%) 16.800 $1,88.000 16,560 240 Equity in Subsidiary Income Investment in Subsidiary (To record annual amortization on excess payment) 240 Investment in Subsidiary balance Beginning balance 3 Equity in Subsidiary Subsidiary Dividend Unrealized gain in upstream sale Unrealized gain in downstream sale Ending Balance -5,600 |-1,280 -195 $1,77,485 5.600 Cash Investment in Subsidiary (To record dividend from investee $7,000 x 809) 5,600 1.280 Equity in Subsidiary Income Investment in Subsidiary (To defer 80% of gain on upstream sales -[3.600 - (3,800/1.80)) 1.280 2000 sh Beginning balance Subsidiary share ($150,000/$75 Parent 80% (200 - 80%) Parent Beg. Investment (1,600 sh * $105) 1.600 sh $1,68,000 195 Equity in Subsidiary Income Investment in Subsidiary (To defer 100% of gain on downstream sales [495 - (495/1.65)]) 195 80% Defer Realized Gain On Intercompany Sales Parent (3,600 - (3,600 /1.80)] Subsidiary [495 - (495/1.65)] Totals $1,800 195 $1,280 195 10,200 100% Interest Expense Cash 5.100 $1,475 15.100 Interest Payable (To Record Bond Interest Expense) 1.154 Ending balance of Fair value acquired Cash Account receivable Income Tax Expense Cash (To record additional Income Tax Expense $2.885 x 40%) $19,500 1.154 2.000 Legal Fees Cash (To record expense of legal costs) Inventory Property. Plant, & Equipment Accumulated Depreciation Account payable Change in Retained Earnings Total Fair Value 13,000 12,000 2.14,500 |-28.000 -21.000 |-14.000 $1,96,000 2.000 Therefore 80% of $190.000 (Fair Value) $1,56,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts