Question: Help me with work please!!! Tiger Resources has an expected level of EBIT of $2.5 million for the coming year, which also happens to be

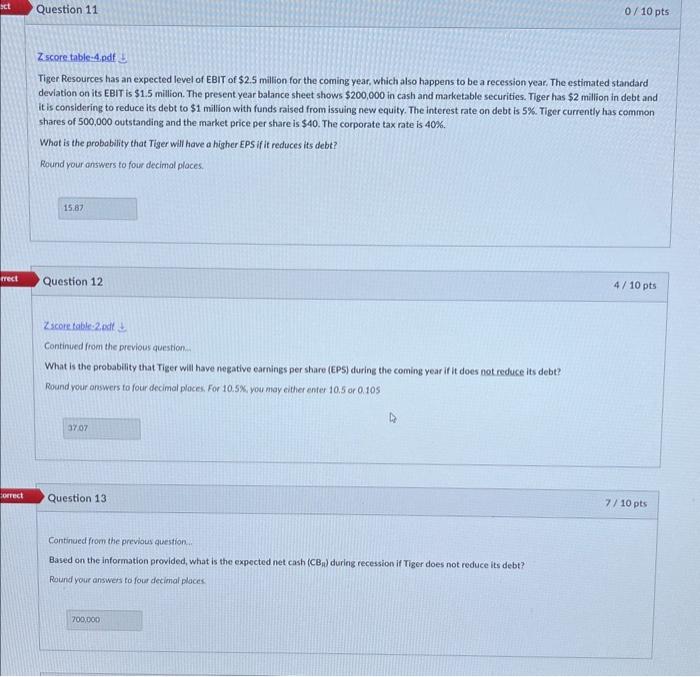

Tiger Resources has an expected level of EBIT of $2.5 million for the coming year, which also happens to be a recession year. The estimated standard deviation on its EBIT is $1.5 million. The present year balance sheet shows $200,000 in cash and marketable securities. Tiger has $2 million in debt and it is considering to reduce its debt to $1 million with funds raised from issuing new equity. The interest rate on debt is 5%. Tiger currently has common shares of 500,000 outstanding and the market price per share is $40. The corporate tax rate is 40%. What is the probability that Tiger will have a higher EPS if it reduces its debt? Round your answers to four decimal places. Question 12 4/10pts Zscore table: 2 adt Continued from the previous question What is the probability that Tiger will have negative earnings per share (EPS) during the coming year if it does not reduce its debt? Round your answers to four decimal ploces. For 10.5% you may either enter 10.5 or 0.105 Question 13 7/10pts Continued from the previous question. Based on the information provided, what is the expected net cash (CB CHp during recession if Tiger does not reduce its debt? Round your answers to four decimal ploces Zscore toble:-5,pdi 3 Continued from the previous question.w Tiger management would prefer to assume less than 5% risk of running out of cash during the one year of recession. How much net cash should Tiger have? Round your onswers to four decimal places. You may enter your answer in millions. For exampic for 5805,000 , you may enter either 0.8050 or 805,000.0000 Tiger Resources has an expected level of EBIT of $2.5 million for the coming year, which also happens to be a recession year. The estimated standard deviation on its EBIT is $1.5 million. The present year balance sheet shows $200,000 in cash and marketable securities. Tiger has $2 million in debt and it is considering to reduce its debt to $1 million with funds raised from issuing new equity. The interest rate on debt is 5%. Tiger currently has common shares of 500,000 outstanding and the market price per share is $40. The corporate tax rate is 40%. What is the probability that Tiger will have a higher EPS if it reduces its debt? Round your answers to four decimal places. Question 12 4/10pts Zscore table: 2 adt Continued from the previous question What is the probability that Tiger will have negative earnings per share (EPS) during the coming year if it does not reduce its debt? Round your answers to four decimal ploces. For 10.5% you may either enter 10.5 or 0.105 Question 13 7/10pts Continued from the previous question. Based on the information provided, what is the expected net cash (CB CHp during recession if Tiger does not reduce its debt? Round your answers to four decimal ploces Zscore toble:-5,pdi 3 Continued from the previous question.w Tiger management would prefer to assume less than 5% risk of running out of cash during the one year of recession. How much net cash should Tiger have? Round your onswers to four decimal places. You may enter your answer in millions. For exampic for 5805,000 , you may enter either 0.8050 or 805,000.0000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts