Question: help mee Please use your analysis in Q1 to estimate the free cash flows and perform the DCF valuation per share for the Sunshine company.

help mee

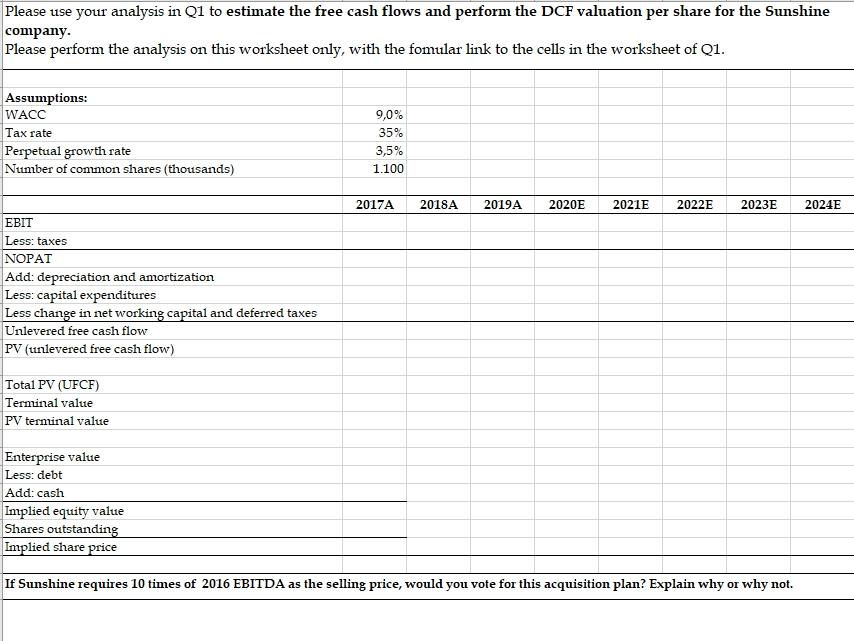

Please use your analysis in Q1 to estimate the free cash flows and perform the DCF valuation per share for the Sunshine company. Please perform the analysis on this worksheet only, with the fomular link to the cells in the worksheet of Q1. Assumptions: WACC Tax rate Perpetual growth rate Number of common shares (thousands) 9,0% 35% 3,5% 1.100 2017A 2018A 2019A 2020E 2021E 2022E 2023E 2024E EBIT Less: taxes NOPAT Add: depreciation and amortization Less: capital expenditures Less change in net working capital and deferred taxes Unlevered free cash flow PV (unlevered free cash flow) Total PV (UFCF) Terminal value PV terminal value Enterprise value Less: debt Add: cash Implied equity value Shares outstanding Implied share price If Sunshine requires 10 times of 2016 EBITDA as the selling price, would you vote for this acquisition plan? Explain why or why not. Please use your analysis in Q1 to estimate the free cash flows and perform the DCF valuation per share for the Sunshine company. Please perform the analysis on this worksheet only, with the fomular link to the cells in the worksheet of Q1. Assumptions: WACC Tax rate Perpetual growth rate Number of common shares (thousands) 9,0% 35% 3,5% 1.100 2017A 2018A 2019A 2020E 2021E 2022E 2023E 2024E EBIT Less: taxes NOPAT Add: depreciation and amortization Less: capital expenditures Less change in net working capital and deferred taxes Unlevered free cash flow PV (unlevered free cash flow) Total PV (UFCF) Terminal value PV terminal value Enterprise value Less: debt Add: cash Implied equity value Shares outstanding Implied share price If Sunshine requires 10 times of 2016 EBITDA as the selling price, would you vote for this acquisition plan? Explain why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts