Question: help meee Part 1: (2.5 points) True False Questions. Decide whether the following statements are True or False Explain your reasoning When the government tax

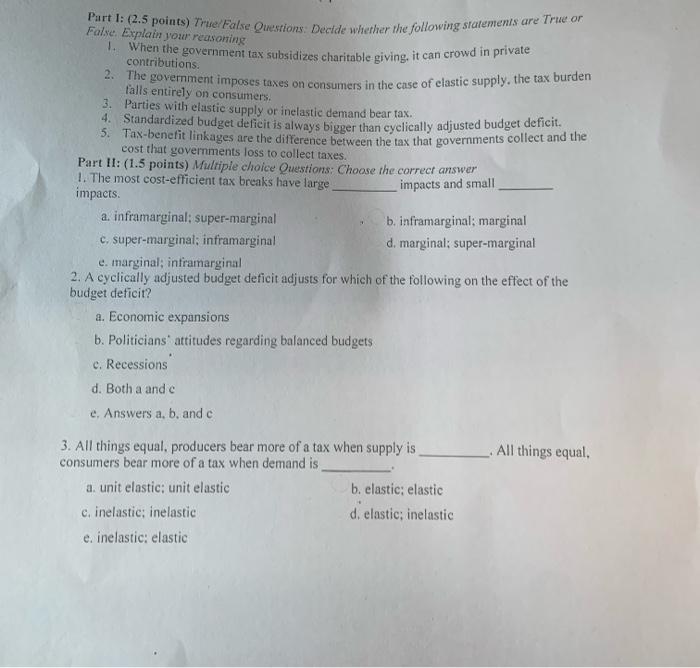

Part 1: (2.5 points) True False Questions. Decide whether the following statements are True or False Explain your reasoning When the government tax subsidizes charitable giving, it can crowd in private contributions 2. The government imposes taxes on consumers in the case of elastic supply, the tax burden falls entirely on consumers. 3. Parties with elastic supply or inelastic demand bear tax. 4. Standardized budget deficit is always bigger than cyclically adjusted budget deficit. 5. Tax-benefit linkages are the difference between the tax that governments collect and the cost that governments loss to collect taxes. Part II: (1.5 points) Multiple choice Questions: Choose the correct answer 1. The most cost-efficient tax breaks have large impacts and small impacts a. inframarginal: super-marginal b. inframarginal; marginal c. super-marginal; inframarginal d. marginal: super-marginal e marginal; intramarginal 2. A cyclically adjusted budget deficit adjusts for which of the following on the effect of the budget deficit? a. Economic expansions b. Politicians' attitudes regarding balanced budgets c. Recessions d. Both a and e, Answers a, b, and c All things equal. 3. All things equal, producers bear more of a tax when supply is consumers bear more of a tax when demand is a, unit elastic; unit elastic b. elastic: elastic e, inelastic, inelastic d. elastic; inelastic e. inelastic: elastic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts