Question: help me..thank you PROBLEMS: PROBLEM 1: TRUE OR FALSE 1. The basis for consolidation is power. 2.Entity A acquires Entity B on November 1, 20x1.

help me..thank you

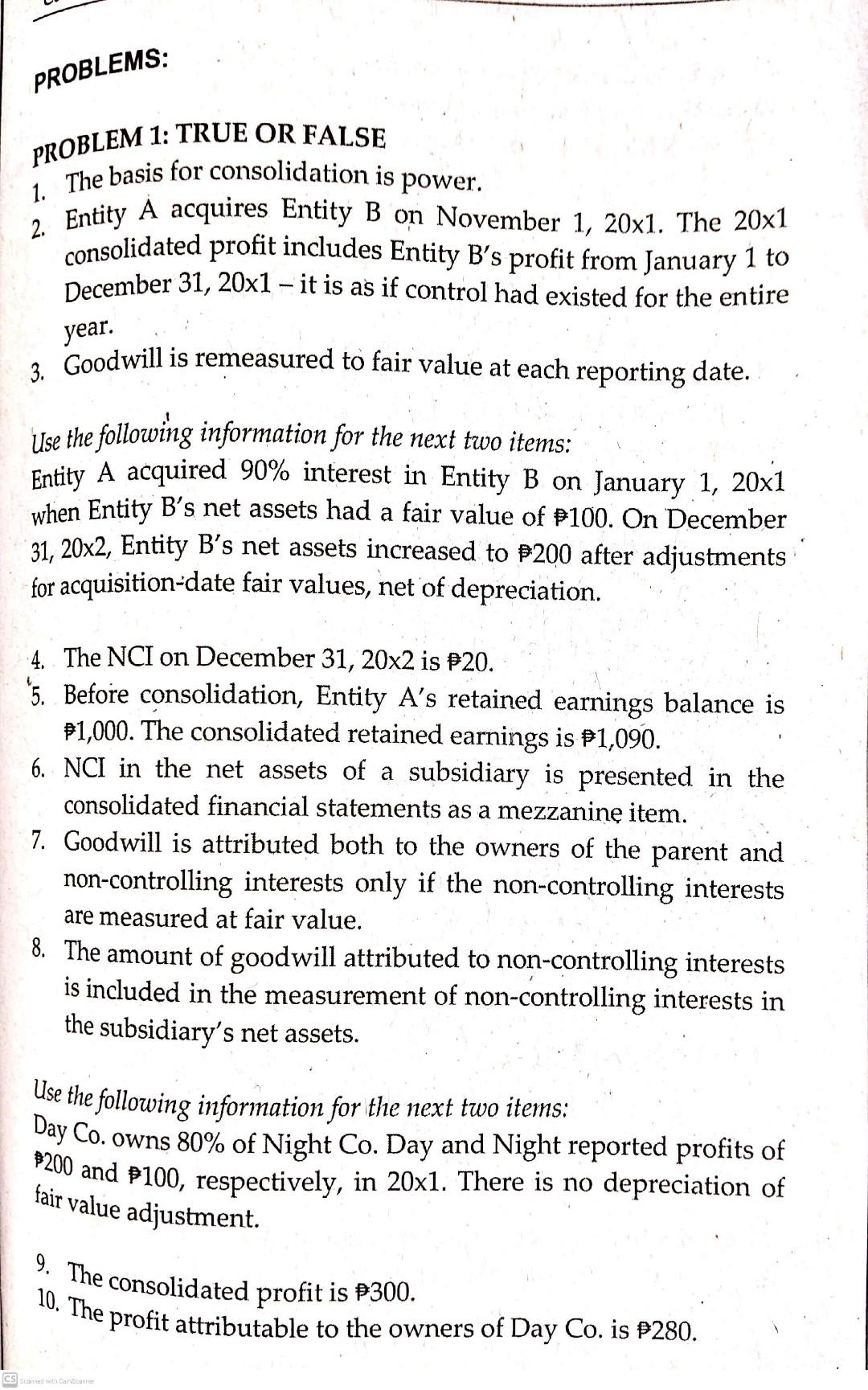

PROBLEMS: PROBLEM 1: TRUE OR FALSE 1. The basis for consolidation is power. 2.Entity A acquires Entity B on November 1, 20x1. The 20x1 consolidated profit includes Entity B's profit from January 1 to December 31, 20x1 - it is as if control had existed for the entire year. 3. Goodwill is remeasured to fair value at each reporting date. Use the following information for the next two items: Entity A acquired 90% interest in Entity B on January 1, 20x1 when Entity B's net assets had a fair value of P100. On December 31, 20x2, Entity B's net assets increased to $200 after adjustments for acquisition-date fair values, net of depreciation. 4. The NCI on December 31, 20x2 is $20. *5. Before consolidation, Entity A's retained earnings balance is $1,000. The consolidated retained earnings is P1,090. 6. NCI in the net assets of a subsidiary is presented in the consolidated financial statements as a mezzanine item. 7. Goodwill is attributed both to the owners of the parent and non-controlling interests only if the non-controlling interests are measured at fair value. 8. The amount of goodwill attributed to non-controlling interests is included in the measurement of non-controlling interests in the subsidiary's net assets. Use the following information for the next two items: Day Co. owns 80% of Night Co. Day and Night reported profits of 8200 and $100, respectively, in 20x1. There is no depreciation of fair value adjustment. 9. The consolidated profit is P300. 10. The profit attributable to the owners of Day Co. is $280

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts