Question: HELP! need help on this question tonight, ill leave a like !! Problem 4-4A Preparing financial statements and closing entries 01 P2 The adjusted trial

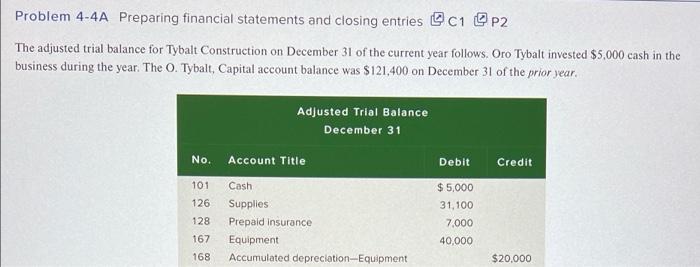

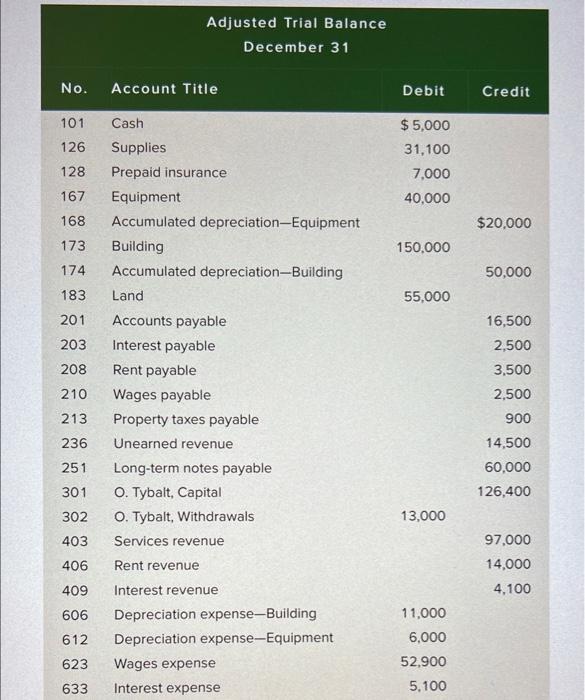

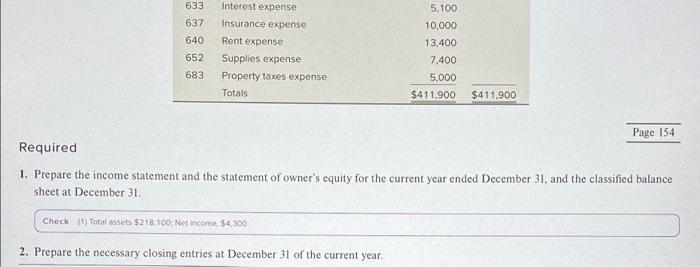

Problem 4-4A Preparing financial statements and closing entries 01 P2 The adjusted trial balance for Tybalt Construction on December 31 of the current year follows. Oro Tybalt invested $5,000 cash in the business during the year. The 0. Tybalt, Capital account balance was $121,400 on December 31 of the prior year. Adjusted Trial Balance December 31 No. Account Title Debit Credit 101 126 Cash Supplies Prepaid insurance Equipment Accumulated depreciation Equipment $ 5,000 31,100 7,000 40,000 128 167 168 $20,000 Adjusted Trial Balance December 31 No. Account Title Debit Credit 101 126 $5,000 31,100 7,000 40,000 128 167 168 $20,000 173 150.000 174 50,000 183 55,000 201 Cash Supplies Prepaid insurance Equipment Accumulated depreciation Equipment Building Accumulated depreciation-Building Land Accounts payable Interest payable Rent payable Wages payable Property taxes payable Unearned revenue Long-term notes payable O. Tybalt, Capital 0. Tybalt, Withdrawals Services revenue 203 208 210 16,500 2,500 3,500 2,500 900 14,500 60,000 126,400 213 236 251 301 302 13,000 403 406 Rent revenue 97,000 14,000 4,100 409 606 612 Interest revenue Depreciation expense-Building Depreciation expense-Equipment Wages expense Interest expense 11,000 6,000 52.900 5.100 623 633 633 637 640 652 683 Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Totals 5.100 10,000 13,400 7.400 5,000 $411.900 $411.900 Page 154 Required 1. Prepare the income statement and the statement of owner's equity for the current year ended December 31, and the classified balance sheet at December 31 Check (1) Total assets $218.100. Net income. 54,300 2. Prepare the necessary closing entries at December 31 of the current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts