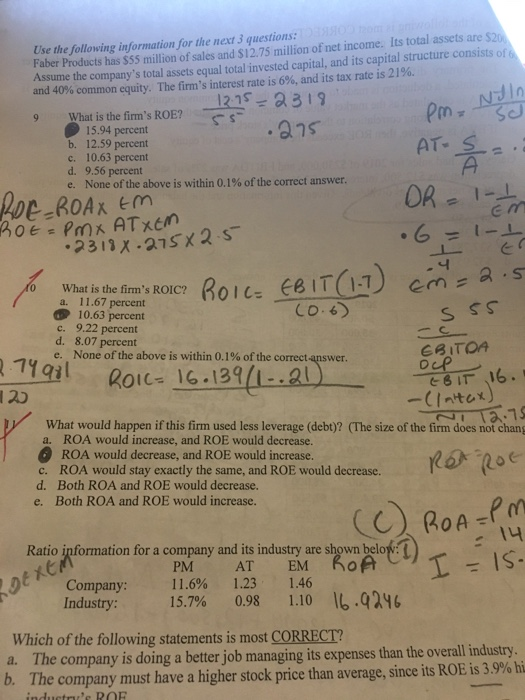

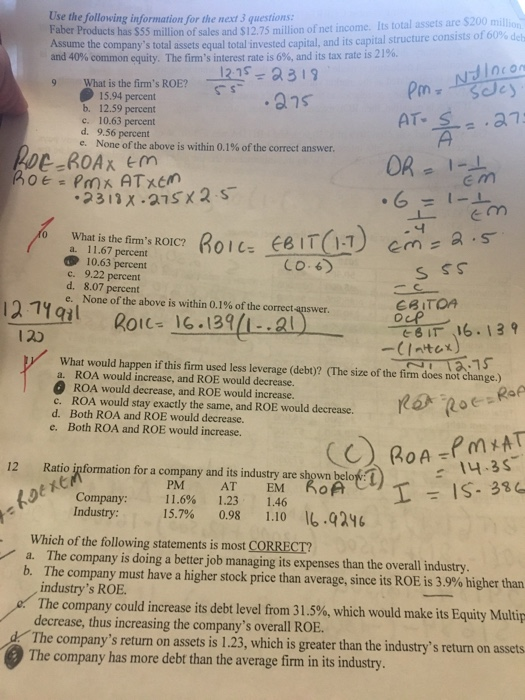

Question: help needed 9-11 please dont use excel and show all the formulas especially for firm's ROIC Use the following information for the next 3 questions:

Use the following information for the next 3 questions: Faber Products has $55 million of sales and $12.75 million of net income. Its total assets are $200 Assume the company's total assets equal total invested capital, and its capital structure consists of and 40% common equity. The firm's interest rate is 6%, and its tax rate is 21%. ROE? 55 pm - Nilo 275 12.15 2318 What is the firm's ROE? 15.94 percent b. 12.59 percent c. 10.63 percent d. 9.56 percent e. None of the above is within 0.1% of the correct answer. ATS -ROAX EM ROE = Px ATxen .23188.275*2.5 DR = 1 - for .6 = 1-16 ED -s55 S GITOA fo What is the firm's ROIC BOL- EBIT(1.1) cm a. 11.67 percent 10.63 percent (0.6) c. 9.22 percent -. d. 8.07 percent e. None of the above is within 0.1% of the correct answer. 2.79981 ROIC- 16.139/1-.21) EBIT 16. 120 -(latax) NIT2.75 What would happen if this firm used less leverage (debt)? (The size of the firm does not chang a. ROA would increase, and ROE would decrease. ROA would decrease, and ROE would increase. c. ROA would stay exactly the same, and ROE would decrease. d. Both ROA and ROE would decrease. e. Both ROA and ROE would increase. 13971-120W t g (C) ROA=Pm - 14 Ratio information for a company and its industry are shown below: PM AT EM ROA Company: 11.6% 1.23 1.46 Industry: 15.7% 0.98 1.10 16.9246 BOEXEM" Which of the following statements is most CORRECT? a. The company is doing a better job managing its expenses than the overall industry. b. The company must have a higher stock price than average, since its ROE is 3.9% hi inductie ROF SROE? 55 pm. Nie Use the following information for the next 3 questions: Faber Products has 555 million of sales and S1275 million of net income. Its total assets are $200 million Assume the company's total assets equal total invested capital, and its capital structure consists of 00% deb and 40% common equity. The firm's interest rate is 6%, and its tax rate is 21%. 12.75 - 2319 What is the firm's ROE? 15.94 percent .275 b. 12.59 percent 27 c. 10.63 percent d. 9.56 percent c. None of the above is within 0.1% of the correct answer. ROE-ROAX EM ROE=PMX ATXEM .2318 X.275 X 2.5 ATS DR = 1-1 .com 165 EBIT (1:1) c m = 2.5 s 55 12.74931 What is the firm's ROIC? BOL E BIT1-7 a. 11.67 percent 10.63 percent (0.6) c. 9.22 percent d. 8.07 percent e. None of the above is within 0.1% of the correct answer EBIT 16.139 -(lattax) What would happen if this firm used less leverage (debt)? (The size of the firm does not change.) NiT2.75 a. ROA would increase, and ROE would decrease. ROA would decrease, and ROE would increase. c. ROA would stay exactly the same, and ROE would decrease. d. Both ROA and ROE would decrease. e. Both ROA and ROE would increase. Roice 16.139/1-.21 RON 120 Ret Rot=Ro (C) ROA=PMXAT 12 = 14.35 Ratio information for a company and its industry are shown below: PM AT EM BOAT Company: 11.6% 1.23 1.46 Industry: 15.7% 0.98 1.10 16.9246 -LOEXEM" -IS96 Cristina Which of the following statements is most CORRECT? a. The company is doing a better job managing its expenses than the overall industry. b. The company must have a higher stock price than average, since its ROE is 3.9% higher than industry's ROE. 0. The company could increase its debt level from 31.5%, which would make its Equity Multip decrease, thus increasing the company's overall ROE. d. The company's return on assets is 1.23, which is greater than the industry's return on assets The company has more debt than the average firm in its industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts