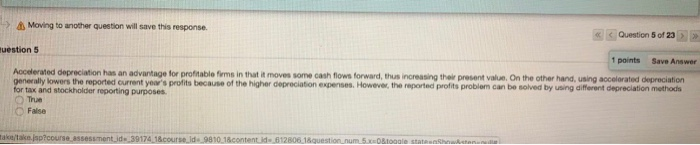

Question: help needed A Moving to another question will save this response. Question 5 of 230 uestion 5 points Save Answer Accelerated depreciation has an advantage

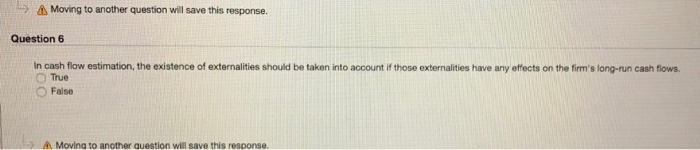

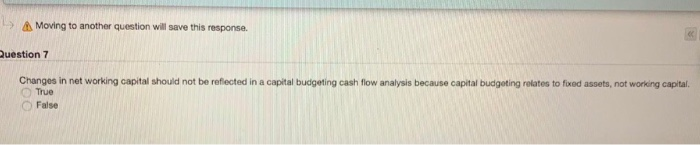

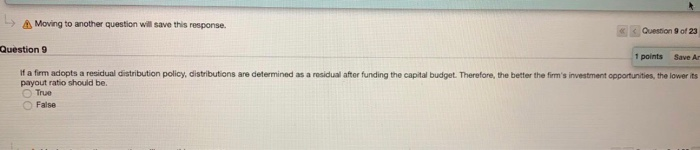

A Moving to another question will save this response. Question 5 of 230 uestion 5 points Save Answer Accelerated depreciation has an advantage for profitable fims in that it moves some cash flows forward, thus increasing their present value. On the other hand, using accelorated depreciation generally lowers the reported current year's profits because of the higher depreciation expenses. However, the reported profits problem can be solved by using different depreciation methods for tax and stockholder reporting purposes True OFalse ake/take.jsp?course assessment ids 39174.18course ids 9810 18content id.612806.18question num 5x08toggle stateentaktan A Moving to another question will save this response. Question 6 In cash flow estimation, the existence of externalities should be taken into account if those externalities have any effects on the firm's long-run cash flows. True False A Moving to another question will save this response. A Moving to another question will save this response. Question 7 Changes in net working capital should not be reflected in a capital budgeting cash flow analysis because capital budgeting relates to fixed assets, not working capital. True False A Moving to another question will save this response. Question 9 of 23 Question 9 1 points Save An If a firm adopts a residual distribution policy, distributions are determined as a residual after funding the capital budget. Therefore, the better the firm's investment opportunities, the lower its payout ratio should be. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts