Question: help needed!! finance!!! Question; Consider a boud hanig a par value of $10,000 & a coupon rate of 9%5 years are remaining till matuity &

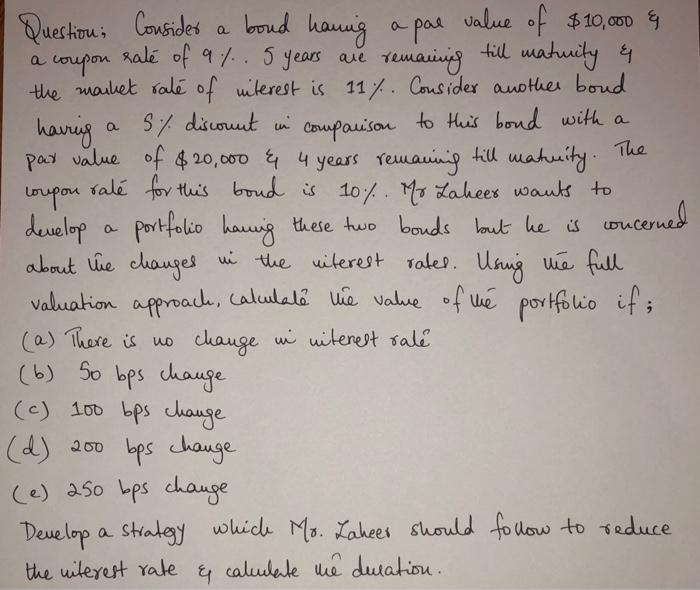

Question; Consider a boud hanig a par value of $10,000 \& a coupon rate of 9%5 years are remaining till matuity \& the maiket rate of witersest is 11%. Consider another boud havrig a S\% discount in comparison to this bond with a par value of $20,000&4 years remaning till matuity. The coupon rate for this boud is 10% Mr Lakeer wants to develop a portfolio hanig these two bouds but he is concerned about the changes in the viterest rates. Using tie full valuation approach, calculate vie value of the portfolio if; (a) There is no change in witerest rate Question; Consider a boud hanig a par value of $10,000 \& a coupon rate of 9%5 years are remaining till matuity \& the maiket rate of witersest is 11%. Consider another boud havrig a S\% discount in comparison to this bond with a par value of $20,000&4 years remaning till matuity. The coupon rate for this boud is 10% Mr Lakeer wants to develop a portfolio hanig these two bouds but he is concerned about the changes in the viterest rates. Using tie full valuation approach, calculate vie value of the portfolio if; (a) There is no change in witerest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts