Question: help needed kindle solve this Q5. You are considering to place funds of Rs. one billion in Daily Product Account (DPAs) for the purpose of

help needed

kindle solve this

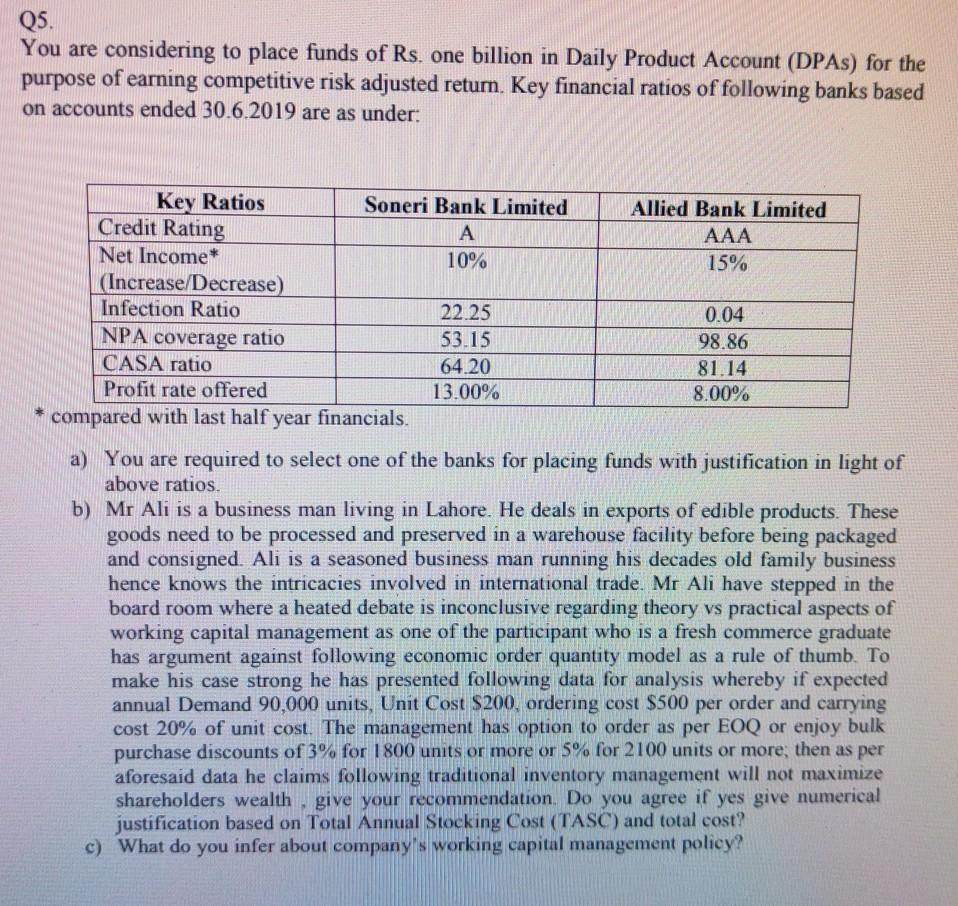

Q5. You are considering to place funds of Rs. one billion in Daily Product Account (DPAs) for the purpose of earning competitive risk adjusted return. Key financial ratios of following banks based on accounts ended 30.6.2019 are as under: Key Ratios Soneri Bank Limited Allied Bank Limited Credit Rating A AAA Net Income* 10% 15% (Increase/Decrease) Infection Ratio 22.25 0.04 NPA coverage ratio 53.15 98.86 CASA ratio 64.20 81.14 Profit rate offered 13.00% 8.00% compared with last half year financials. a) You are required to select one of the banks for placing funds with justification in light of above ratios. b) Mr Ali is a business man living in Lahore. He deals in exports of edible products. These goods need to be processed and preserved in a warehouse facility before being packaged and consigned Ali is a seasoned business man running his decades old family business hence knows the intricacies involved in international trade. Mr Ali have stepped in the board room where a heated debate is inconclusive regarding theory vs practical aspects of working capital management as one of the participant who is a fresh commerce graduate has argument against following economic order quantity model as a rule of thumb. To make his case strong he has presented following data for analysis whereby if expected annual Demand 90,000 units, Unit Cost $200 ordering cost $500 per order and carrying cost 20% of unit cost. The management has option to order as per EOQ or enjoy bulk purchase discounts of 3% for 1800 units or more or 5% for 2100 units or more; then as per aforesaid data he claims following traditional inventory management will not maximize shareholders wealth give your recommendation. Do you agree if yes give numerical justification based on Total Annual Stocking Cost (TASC) and total cost? c) What do you infer about company's working capital management policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts