Question: help needed Mastery Problem: Variable Casting for Management Analysis Absorption vs. Variable Operating comes one of the most important is reported by a company. Depending

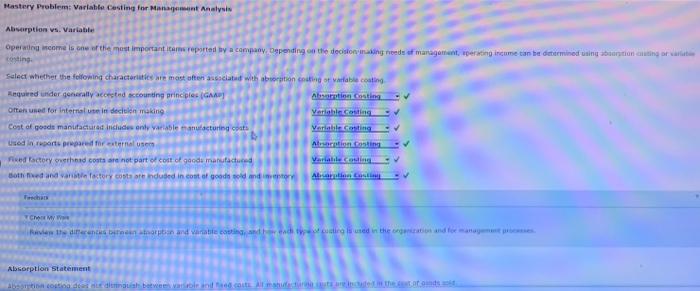

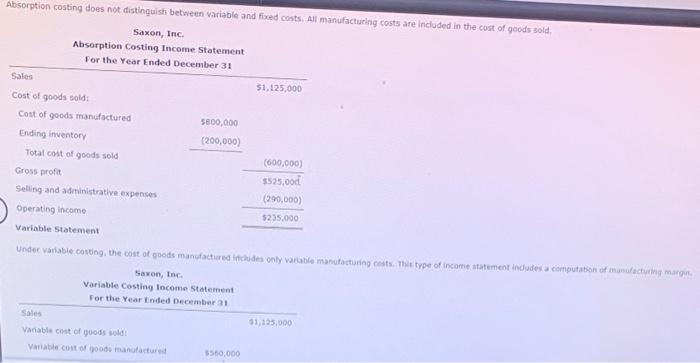

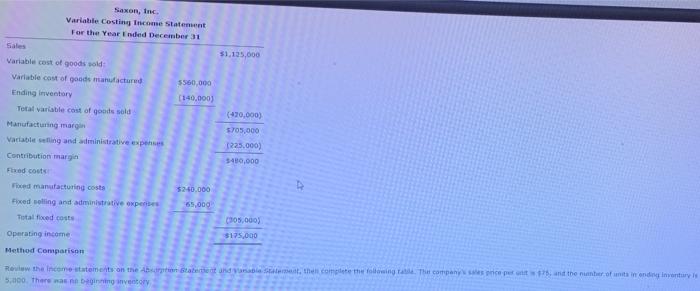

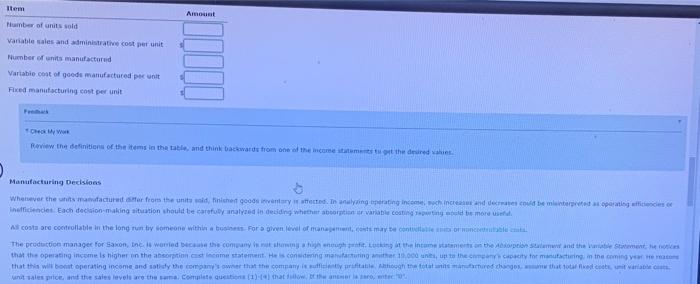

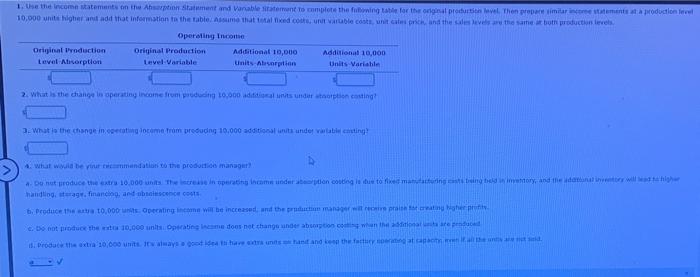

Mastery Problem: Variable Casting for Management Analysis Absorption vs. Variable Operating comes one of the most important is reported by a company. Depending on the decision making nede of management pering income can be determined using in ciuiting or costing Select whether the following characteristics are most often associated with abortion of variable coating Required under generally accepted accounting principles (GA often used for internal decision making Variablering Cont of goods manufacturat includes only variable manufacturing costs Variable crosting used in reports prepared mene Alsation.casting Redactory stand costs are not part of cost of goods manufactured Boted and want to constenduded in cont of good old and Alvaro Cast Trans CW Mediecents born and raising and edital e tendo Absorption Statement Ano de los Absorption costing does not distinguish between variable and fed costs. All manufacturing costs are included in the cost of goods sold, Saxon, Inc. Absorption Costing Income Statement For the Year Ended December 31 Sales $1,125,000 Cost of goods sold: Cost of goods manufactured 5800,000 Ending Inventory 200,000 Total cost of goods sold (600,000) Gross profit 5525,000 Selling and administrative expenses (200,000) Operating income 5235.000 Variable Statement under variable conting the cost of goods manufactured incodes only variable manufacturing costs. This type of income statement includes a computation of manufacturing margin Saxon, Inc Variable Costing Income Statement For the Year Ended December 31 Sales 11,125,000 Variable cost of goods sold Variable cost of manufactured 5560.000 Saxon, Inc Variable Costing Income Statement For the Year Ended December 31 Sales 31.135.000 Variable cost of goods sold Variable cost of good manufactured 5560.000 Ending inventory (140,000) Total variable cost of goods sold (470,000) Manufacturing margin 5705,000 Variable selling and administrative expenses (225.000 Contribution margin 3489,000 Fred costs Foed manufacturing costs $20.000 Fixed selling and administrative expenses 65.000 Total floed cost 105.000 $175,000 Operating income Method Comparison Row the income statements on the statement and variant, the complete the following that companies and the number of indinantys 5.000. There was ning inventory D Item Amount Number of units sold Variable sales and administrative cost per unit Number of units manufactured Variable cost of goods manufactured poc unit Fixed manufacturing cost per unit F Check Review the definitions of the items in the table, and think backwards from the income statement of the deed Manufacturing Decisions Whatever the actuar from the united finished goods inventory wed. Thanlying pating incom china and deco e mentre pesce Theiciendes. Each decision-making situation should be carefu analyzed to deciding whether abortion or variable coating more se A costare controllable in the long run by someone with a Por given woran may contact The production manager for Sakon, Inc. worried because the commune ruta nu in the Intumestament on the open solum and the Vie Statemente that the operating income is higher in the absorption istenmestament els conding manufacturing the 12.000 units, up to the concept for mantering in the coming year Herce that this will boost operating income and said the company wner that the company is the famoured thongs that tota la contact unit sales price and the sale levels are the sun compte que (1)) that want to 1. Use the income statements in the Ahsation samt and Vanable statement to complete the following table for the original productive. The prepare similar inte minst production level 10.000 units higher and add that information to the table Assume that take court Varble costs unit is prich, and there the same but production levels Operating Income Original Production Original Production Additional 10,000 Additional 10,000 Level Atisorption Level Variable Units Absorption Units Variable 2. What is the change in operating income from producing 10,000 units under option costing 3. What is the change in.comglocom From producing 10.000 addition under van hitting what would be your commandation to the production manager 4. Dentroduce the extra 10.000 units the rise in prating home indertelen til de to like matering in bed wory, and the day will handling, storage finance, and obscence Co b. Produce the 10.000 Operating will be increased and the productimai trang Nghe c. Do not produce the 10.000 units Operating income doos not change under betonowe is. Produce the actia 10,000 units ways got the constant and the fact

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts