Question: Help Needed please Task 3 - Inventories & Depreciation 25 MARKS Ted Lucky was operating a retail business on his own prior to starting a

Help Needed please

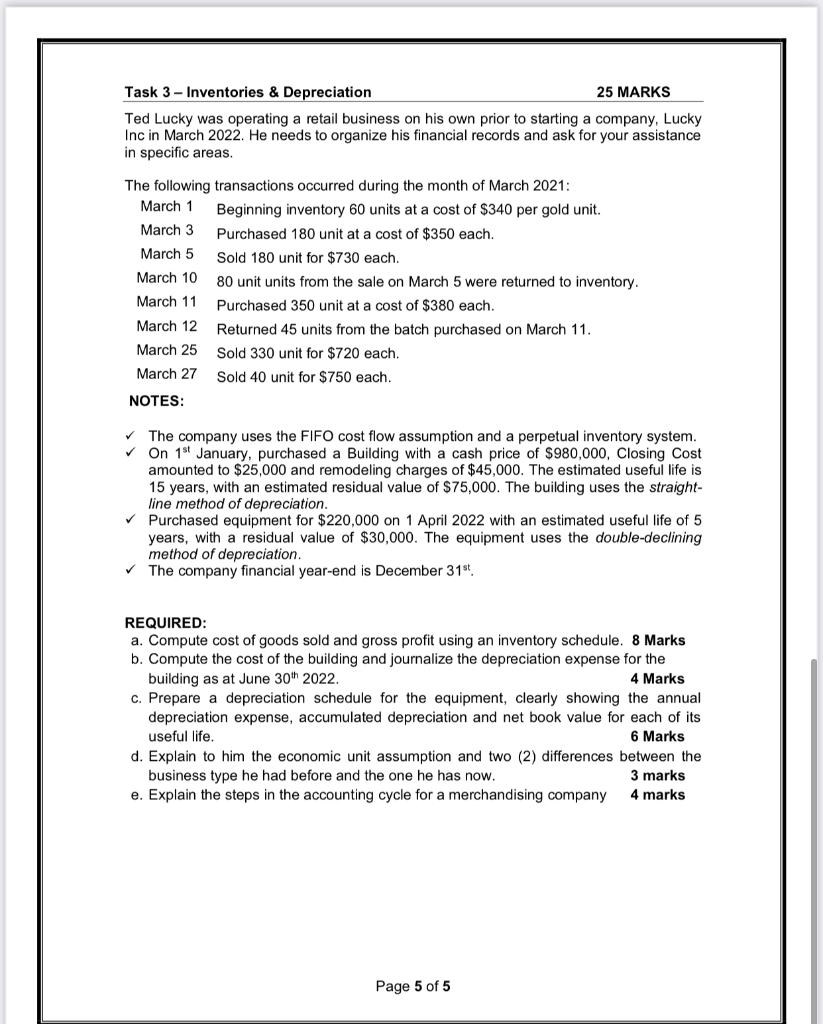

Task 3 - Inventories & Depreciation 25 MARKS Ted Lucky was operating a retail business on his own prior to starting a company, Lucky Inc in March 2022. He needs to organize his financial records and ask for your assistance in specific areas. The following transactions occurred during the month of March 2021: March 1 Beginning inventory 60 units at a cost of $340 per gold unit. March 3 Purchased 180 unit at a cost of $350 each. March 5 Sold 180 unit for $730 each. March 10 80 unit units from the sale on March 5 were returned to inventory. March 11 Purchased 350 unit at a cost of $380 each. March 12 Returned 45 units from the batch purchased on March 11. March 25 Sold 330 unit for $720 each. March 27 Sold 40 unit for $750 each. NOTES: The company uses the FIFO cost flow assumption and a perpetual inventory system. On 15 January, purchased a Building with a cash price of $980,000, Closing Cost amounted to $25,000 and remodeling charges of $45,000. The estimated useful life is 15 years, with an estimated residual value of $75,000. The building uses the straight- line method of depreciation. Purchased equipment for $220,000 on 1 April 2022 with an estimated useful life of 5 years, with a residual value of $30,000. The equipment uses the double-declining method of depreciation. The company financial year-end is December 31st REQUIRED: a. Compute cost of goods sold and gross profit using an inventory schedule. 8 Marks b. Compute the cost of the building and journalize the depreciation expense for the building as at June 30th 2022. 4 Marks c. Prepare a depreciation schedule for the equipment, clearly showing the annual depreciation expense, accumulated depreciation and net book value for each of its useful life. 6 Marks d. Explain to him the economic unit assumption and two (2) differences between the business type he had before and the one he has now. 3 marks e. Explain the steps in the accounting cycle for a merchandising company 4 marks Page 5 of 5 Task 3 - Inventories & Depreciation 25 MARKS Ted Lucky was operating a retail business on his own prior to starting a company, Lucky Inc in March 2022. He needs to organize his financial records and ask for your assistance in specific areas. The following transactions occurred during the month of March 2021: March 1 Beginning inventory 60 units at a cost of $340 per gold unit. March 3 Purchased 180 unit at a cost of $350 each. March 5 Sold 180 unit for $730 each. March 10 80 unit units from the sale on March 5 were returned to inventory. March 11 Purchased 350 unit at a cost of $380 each. March 12 Returned 45 units from the batch purchased on March 11. March 25 Sold 330 unit for $720 each. March 27 Sold 40 unit for $750 each. NOTES: The company uses the FIFO cost flow assumption and a perpetual inventory system. On 15 January, purchased a Building with a cash price of $980,000, Closing Cost amounted to $25,000 and remodeling charges of $45,000. The estimated useful life is 15 years, with an estimated residual value of $75,000. The building uses the straight- line method of depreciation. Purchased equipment for $220,000 on 1 April 2022 with an estimated useful life of 5 years, with a residual value of $30,000. The equipment uses the double-declining method of depreciation. The company financial year-end is December 31st REQUIRED: a. Compute cost of goods sold and gross profit using an inventory schedule. 8 Marks b. Compute the cost of the building and journalize the depreciation expense for the building as at June 30th 2022. 4 Marks c. Prepare a depreciation schedule for the equipment, clearly showing the annual depreciation expense, accumulated depreciation and net book value for each of its useful life. 6 Marks d. Explain to him the economic unit assumption and two (2) differences between the business type he had before and the one he has now. 3 marks e. Explain the steps in the accounting cycle for a merchandising company 4 marks Page 5 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts