Question: help needed subject: Financial Management Weight Weighted Beta = Beta for each company X Weight Beta (5Y Monthly) Ticker Symbol MCD 0.61 .20 0.122 0.62

help needed

subject: Financial Management

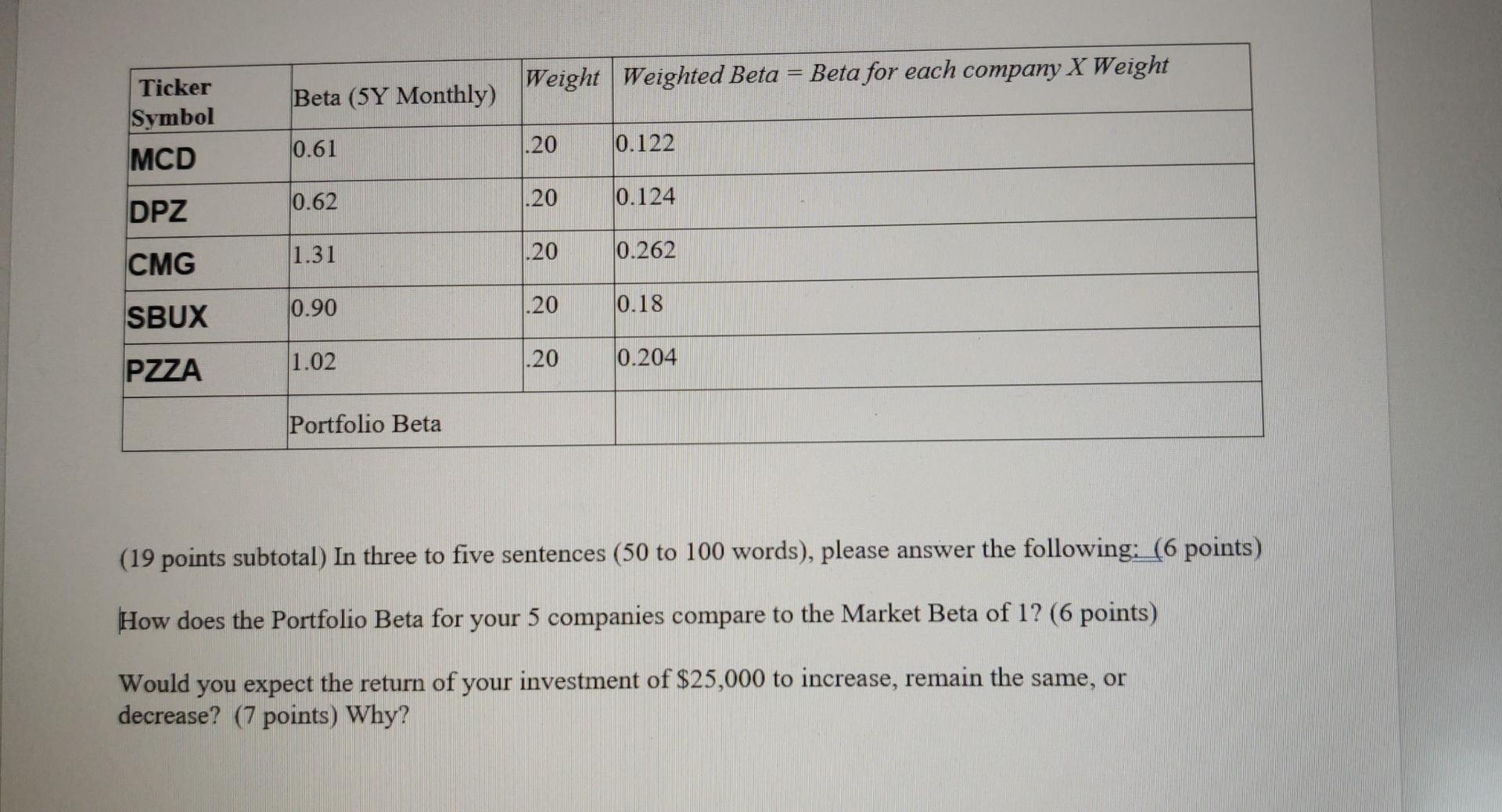

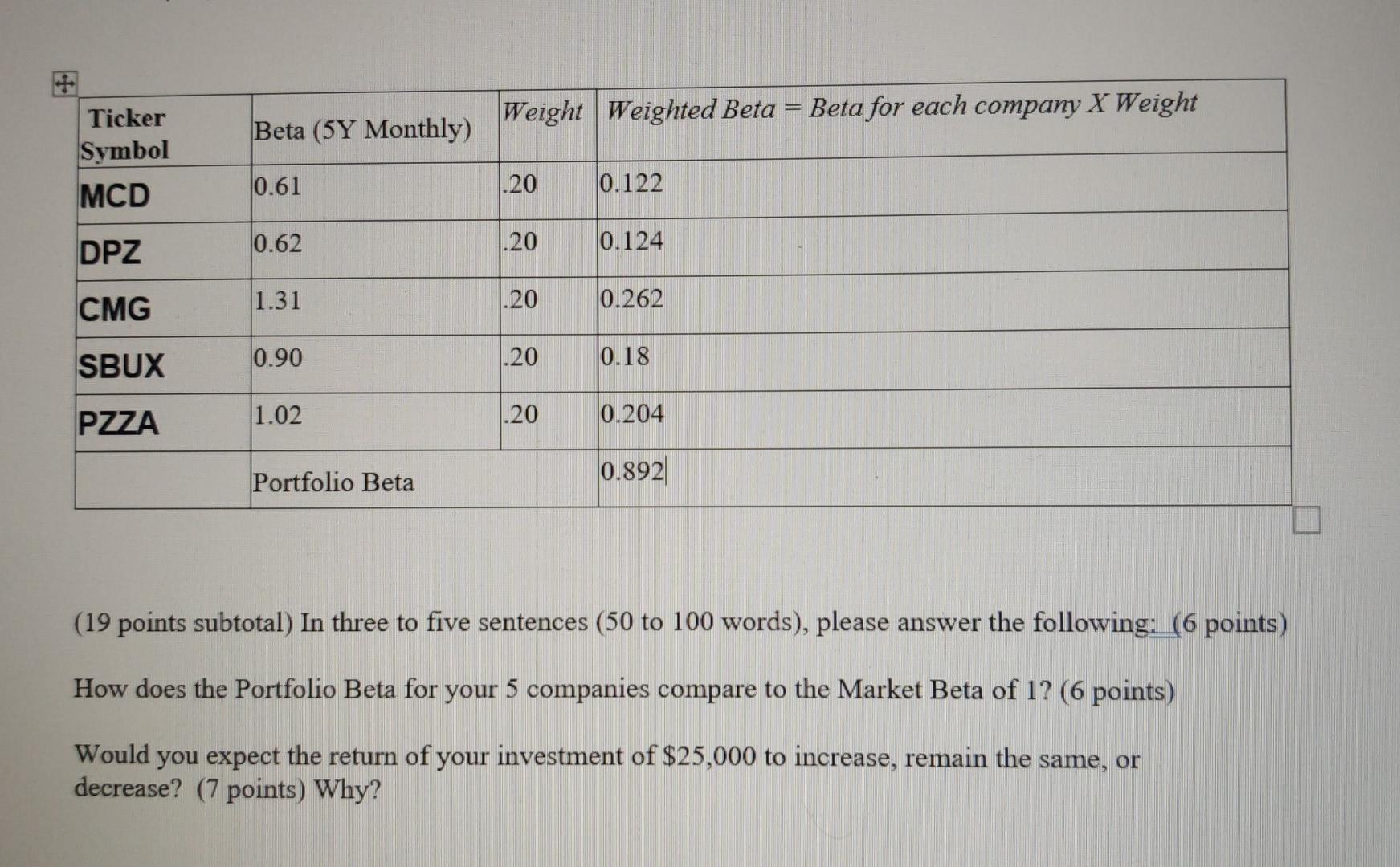

Weight Weighted Beta = Beta for each company X Weight Beta (5Y Monthly) Ticker Symbol MCD 0.61 .20 0.122 0.62 .20 DPZ 0.124 1.31 .20 CMG 0.262 0.90 .20 SBUX 0.18 1.02 .20 0.204 PZZA Portfolio Beta (19 points subtotal) In three to five sentences (50 to 100 words), please answer the following:_(6 points) How does the Portfolio Beta for your 5 companies compare to the Market Beta of 1? (6 points) Would you expect the return of your investment of $25,000 to increase, remain the same, or decrease? (7 points) Why? Weight Weighted Beta = Beta for each company X Weight Beta (5Y Monthly) Ticker Symbol MCD 0.61 .20 0.122 DPZ 0.62 .20 0.124 CMG 1.31 .20 0.262 SBUX 0.90 .20 0.18 PZZA 1.02 .20 0.204 Portfolio Beta 0.892 (19 points subtotal) In three to five sentences (50 to 100 words), please answer the following: (6 points) How does the Portfolio Beta for your 5 companies compare to the Market Beta of 1? (6 points) Would you expect the return of your investment of $25,000 to increase, remain the same, or decrease? (7 points) Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts