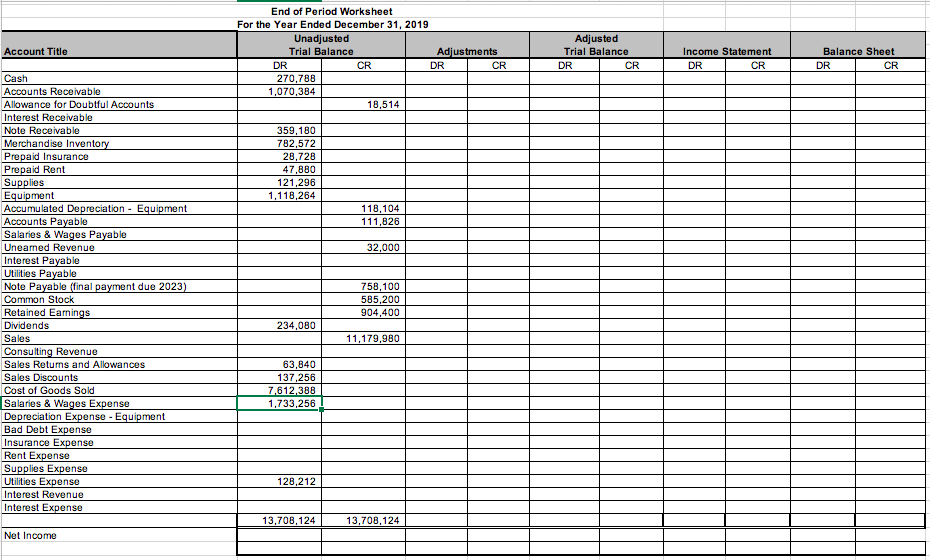

Question: Help needed with preparing the adjusting journal entries for the period. End of Period Worksheet For the Year Ended December 31, 2019 Unadjusted Adjusted Trial

Help needed with preparing the adjusting journal entries for the period.

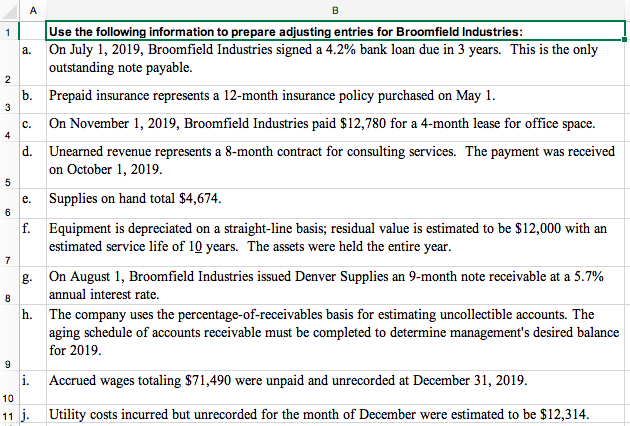

End of Period Worksheet For the Year Ended December 31, 2019 Unadjusted Adjusted Trial Balance Adjustments Account Title Trial Balance Income Statement Balance Sheet CR CR CR CR CR DR DR DR DR DR Cash 270,788 1,070,384 Accounts Receivable Allowance for Doubtful Accounts 18,514 Interest Receivable Note Receivable 359,180 782,572 Merchandise Inventory Prepaid Insurance Prepaid Rent Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Salaries & Wages Payable 28,728 47,880 121,296 1,118,264 118,104 111,826 Uneamed Revenue 32,000 Interest Payable Utilities Payable Note Payable (final payment due 2023) Common Stock 758,100 585,200 Retained Eamnings 904,400 Dividends 234,080 Sales 11,179,980 Consulting Revenue Sales Returns and Allowances 63,840 137,256 Sales Discounts Cost of Goods Sold 7,612,388 1,733,256 Salaries & Wages Expense Depreciation Expense Equipment Bad Debt Expense Insurance Expense Rent Expense Supplies Expense Utilities Expense 128,212 Interest Revenue Interest Expense 13,708,124 13,708,124 Net Income A Use the following information to prepare adjusting entries for Broomfield Industries: On July 1, 2019, Broomfield Industries signed a 4.2% bank loan due in 3 years. This is the only outstanding note payable 1 . Prepaid insurance represents a 12-month insurance policy purchased on May 1 b. 3 On November 1, 2019, Broomfield Industries paid $12,780 for a 4-month lease for office space. . 4 d. Unearned revenue represents a 8-month contract for consulting services. The payment was received on October 1, 2019. 5 Supplies on hand total $4,674 . 6 f. Equipment is depreciated on a straight-line basis; residual value is estimated to be $12,000 with an estimated service life of 10 years. The assets were held the entire year 7 On August 1, Broomfield Industries issued Denver Supplies an 9-month note receivable at a 5.7% annual interest rate h. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The aging schedule of accounts receivable must be completed to determine management's desired balance for 2019 9 Accrued wages totaling $71,490 were unpaid and unrecorded at December 31, 2019. 10 11 .Utility costs incurred but unrecorded for the month of December were estimated to be $12,314. N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts