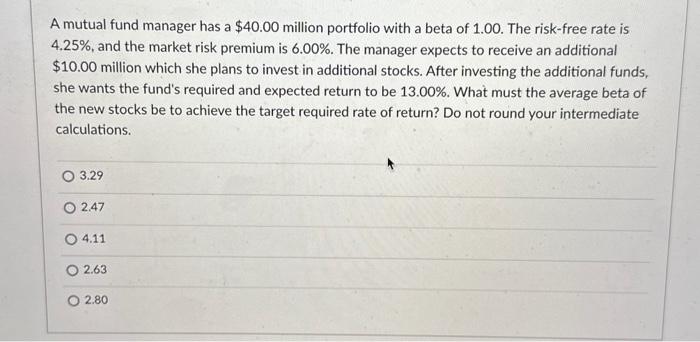

Question: Help needed with this problem. A mutual fund manager has a $40.00 million portfolio with a beta of 1.00 . The risk-free rate is 4.25%,

A mutual fund manager has a $40.00 million portfolio with a beta of 1.00 . The risk-free rate is 4.25%, and the market risk premium is 6.00%. The manager expects to receive an additional $10.00 million which she plans to invest in additional stocks. After investing the additional funds, she wants the fund's required and expected return to be 13.00%. What must the average beta of the new stocks be to achieve the target required rate of return? Do not round your intermediate calculations. 3.29 2.47 4.11 2.63 2.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts