Question: help ! net book value for year 2 EXERCISE 4: Double-Declining Balance Method ABC Marketing recently purchased a machine costing $80,000. The machine is expected

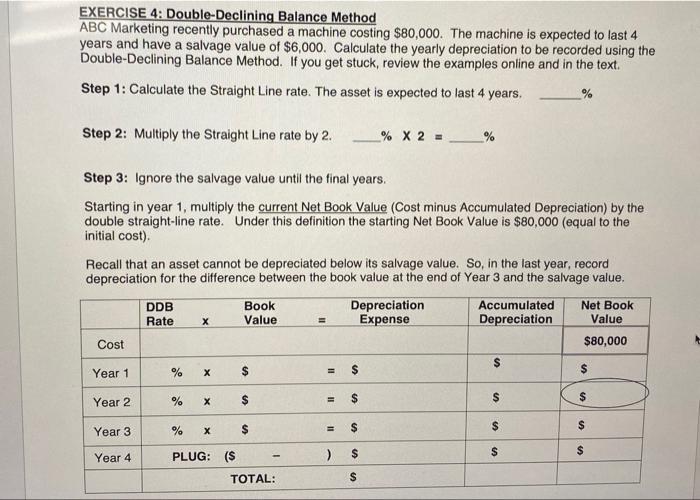

EXERCISE 4: Double-Declining Balance Method ABC Marketing recently purchased a machine costing $80,000. The machine is expected to last 4 years and have a salvage value of $6,000. Calculate the yearly depreciation to be recorded using the Double-Declining Balance Method. If you get stuck, review the examples online and in the text. Step 1: Calculate the Straight Line rate. The asset is expected to last 4 years. Step 2: Multiply the Straight Line rate by 2. %2= Step 3: Ignore the salvage value until the final years. Starting in year 1 , multiply the current Net Book Value (Cost minus Accumulated Depreciation) by the double straight-line rate. Under this definition the starting Net Book Value is $80,000 (equal to the initial cost). Recall that an asset cannot be depreciated below its salvage value. So, in the last year, record depreciation for the difference between the book value at the end of Year 3 and the salvage value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts