Question: help!! no idea how to even start this problem.. [The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared

![applies to the questions displayed below.] The following unadjusted trial balance is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e5a8626db17_88266e5a8620ba79.jpg)

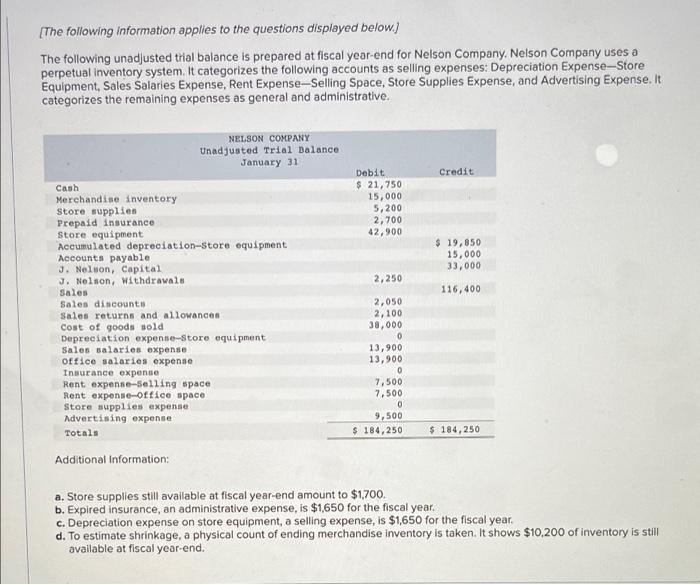

[The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company, Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. NELSON COMPANY Unadjusted Trial Balance January 31 Credit Debit $ 21,750 Cash 15,000 Merchandise inventory Store supplies 5,200 Prepaid insurance. 2,700 Store equipment 42,900 Accumulated depreciation-store equipment $ 19,850 15,000 Accounts payable J. Nelson, Capital 33,000 J. Nelson, Withdrawals 2,250 Sales 116,400 Sales discounts. 2,050 Sales returns and allowances 2,100 Cost of goods sold 38,000 Depreciation expense-Store equipment 0 Sales salaries expense 13,900 office salaries expense 13,900 Insurance expense 0 Rent expense-Selling space 7,500 Rent expense-Office space 7,500 Store supplies expense. Advertising expense Totals 0 9,500 $ 184,250 $184,250 Additional Information: a. Store supplies still available at fiscal year-end amount to $1,700. b. Expired insurance, an administrative expense, is $1,650 for the fiscal year. c. Depreciation expense on store equipment, a selling expense, is $1,650 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,200 of inventory is still available at fiscal year-end. ces Unadjusted Trial Balance January 31 Credit Debit $ 21,750 Cash Merchandise inventory 15,000 Store supplies 5,200 Prepaid insurance 2,700 store equipment 42,900 Accumulated depreciation-store equipment $ 19,850 Accounts payable 15,000 J. Nelson, Capital. 33,000 J. Nelson, Withdrawals 2,250 Sales 116,400 Sales discounts 2,050 Sales returns and allowances 2,100 Cost of goods sold 38,000 Depreciation expense-Store equipment 0 Sales salaries expense 13,900 office salaries expense 13,900 Insurance expense 0 7,500 7,500 Rent expense-Selling space Rent expense-Office space Store supplies expense Advertising expense Totals 0 9,500 $184,250 $ 184,250 Additional Information: a. Store supplies still available at fiscal year-end amount to $1,700. b. Expired Insurance, an administrative expense, is $1,650 for the fiscal year. c. Depreciation expense on store equipment, a selling expense, is $1,650 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,200 of inventory is still available at fiscal year-end. 4. Compute the current ratio, acid-test ratio, and gross margin ratio as of January 31. (Round your answers to 2 decimal places.) Current ratio |:1 Acid-test ratio :1 Gross margin ratio :1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts