Question: HELP ON A, B , & C (Common stock valuation) The common stock of NCP paid $1.35 in dividends last year. Dividends are expected to

HELP ON A, B , & C

HELP ON A, B , & C

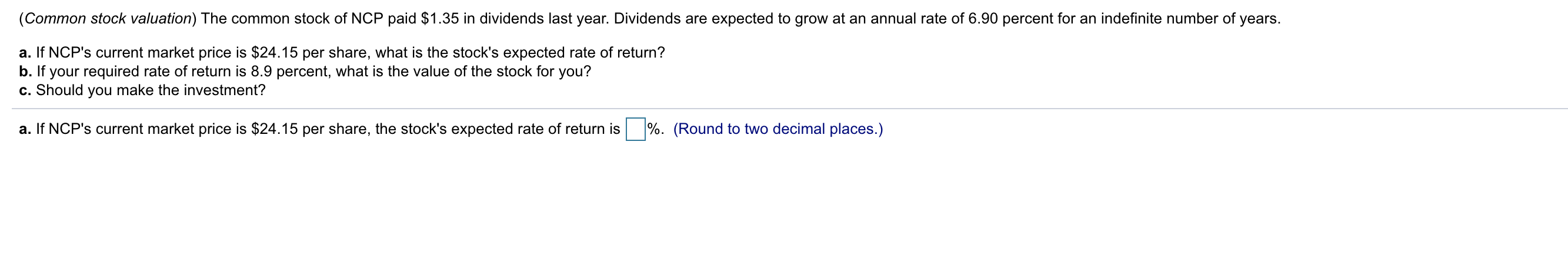

(Common stock valuation) The common stock of NCP paid $1.35 in dividends last year. Dividends are expected to grow at an annual rate of 6.90 percent for an indefinite number of years. a. If NCP's current market price is $24.15 per share, what is the stock's expected rate of return? b. If your required rate of return is 8.9 percent, what is the value of the stock for you? c. Should you make the investment? a. If NCP's current market price is $24.15 per share, the stock's expected rate of return is [%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts